List of Abbreviations

ABBACUS Assessment Billing Benefit and Collection Update System

AFBI Agri-Food and Biosciences Institute

ALB Arm’s Length Body

BSO Business Services Organisation

BTP Business Transformation Partner

CAP Common Agricultural Policy

CoPE Centre of Procurement Expertise

CDDO Central Digital and Data Office

CDG Commercial Delivery Group

CMU Contract Management Unit

CPD Construction and Procurement Delivery

DAERA Department of Agriculture, Environment and Rural Affairs

DE Department of Education

DfI Department for Infrastructure

DoF Department of Finance

DoH Department of Health

EdIS Education Information Solutions programme

EA Education Authority

ERP Enterprise Resource Planning solution

ETS Education Technology Services

EU European Union

FBC Full Business Case

HSC Health and Social Care

HR Human Resources

ICF Intelligent Client Function

ICT Information and Communication Technology

IDP Integr8 Delivery Partner

IPA Infrastructure and Projects Authority

ISLAND Information System for Laboratories in AFBI, NIEA and DAERA

IT Information Technology

LPS Land & Property Services

NIAO Northern Ireland Audit Office

NIEA Northern Ireland Environment Agency

NICS Northern Ireland Civil Service

NICS HR Northern Ireland Civil Service Human Resources function

NIFAIS Northern Ireland Food Animal Information System

NIPP Northern Ireland Planning Portal

NISRA Northern Ireland Statistics and Research Agency

OBC Outline Business Case

P3O Departmental Portfolio, Programme and Project Offices

PAC Public Accounts Committee

PAS Payroll Administrative Services

PfG Programme for Government

RAG Red, Amber and Green

RPA Risk Potential Assessment

SOC Strategic Outline Case

SIMS Schools Management Information System

SMS Schools Management System

SPSMS Strategic Partner and Schools Management System

SRO Senior Responsible Officer

T&M Time and materials

TOM Target Operating Model

Key facts in the period April 2022 to March 2025

29 - The number of major IT projects across NICS departmental portfolio

£5.2 billion - Current estimated whole life cost of delivering major IT project portfolio

Almost half of projects and over two-thirds of the estimated cost, relate to the Department of Health and the Department of Finance

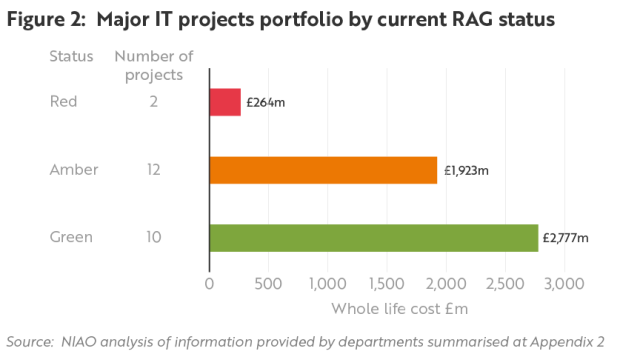

58 per cent - Over half of live major IT projects with value of £2.2 billion have a Red or Amber project status

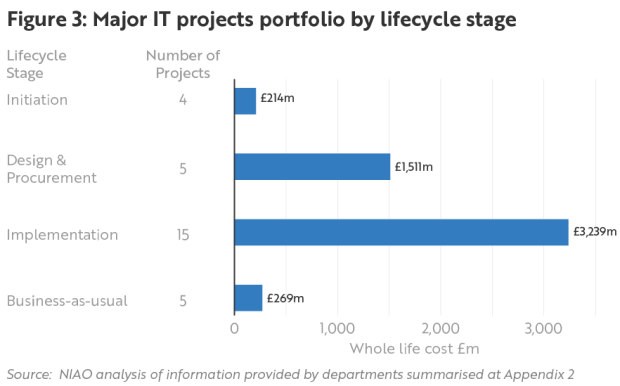

Almost 6.5 years - Average length of time for a major IT project to be designed, procured, implemented and become fully operational

24 out of 29 - Major IT projects undertaken to replace legacy IT systems

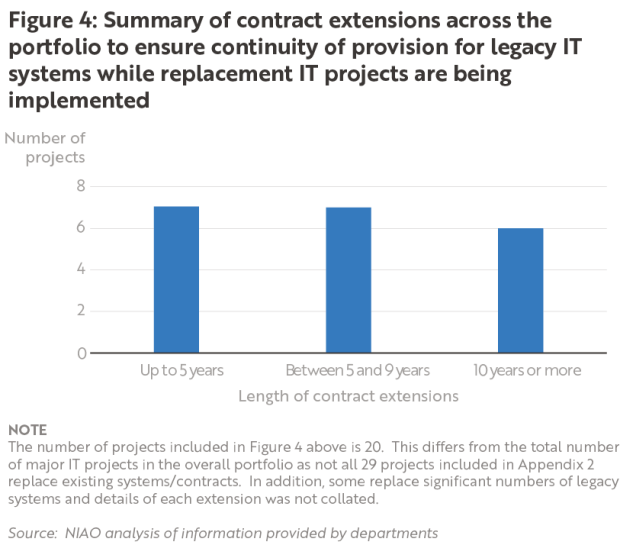

Almost 8 years - Average length of contract extensions required for legacy systems to ensure continuity of service while replacement systems are being commissioned and implemented

Executive Summary

1. Pressures on public finances, evolving expectations and end user needs bring a drive for greater efficiencies in the way new and existing services are delivered, both in terms of speed and costs. The successful implementation of new IT systems and IT-enabled programmes and projects presents opportunities to improve services, deliver efficiencies and enable transformation in the public sector. However, the difficulties in effectively managing these projects are consistently highlighted across the United Kingdom and beyond.

2. This report presents an overview of the portfolio of major IT projects across Northern Ireland central government and the progress in delivering the projects. In the period April 2022 – March 2025, Northern Ireland departments, and their arm’s length bodies (ALBs), managed 29 major IT projects with a current total estimated whole life cost of £5.2 billion. For the purposes of the report, we defined major as over £25 million in whole life cost.

3. In recent years these projects have been set against a background of an uncertain operating environment including the impact of the COVID-19 pandemic, inflationary increases, long periods without Ministers, systemic capacity and capability issues, and the ongoing difficulties presented by both single year budgets and delays in budgets being agreed.

4. Many of the major IT projects are facing significant issues. The latest assessments by project teams show that the majority of live projects have a Red or Amber rating – almost 60 per cent of projects with a value of £2.2 billion. It is vital that these programmes and projects are well managed to ensure successful delivery and value for money.

There is no consistent approach to planning for major IT projects, or collating data on existing IT systems across Northern Ireland departments

5. We found that there is no consistent process in place to identify, manage and report on IT systems, or to appraise each system and set priorities for new or replacement systems. There is no overarching portfolio view of major IT projects, or existing IT systems, across government and the approach within individual departments varies. The previous Northern Ireland Civil Service (NICS) IT strategy ended in 2021. It was not fully implemented and has not been evaluated.

6. There is currently no NICS-wide IT strategy and we were told there is no authority to mandate the implementation and delivery of a NICS IT strategy across departments. Whilst we recognise that each individual department is a separate legal entity, they must find ways to work and plan collectively to: establish priorities for investment and the delivery of efficiencies; ensure best use of skills; better understand the interdependencies and risks across IT systems both within departments and across the NICS; and ensure compatibility and synergies in the IT solutions.

7. We were unable to ascertain the cost for all IT systems across departments and their arms’ length bodies (ALBs) as there was little information readily available on the annual costs of IT systems and costs to date. Cost information should be readily available as accurate financial information is essential to support informed decision-making and regular monitoring.

Continued contract extensions are too often a necessity due to a lack of strategic planning and delays in implementing new systems

8. Most of the programmes and projects (24 of 29) within the portfolio of major IT projects are to replace legacy systems and for almost all those projects, the legacy contract has been extended multiple times, and the systems are operating well beyond their intended life. Whilst not all legacy systems will require replacement at contract end, and there can be valid business decisions to extend contracts and maintain existing systems, many of the extensions were a necessity to maintain continuity of service, as opposed to a strategically planned choice. On average, across the portfolio, legacy system contracts were extended by almost eight years. Approximately a third of these contracts were extended for 10 or more years, with the longest contract extension being 18 years.

9. Continued contract extensions may come with a significant cost – both financial costs as well as benefits foregone or a negative impact on quality of service. As part of this report, we examined progress on five programmes/projects and found that all experienced delays in project initiation, resulting in reliance on contract extensions to maintain legacy systems. The value of these contract extensions is in excess of £573 million. Extending contracts without competition limits the extent to which the Accounting Officer can be assured that value for money has been achieved.

10. It takes close to six and half years for a major IT project to be designed, procured, implemented and become business-as-usual across the NICS. Proper planning is essential to make the best use of limited resources and to mitigate the challenges being presented by multiple IT systems reaching end of life at the same time. However, departments told us that one of the main reasons for continued contract extensions is pressure on resources, meaning that the focus is on business-as-usual and day-to-day delivery. This, combined with single year budgets and capacity and capability issues, results in plans to implement new IT programmes and projects starting late and legacy systems being extended well beyond their intended life.

11. Both the NIAO and the Public Accounts Committee (PAC) have previously highlighted the risks associated with ongoing contract extensions and the need for strong contract management controls and strategic planning. Whilst we recognise the need to maintain continuity of service, the level of reliance on contract extensions to maintain legacy systems, many of which are no longer efficient, is extremely concerning. The focus, and spend, on contract extensions is often to maintain the system, prevent operational failure and reduce the risk of cyber-attacks, as opposed to enhancing functionality and performance. Over time the gap between functionality and need widens, the systems become increasingly inefficient, as does the citizen experience. This represents very poor value for money and missed opportunities to have modern, more efficient systems in place at an earlier stage.

There must be comprehensive planning at the project initiation stage to set projects up for successful delivery

12. Each of the case studies experienced delays or issues at the project initiation stage. The reasons included: a lack of clarity on the scope and intended outcomes; no clear project plan; no target operating model; and insufficient suitable resources. Appropriately skilled staff were not always involved in developing the business case, resulting in the complexity of the project not being fully understood and unrealistic costs and timescales for the project being estimated. Time must be better invested at the early stages of projects to provide the best chance of successful delivery, including clearly defining and understanding the intended outcomes and benefits of the new system.

Effective governance and assurance structures are essential to support effective delivery

13. The principal governance mechanism is often the programme or project board. In three of the case studies, issues with governance arrangements were identified including infrequent meetings and membership that was not sufficiently representative of stakeholders. Effective governance arrangements must be in place to provide oversight, challenge and support decision-making. Membership should be tailored throughout the life of a project, to ensure the appropriate skills mix and value is added by the appropriate stakeholders at the best time.

14. In addition to internal assurance and reporting processes within departments and project teams, the Gateway review process provides an independent source of assurance on programmes and projects. We saw examples of constructive engagement with the Gateway review process, and the value to be gained from the process, especially when that engagement is completed at an early stage.

Having people with the right skills and experience in place from the outset is essential

15. People with the right skills, experience and time are crucial at every stage of an IT project life cycle. In addition to project and contract management skills, in IT projects there is a need for specific technical skills including digital skills such as software development, and cyber security. The majority of the projects in the major IT portfolio are IT-enabled business change and transformation, and therefore skills in business change and user/ stakeholder engagement are essential.

16. Capacity and capability issues impact from the very outset of projects in Northern Ireland and hamper the ability to undertake comprehensive planning, understand the complexities of the projects, estimate realistic costs and timetables, be intelligent customers, and engage effectively with stakeholders. Projects are often initiated with smaller teams than are needed, key roles are not adequately filled with skilled staff and often staff do not have the capacity required to fulfil their roles as they continue with their normal day to day responsibilities.

17. Whilst there has been some progress, led by the Department of Finance (DoF), to develop project delivery capacity and capability and the NICS Project Delivery Profession, overall progress to address this long-standing systemic issue has been much too slow. There remains a clear and urgent need to develop and enable a NICS-wide approach to build the capacity and capability needed to successfully deliver major projects. The NICS must implement previous recommendations in this area at pace.

Conclusion and recommendations

18. Major projects, including major IT programmes and projects, are complex. Delivery problems are not unique to Northern Ireland and are compounded by an uncertain operating environment. Many of the same issues that have been known for a long time persist. The lessons are known and have been widely reported, yet often projects are still not set up for success. Action is needed at pace, to address issues, including significant skills gaps impacting at every stage of a project lifecycle, at a system level.

19. The cost of ongoing contract extensions and the risks posed by maintaining legacy systems well beyond their intended lives is not value for money. This must be recognised and addressed across the NICS and wider public sector. Strategically planned, procured and well managed longer-term partnerships with innovation and continuous improvement built into the contract term can bring opportunities to ensure value for money for longer.

20. Reform and transformation of public services is one of the nine priorities for the 2024-2027 Programme for Government, with digital transformation highlighted as an enabling action. The current approach to major IT projects, if continued, will result in continued risk to value for money and missed opportunities to realise the benefits that can be delivered through ever changing and evolving technologies. A NICS-wide approach is needed in order to deliver on the ambitions of the Programme for Government and deliver real public service IT transformation.

Recommendation 1

In the next 12 months, each department should undertake a review of the maturity and adequacy of the support provided by its Portfolio, Programme and Project Offices (P3Os). The review should determine the impact and value of having a P3O and identify areas for improvement. DoF should drive the completion of these reviews and report the outcomes, including recommendations for improvement, to the NICS Board.

Recommendation 2

We recommend that all departments and ALBs establish a rigorous framework to identify legacy IT systems, and those soon to become legacy, and assess the risks associated with the systems. This assessment should be used to drive the prioritisation of investment decisions and enable risk-based succession planning to manage and maintain, or to replace, systems well in advance of current contract expiry. This is essential to deliver efficiency savings and ensure value for money.

Recommendation 3

A NICS-wide IT strategy should be put in place within the next 12 months. It must be collectively owned by all NICS departments and applied across the NICS to drive consistency in approach, including the application of common standards, and deliver more compatible systems which drive cost efficiencies and assist in delivering on the public service transformation ambitions of the Programme for Government.

Recommendation 4

Departments must ensure that there is accurate and timely contract management and cost information available to enable regular monitoring and reporting and to support decision-making by the relevant governance mechanisms.

Recommendation 5

Departments should ensure that sufficiently skilled staff are available from the early stages of a project to allow full consideration of the complexity of the project, enabling realistic timescales, costs and internal resource requirements to be included within business cases to support more robust decision-making on the affordability and feasibility of the project.

Recommendation 6

To maximise value for money it is crucial that Accounting Officers and DoF ensure that the benefits to be achieved by investing in new systems are clearly defined in business cases. Benefits should be measurable and there must be clarity on how they will be realised. Benefits must be monitored and reported on once systems are operational to ensure that the intended benefits are delivered and value for money is achieved.

Recommendation 7

All projects and programmes with a value over £5 million are required to engage with the Gateway process by completing a Risk Potential Assessment. We recommend that Accounting Officers put in place project reporting arrangements to ensure that programmes and projects within their remit actively engage with the assurance process, particularly at the early stages of a project. Accounting Officers, Senior Responsible Officers and Project Boards must also satisfy themselves that the recommendations of the independent Gateway reviews, including the timing of the next recommended reviews, are actioned.

Recommendation 8

Governance structures, such as the project or programme board, should be a key component to the successful delivery of projects. They must be active and include key stakeholders with an appropriate mix of skills and experience. This should be tailored and strengthened throughout the life of a project as necessary.

Recommendation 9

The NICS must urgently address, at a system level, the adequacy of project management and delivery skills. This should include identifying the skills gap and putting clear plans in place to develop a mature NICS Project Delivery profession and ensure that sufficiently trained and skilled staff are available throughout the project life cycle. This is a service-wide issue that needs to be taken forward across the NICS. DoF should take the lead on implementing this recommendation with the support of NICS Human Resources.

Recommendation 10

The NICS Board should take the lead in identifying recurrent issues impacting on the delivery of major IT projects and the lessons to be learned. A clear, timebound action plan to address these issues must be developed.

Part One: Introduction and background

Major IT projects can play an important role in changing how services are delivered including improving efficiency, reducing costs and designing services to meet user needs

1.1 Information technology (IT) plays an ever-increasing role in the provision of public services - whether it is accessing benefits, the provision of education or healthcare, or the day-to-day interactions between government and citizens for services such as obtaining a new driving licence or making a planning application. Pressures on public finances and evolving expectations and end-user needs bring a drive for greater efficiencies in the way new and existing services are delivered. In February 2025 the Executive agreed a Programme for Government (PfG) 2024-2027 ‘Our Plan: Doing What Matters Most’. One of the nine priorities is the Reform and Transformation of Public Services. The successful delivery of major IT projects can play an important part in transformation and is essential for improving public services.

1.2 IT projects were traditionally defined as a type of project that focused primarily on the delivery of a new or improved technology solution dealing primarily with technical components such as IT infrastructure, information systems or computers. Examples included: web development; software or applications development and implementation; network configuration; hardware installation; and database management.

1.3 Over the years IT projects have evolved and become more complex. The term ‘IT-enabled business change’ is now widely used throughout the NICS and the vast majority of current major IT projects (26 of 29) are considered by departments to be IT-enabled projects. An IT-enabled business change project uses the technology as a catalyst to implement and support significant changes in how a service is delivered to customers or an organisation’s business processes, structures or strategies. The successful delivery of IT-enabled business change requires not just better technology but an understanding of the needs of different users and the potential for service improvements and efficiencies.

1.4 For the purposes of this report the term IT projects should be considered to also refer to IT-enabled business change projects.

Scope and structure of the report

1.5 This report presents an overview of the portfolio of major IT projects across Northern Ireland central government and the progress in delivering the projects. We defined major as over £25 million whole life costs. Whole life cost is the total cost of a project over its whole life and takes account of both capital costs and revenue costs, including staff, operational, maintenance, repair, upgrade and eventual disposal costs. Our methodology is set out in Appendix 1.

1.6 The majority of the programmes and projects within the portfolio of major IT projects are necessary to replace legacy systems. The Central Digital and Data Office (part of the UK Government’s Department for Science, Innovation and Technology) defines the term ‘legacy IT’ as outdated and often obsolete technology systems, software, and hardware that have been in use for a considerable period of time. Whilst these systems served their purpose effectively when first implemented, over time they can present challenges and risks. These challenges may include higher maintenance costs, limited scalability, reduced agility, increased susceptibility to cyber threats, and difficulties in integrating with newer, more advanced systems.

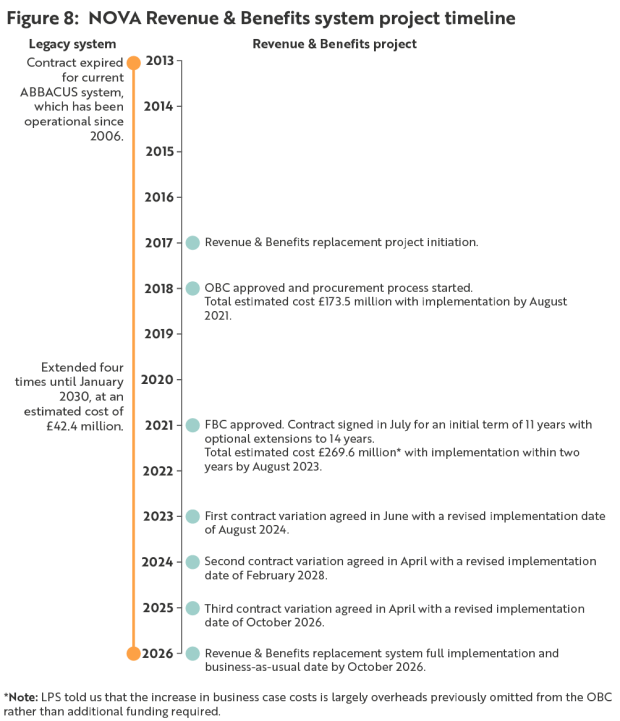

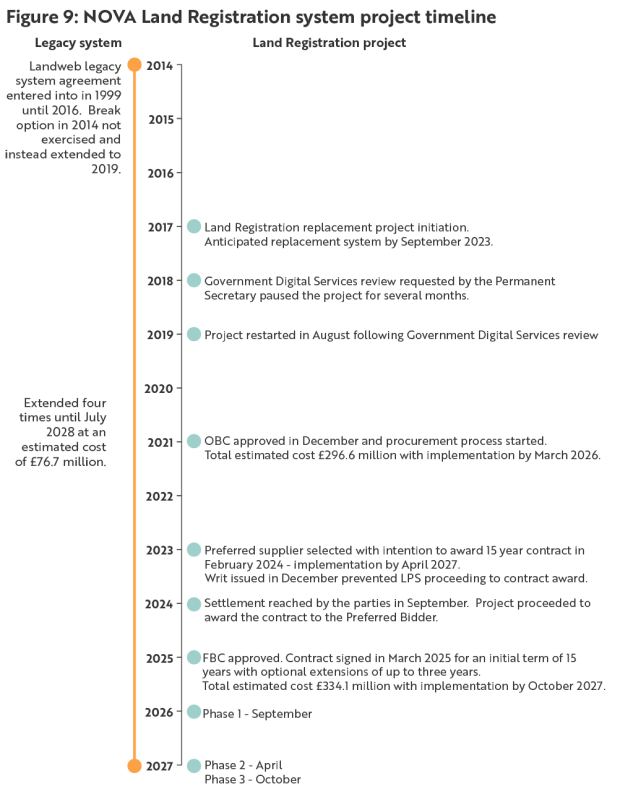

1.7 There are significant costs associated with contract extensions for legacy systems to maintain continuity of service until new systems are up and running. The report includes five major IT projects as case studies, all of which replace legacy systems. The projects were selected as case studies due to their size and importance to their sector. The Land & Property Services (LPS) NOVA Programme includes the Land Registration project, which is the replacement for the Landweb project, and the Revenue and Benefits project, which is the replacement for the ABBACUS system, both of which were previously reported on by the NIAO and the Public Accounts Committee. The total cost of contract extensions to maintain the legacy systems beyond the original contract end date across the case studies (excluding encompass) alone is approximately £573 million (see Figure 5 at paragraph 4.2).

- Department of Health – encompass programme (Case Study 1)

- Department of Finance – Integr8 programme (Case Study 2)

- Department of Finance – LPS NOVA programme – specifically the Revenue and Benefits project and the Land Registration project (Case Study 3)

- Department of Education – Education Authority’s Education Information Solutions programme (EdIS) (Case Study 4)

- Department for Infrastructure – Planning Portal (Case Study 5)

1.8 The structure of this report is as follows:

- Part One sets out the roles and responsibilities for the commissioning and delivery of major IT projects in Northern Ireland. It also includes findings from our other work which are relevant to the successful delivery of all major projects.

- Part Two considers the oversight and assurance arrangements in place for major IT projects, including the identification and management of legacy systems.

- Part Three provides an overview of the departmental major IT portfolio as at March 2025.

- Part Four includes the case studies as listed in paragraph 1.7.

- Part Five considers the common themes and issues arising in the delivery of major IT projects.

A number of public bodies have a role to play in the commissioning and delivery of major IT projects in Northern Ireland

1.9 Individual departments are responsible and accountable for the commissioning, delivery, and management of major IT projects under their responsibility. They will work with a range of other bodies that have responsibilities for the policy, strategy and guidance on procurement and project delivery in Northern Ireland. The roles and responsibilities of the bodies involved are summarised below.

Departments and arm’s length bodies (ALBs)

- Individual departments and ALBs are the key commissioning, delivery and management agents for their respective major IT projects.

The Department of Finance (DoF)

- DoF, as well as maintaining responsibility for managing its own projects, has a central role in providing guidance on and facilitation of the Gateway review process which provides Senior Responsible Owners and Accounting Officers with assurance on the progress of their major projects (see paragraph 2.5).

- DoF’s ‘Better Business Cases NI’ provides guidance on expenditure appraisal, evaluation, approval and management of policies, programmes and projects within the public sector.

DoF Supply Division

- DoF (through its Supply Division) is required to approve the expenditure set out in project business cases where departments intend to incur expenditure on:

- IT projects over £5 million; and

- other capital projects involving over £5 million central government expenditure unless other departmental specific delegations allow.

(Note: at the time of this report these thresholds were under review.)

Construction and Procurement Delivery (CPD)

- Provides policy advice on the NI Executive’s Procurement Policy to Northern Ireland departments and ALBs.

- Assist its clients with preliminary market engagement with relevant suppliers and industry bodies.

- Provides best practice guidance. For example, the Sourcing Toolkits applies the themes contained within the Cabinet Office’s Sourcing Playbook guidance to procurements in Northern Ireland, with the aim of improving commercial focus.

- The Commercial Delivery Group (CDG) within DoF is working to develop the NICS Project Delivery profession alongside leading and championing project delivery across all NICS departments.

Centres of Procurement Expertise (CoPE)

- Public bodies rely on the specialist skills and specific market knowledge of staff within Centres of Procurement Expertise (CoPEs) to ensure that procurement processes are designed to achieve the best possible outcomes and comply with all relevant legislation and public policy objectives. There are nine CoPEs across the public sector in Northern Ireland.

Previous reports highlighted areas for improvement in the delivery of all major projects

1.10 In June 2020 our update report on the LandWeb Project found that poor strategic planning by DoF gave rise to a series of extensions to its service contract and that mechanisms were not put in place to secure value for money such as benchmarking, market testing and open book accounting. The continuous need for contract extensions remains an issue across the current major IT portfolio. (See paragraphs 3.10-3.11).

1.11 Our November 2020 report on Capacity and Capability in the Northern Ireland Civil Service (NICS) noted that many specialist activities in the NICS, such as project management and contract management, are carried out by general service staff without specific skills or qualifications. The report concluded that more needs to be done to prioritise the identification and development of the skills, knowledge and experience which are key to the delivery of modern public services. It is extremely concerning that issues with capacity and capability across the NICS remain and continue to impact on the successful delivery of major IT projects. It is essential that the right people, with the right skills, are in place from the outset of a project. This must be addressed with urgency. (See paragraphs 5.16-5.26).

1.12 In April 2023, our report on Public Procurement in Northern Ireland examined the arrangements in place to ensure the overall effectiveness of procurement across the public sector. The report acknowledged recent action taken to improve how procurement works including: the reconstitution of the Procurement Board with a new membership; the development of new procurement policies, including social value; and changes to the training and guidance available to public sector staff involved in procurement with new commercial training and new toolkit guidance introduced. However, we concluded that the structures and arrangements to provide leadership, governance and accountability in public sector procurement are not working effectively.

1.13 In June 2023, we reported on the Northern Ireland Food Animal Information System, a project within the Department of Agriculture, Environment and Rural Affairs designed to replace the legacy Animal Public Health Information System (APHIS) system, the contract for which initially expired in 2007. At each stage there were significant delays requiring contract extensions totalling 18 years to ensure continuity of service. The process to replace the system did not start until a year after contract expiration and took eight years before the contract was awarded in 2016. The new NIFAIS system was expected to be fully implemented and operational by December 2018 but there were further delays, with NIFAIS now expected to be fully operational from December 2025. This major IT project is included within the departmental portfolio at Appendix 2. Our report highlighted some key issues and lessons which are applicable to all major IT projects:

- Succession planning - a strategy for replacing a computer system (or service) was not established well in advance of the expiry of current contractual arrangements.

- Intelligent Customer - the need for the correct expertise to identify business needs and to evaluate proposals from suppliers; and sufficient experience of the competitive dialogue procurement process.

- Demonstrating commitment - The Department took decisive action on the results of the 2019 Gateway Review. This was an important factor in re-building confidence amongst the key stakeholders. However, earlier intervention at a senior level in the Department may have prevented the project from drifting into failure in the first place.

- Team resources - The Project team should have the right skills, experience and capacity to manage the project.

- Partnership - A shared commitment and constructive co-operation was essential to advancing the project’s prospects.

- Flexibility - Being prepared to stop, re-evaluate and proceed with a different approach is often overlooked in favour of pressing on with added vigour when projects don’t go to plan.

- Finances - internal costs escalated, along with the continued costs of supporting the legacy system and the business risks this posed to the Department and its customers.

- The lost opportunity of utilising scarce staff time on other departmental work and unrealised benefits of having a modern system in place for all its stakeholders, represents very poor value for money.

1.14 Most recently, our report on Major Capital Projects in February 2024 which followed up on our previous report in December 2019 concluded that fundamental reforms are needed to the commissioning and delivery system for major capital projects. The report found that capacity and capability issues remain a risk to the successful delivery of projects, including issues with recruitment and retention both within the NICS as a whole but also within project teams over the life of a project, with a lack of expertise at the early stages impacting on project specifications, costings and timetables.

Part Two: The strategic oversight and assurance of major IT projects and legacy IT systems

Internal reporting arrangements for major programmes and projects vary across departments

2.1 In Northern Ireland, departments are separate legal entities under the direction of their Minister and responsibility for the delivery of all projects, including major IT projects, rests with individual Senior Responsible Officers (SROs), the Permanent Secretary and Minister.

2.2 Across individual departments, reporting arrangements vary in terms of frequency and nature, but overall, the scrutiny of major programmes and projects by individual Accounting Officers and Boards has increased in recent years. Revised policy and guidance on best practice in project delivery has included the establishment of Departmental Portfolio, Programme and Project Offices (P3Os). P3Os are intended to ensure visibility, and provide support for governance, oversight and reporting on programme/project delivery and assurance. A P3O forum assists departments to share best practice, develop learning, support the project delivery function and strengthen reporting.

2.3 DoF guidance suggests that a P3O will mature over time and services provided should grow as staff skills and experience develop. A mature P3O should aim to provide support across the following areas:

- Governance – support for governance through scrutiny and challenge, maximising return on programme/project investment through oversight of delivery and risk.

- Transparency – relevant, accurate and timely data and information (single-source) to support decision making.

- Delivery support – helping programme and project SROs, managers and teams to do the right things and to do them in alignment with overarching policy and best practice.

- Reusability – embedding best practice, establishing standards, sharing knowledge and lessons learned.

2.4 Whilst every Northern Ireland department has a P3O (or equivalent) how they are resourced, their role, maturity and the extent of support they provide varies across departments, depending on the skills and experience of the P3O team and the size of the portfolio of programmes or projects within the department.

Recommendation 1

In the next 12 months, each department should undertake a review of the maturity and adequacy of the support provided by its Portfolio, Programme and Project Offices (P3Os). The review should determine the impact and value of having a P3O and identify areas for improvement. DoF should drive the completion of these reviews and report the outcomes, including recommendations for improvement, to the NICS Board.

All programmes and projects valued over £5 million are required to engage with the Gateway review process

2.5 The Commercial Delivery Group (CDG) within DoF is responsible for facilitating Gateway™ Reviews and other assurance processes across NICS departments and their ALBs. The Gateway review process is a series of independent peer reviews undertaken at key stages of a programme or project lifecycle. It is an assurance mechanism designed to provide an objective view of the ability to deliver on time and to budget and provide assurance that programmes and projects can progress successfully to the next stage. Engagement with the Gateway review process is mandatory within all public bodies (excluding local councils) for all programmes and projects valued at £5 million and above. It is important to note that it is complementary to, and not a replacement for, internal assurance processes within departments and project teams.

2.6 The first step is the completion by the programme/project team of a Risk Potential Assessment (RPA). Following revised guidance issued in November 2023, programmes and projects which are assessed as high risk will be subject to the Gateway review process until programme/project closure. (Prior to the change in guidance all medium risk programmes and projects were also subject to the Gateway review process). Whilst not mandated, departments can choose to continue to use the Gateway review process for medium or low risk programmes and projects. Guidance recommends that all low and medium risk projects have an internal peer review carried out by someone independent from the project team.

2.7 The Gateway review process is anchored to the five-case business model and seeks to examine programmes and projects at key decision points. The process emphasises early review for maximum added value. Gateway review reports will give the programme/project a Stage Gate Assessment (red, amber or green) and recommend the date the next assurance review should take place. See Appendix 3 for further details.

There is central reporting to the NICS Board on the assurance status for major programmes and projects

2.8 Since June 2022, a report on major projects, including IT projects, has been brought to the NICS Board every six months. The reports received by the NICS Board are based on assurance reporting and include the latest gateway assurance RAG status (red, amber, green) and the latest highlight report status (this is a standard template developed by DoF and used by project teams to record their internal assessment of progress twice a year) for Major programmes and projects that were categorised as high risk following completion of the initial RPA. In January 2025, 12 of the 56 major programmes and projects categorised as high risk (almost 20 per cent) were major IT projects.

2.9 The reporting arrangement to the NICS Board does not add scrutiny or challenge, as accountability rests with individual departments, but it was intended to increase transparency and identify common themes or issues in projects. There is little evidence to date as to the impact of this reporting arrangement.

The most recent NICS ICT strategy ended in 2021 and has not been evaluated

2.10 The NICS ICT Strategy 2017-21 aimed to deliver better, high quality public services through the use of modern IT. The strategy was to provide direction for investment across government and was to be managed and driven by a new Strategic Design Authority. It included goals to reduce the burden of legacy software by moving away from using out-of-date or redundant software and further reduce dependency upon aging legacy systems. However, DoF told us that due to budget constraints and each department being accountable for their individual major IT projects, a Strategic Design Authority was not established, and the strategy was not fully implemented. There was no evaluation of the NICS ICT Strategy.

2.11 Whilst there is an acceptance by departments that a more strategic approach to supporting digital delivery is needed, there is currently no NICS-wide IT strategy, and we were told there is no authority to mandate the implementation and delivery of a NICS IT strategy across departments. Whilst we recognise that each individual department is a separate legal entity, they must find ways to work and plan collectively to: establish priorities for investment and the delivery of efficiencies; make the best use of resources including skills; better understand the interdependencies and risks across IT systems both within departments and across the NICS; and ensure compatibility and synergies in the IT solutions.

There is no consistent approach to collating data on IT systems across departments

2.12 We found that there is no consistent process in place to identify, manage and report on IT systems, or to appraise each system and set priorities for new or replacement systems. Whilst all departments had some form of register for their IT systems, there was considerable variation in terms of what was included on the registers and a lack of clarity and consistency as to how the information was used for reporting, decision-making and strategic planning purposes.

2.13 Accurate financial information and regular monitoring are essential to support informed decision-making. However, we were unable to ascertain the cost of IT systems across departments and their ALBs as there was little information readily available on the annual costs of IT systems and costs to date.

2.14 Departments have arrangements in place to look ahead and identify IT systems and applications which need replaced, upgraded or for which the contract is due to expire. This forward look was usually 6-12 months into the future. However, we found that on average, it takes almost six and a half years for a major IT project to be designed, procured, implemented and become business-as-usual across the NICS. There needs to be a much greater focus on succession planning to enable all options to be appropriately considered – and thereby avoid contract extensions being the only option that can be pursued due to time pressures and the need for continuity of service. (See paragraphs 3.10-3.11 in Part Three of this report).

The majority of the current major IT programmes and projects in the departmental portfolios are to replace legacy IT systems

2.15 Twenty-four of the current major IT programmes and projects in the departmental portfolios are to replace legacy IT systems. Whilst these systems served their purpose effectively when first implemented, they can over time present challenges and risks. According to the Central Digital and Data Office (CDDO), indicators that a system is considered as legacy include:

- Software out of support

- Expired vendor contracts

- Too few people with required knowledge and skills

- Inability to meet current or future business needs

- Unsuitable hardware

- Known security vulnerabilities

- Recent problems/downtime

2.16 In 2022, the UK Government published Transforming for a digital future: 2022 to 2025 roadmap for digital and data which included a commitment to define and identify all ‘red-rated’ legacy systems through an agreed cross-government framework and put agreed remediation plans in place. Following this the CDDO developed the Legacy IT Risk Assessment Framework which is a tool for identifying legacy IT assets and those which are classed as ‘red-rated’ systems (the highest category of risk). The Framework provides a structured approach for evaluating and prioritising the risks associated with outdated IT systems within UK government departments and enables informed decision-making. All UK government Ministerial departments are mandated to provide all their legacy IT assessments to the CDDO each year, thereby ensuring that the government has an accurate overview of the state of legacy IT in UK government. In Northern Ireland there is no such overview, either centrally or for each individual department. DoF told us that a key challenge in addressing legacy from a central perspective is that responsibility rests with each individual department, and there is no central responsibility or mandate.

Conclusion

2.17 More needs to be done to strengthen the framework for the strategic oversight and assurance of major IT projects, including planned projects and current IT systems. There is a lack of strategic planning for major IT projects across departments, including a lack of readily available information on the cost of IT systems. The previous NICS IT strategy ended in 2021. It was not fully implemented and has not been evaluated. There is currently no NICS-wide IT strategy and were told there is no authority to mandate the implementation and delivery of a NICS IT strategy across departments.

2.18 Legacy IT has a number of potential risks including higher maintenance costs, limited scalability, reduced agility, increased susceptibility to cyber threats, and difficulties in integrating with newer, more advanced systems. It is essential that the NICS gathers and maintains robust data to identify and manage the risks associated with IT systems and that all major IT projects are prioritised and planned according to strategic importance. Proper planning is essential to make the best use of limited resources and to mitigate the challenges presented by multiple IT systems reaching end of life at the same time.

Recommendation 2

We recommend that all departments and ALBs establish a rigorous framework to identify legacy IT systems, and those soon to become legacy, and assess the risks associated with the systems. This assessment should be used to drive the prioritisation of investment decisions and enable risk-based succession planning to manage and maintain, or to replace, systems well in advance of current contract expiry. This is essential to deliver efficiency savings and ensure value for money.

Recommendation 3

A NICS-wide IT strategy should be put in place within the next 12 months. It must be collectively owned by all NICS departments and applied across the NICS to drive consistency in approach, including the application of common standards, and deliver more compatible systems which drive cost efficiencies and assist in delivering on the public service transformation ambitions of the Programme for Government.

Recommendation 4

Departments must ensure that there is accurate and timely contract management and cost information available to enable regular monitoring and reporting and to support decision-making by the relevant governance mechanisms.

Part Three: The major IT projects portfolio in Northern Ireland government departments

There were 29 projects in the major IT projects portfolio at March 2025, at an estimated cost of £5.2 billion

3.1 The major IT projects portfolio, as provided by departments, includes details of 29 projects with an original estimated whole life cost of £3.9 billion (see Appendix 2). Departments told us that the scope and final solution of IT projects can change considerably as projects evolve, particularly during the design and development phases. The latest estimate of total whole life costs has increased by £1.3 billion to £5.2 billion, an increase of almost a third. The encompass programme in Health accounts for the majority (£947 million) of the increase in estimated costs. Of the 29 projects, 26 are considered by departments to be IT-enabled projects. Figure 1 shows the number of projects and the estimated whole life cost across the NICS departments. The majority of whole life cycle costs in IT projects are resource costs which account for approximately 75 per cent of estimated costs.

3.2 The Department of Health (DoH) has the greatest number of programmes/projects (eight), accounting for almost half the total whole life cost (£2.5 billion) across the portfolio. The majority of this cost (£1.9 billion) relates to the encompass programme (see Case Study 1).

3.3 The DoF portfolio is the second largest by size and value. It includes six programmes/projects at a combined expected total cost of £1.1 billion, three of which have been included as case studies in this report:

- Integr8 (see Case Study 2)

- Land & Property Services NOVA Revenue and Benefits project; and

- Land & Property Services NOVA Land Registration project (see Case Study 3).

The Integr8 and NOVA programmes account for £1 billion – just over 90 per cent of the total whole life cost in the DoF portfolio.

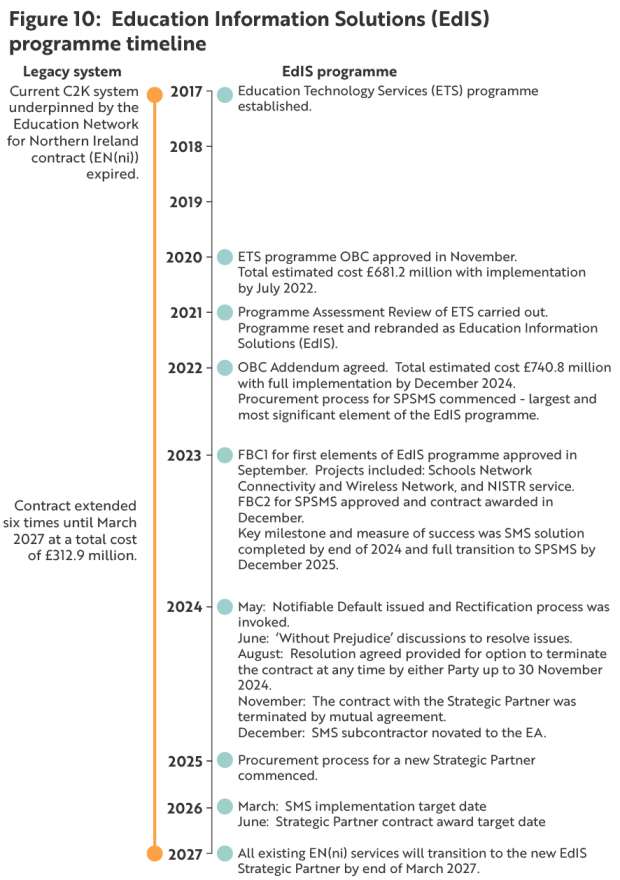

3.4 Whilst there are only two programmes/projects in the Department of Education’s portfolio, it is the third largest portfolio by value at £812.9 million. Both programmes/projects are the responsibility of the Education Authority (EA), with the largest being the Education Information Solutions Programme (EdIS) with an expected total whole life cost of £734.4 million (see Case Study 4).

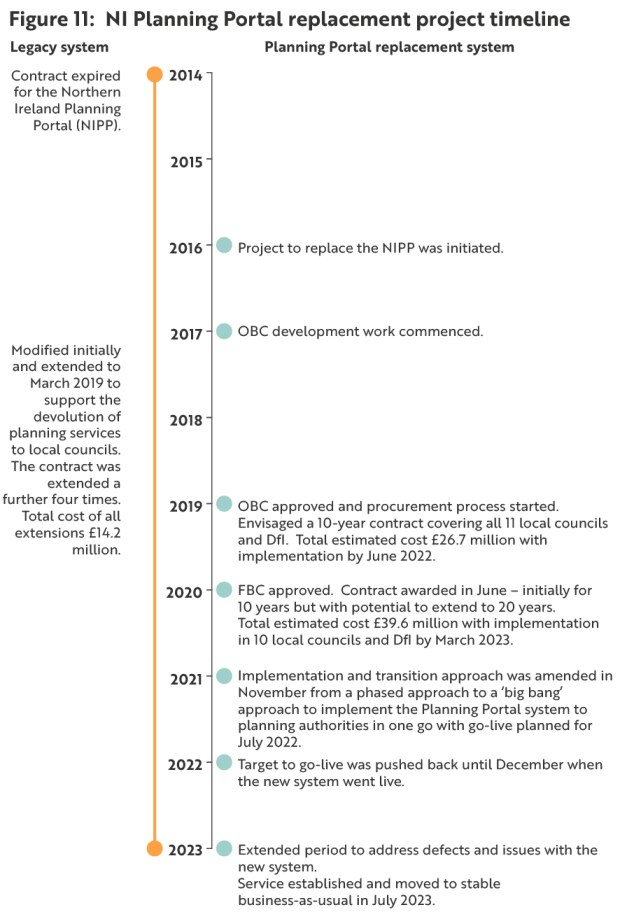

3.5 Almost all of the projects in the Department for Infrastructure (DfI) portfolio (four out of five projects) are the responsibility of its ALBs. The fifth project is the Planning Portal. It was fully implemented in July 2023 at a total cost of £43.1 million (see Case Study 5).

The latest project team assessments show that the majority of the portfolio are facing significant issues

3.6 Based on the latest internal assessments completed by the project teams, the majority of live projects, 14 projects or 58 per cent, with a value of almost £2.2 billion, in the major IT projects portfolio have a Red or Amber RAG status as shown in Figure 2. Half of the live projects have an Amber RAG status, defined as “successful delivery of the programme or project to time, cost and quality appears feasible but significant issues already exist requiring management attention; these appear resolvable at this stage and, if addressed promptly, should not present a cost or schedule overrun.”

On average, it takes almost six and a half years for a major IT project to be designed, procured, implemented and become business-as-usual across the NICS

3.7 For the purposes of this report, we have categorised the major IT projects into lifecycle stages as follows:

Stage 1 – Initiation - This stage involves scoping and discovery work with stakeholders to clarify the requirement and need. Project structures are established, and a Strategic Outline Case (SOC) may be required depending on the size of the project, in accordance with Better Business Cases NI. The initiation stage is completed when the Outline Business Case (OBC) is drafted and approved.

Stage 2 – Design and Procurement – detailed planning and procurement completed with contract signed.

Stage 3 –Implementation, Delivery and Transition - system configured, testing complete, initial training, and ready to go live.

Stage 4 – Business-as-usual – the service is up and running and has become business-as-usual.

3.8 A summary of the portfolio information provided by departments shows that the majority of major IT projects are at Stage 3 (Implementation) of the life cycle (see Figure 3).

3.9 Based on the information provided by departments, from OBC approval to a new system becoming business-as-usual is an average of 77 months – almost 6 and a half years:

- The design and procurement stage (i.e. from OBC approval to contract award) takes on average 28 months (ranging from 4 months to 114 months).

- It then takes on average a further 49 months from contract award for the new system to be fully implemented and business-as usual (ranging from 4 months to 112 months).

Continued contract extensions are too often a necessity due to a lack of strategic planning

3.10 The majority of projects included within the major IT projects portfolio are to replace an existing system and for almost all those projects the legacy contract has been extended multiple times to maintain continuity of service while a new system is delivered. On average across the portfolio, legacy contracts were extended by almost eight years. Whilst we recognise that not all legacy systems will require replacement at contract end, and there can be valid business decisions to extend contracts and maintain existing systems, many of the extensions were a necessity as opposed to a strategically planned choice. Figure 4 summarises the contract extensions. The longest contract extension was for 18 years and relates to the Northern Ireland Food Animal Information System which was the subject of a separate NIAO report.

3.11 Continued contract extensions of this nature, well in excess of the original contract expiry, and use of legacy systems expose the NICS to numerous risks including:

- business failure from its dependence on old technology;

- breach of procurement legislation and inability to demonstrate value for money of the contract;

- increased costs for maintaining old technology;

- reduced agility and difficulty integrating with newer, more advanced systems;

- unrealised benefits of having a modern system in place for all its stakeholders; and

- increased susceptibility to cyber threats.

Part Four: Case studies from the major IT projects portfolio

4.1 We conducted a high-level review of five programmes/projects. Each of the programmes and projects has been impacted by the uncertain operating environment including the impact of the COVID-19 pandemic, inflationary increases, long periods without Ministers, systemic capacity and capability issues, and the ongoing difficulties presented by both single year budgets and delays in budgets being agreed.

4.2 Each of the projects included as a case study replaces a legacy system(s). We found that there were delays in all cases in moving from the legacy system to a new system, primarily due to a lack of strategic planning, the pace of planning, and capacity and capability issues. Some projects also experienced delays due to procurement and post contract award issues. The contracts for the legacy systems have been extended well beyond the original intended life. Figure 5 summarises the contract extensions and the costs which are in excess of £573 million.

Figure 5: Length and cost of contract extensions for the legacy systems associated with the case studies

| Programme/project | Expiration of original contract | Extended to | Length of extensions | Value/Cost of extensions1 £million |

|---|---|---|---|---|

| EdIS | March 2017 | March 2027 | 10 years | £312.9 |

| Planning Portal | September 2014 | December 2022 | 6.25 years | £14.2 |

| LPS NOVA2: Land Registration | July 2019 | July 2028 | 9 years | £76.7 |

| LPS NOVA: Revenue and Benefits | January 2013 | January 2030 | 17 years | £42.4 |

| Integr8 | HR Connect: March 2021 Account NI: March 2018 | HR Connect: March 2027 Account NI: December 2027 | 6 years Further extension required 9.75 years | £86.6 £40.0 |

| Encompass | Replaces approximately 45 systems. Cost details of all extensions have not been collated. However, the cost of the legacy systems per the FBC is approximately £6.5 million a year. |

Source: NIAO analysis of information provided by departments.

Notes:

1. The value of the contract extension relates to the contractual value increase agreed in the contract modification/extension process and is the value up to which the Department can spend during the extension. The actual cost incurred may be lower.

2. The LPS NOVA programme includes three projects for the main line of business systems (Revenue and Benefits; Land Registrations; and Valuations) in addition to an Integration project. In this report we have focused on the two largest projects in the programme – Revenue and Benefits project, and Land Registration project.

Case Study 1 – Department of Health – encompass programme

The encompass programme is key to supporting Health and Social Care (HSC) transformation. The encompass programme represents whole-system transformation and modernisation, enabled by IT infrastructure. It involves developing a single, real time and up-to date digital care record for every patient in Northern Ireland which is accessible to all HSC primary and secondary care staff and patients.

It will fundamentally reshape clinical workflows, business processes, and service delivery models across all Trusts and is the largest change management and digital health initiative ever undertaken in Northern Ireland.

Overview

Background

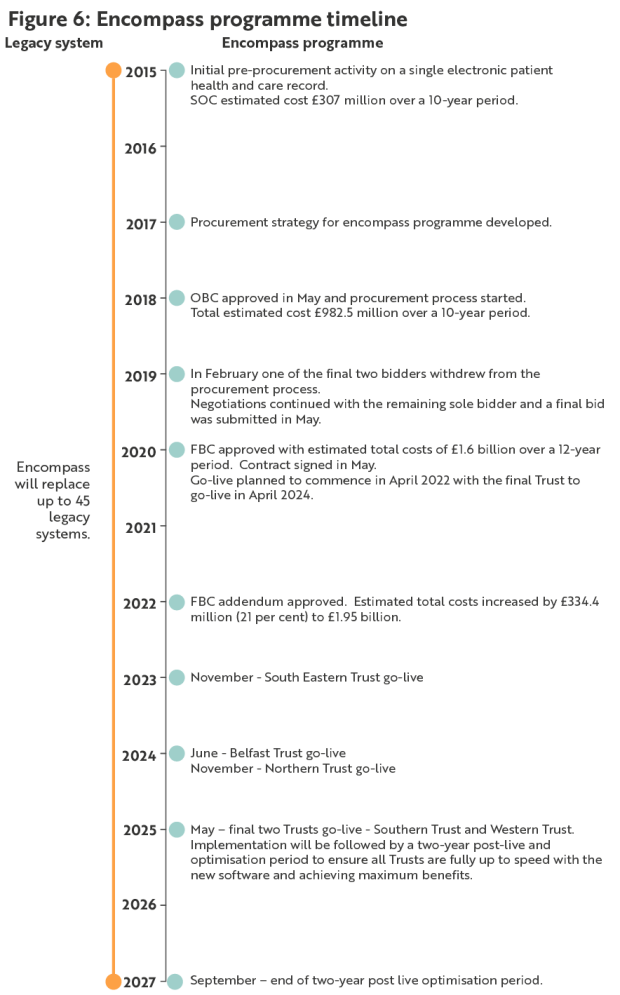

Initial pre-procurement activity on a single electronic patient record system commenced in early 2015. Business Services Organisation (BSO) assumed responsibility for overseeing progress. In November 2017 BSO developed a procurement strategy for what had become known as the encompass programme.

The successful design and implementation of encompass is critical to supporting much needed transformation of the local HSC sector and to enable it to work more efficiently and effectively. The encompass programme involves using cutting edge digital technology to develop a single, real time and up-to-date digital care record for every patient in Northern Ireland which will ultimately be securely accessible to all HSC primary and secondary care staff and the patients themselves. A linked Patient Portal will also allow patients and service users to book appointments, review test results and letters and communicate with HSC care providers. It is the single largest and most ambitious digital project ever delivered within the local HSC sector and will also incorporate social care.

Reliance on legacy systems

HSC staff have long been dependent on various electronic and paper-based legacy record systems. Many of these systems are close to being obsolete. They are expensive to maintain and present major upgrading and interfacing challenges.

Encompass was originally intended to replace around 70 HSC patient legacy systems. The legacy systems range from small systems unique to individual trusts to the Patient Administration System which has long been the principal software solution through which the five trusts have recorded, stored and viewed patient information. The encompass OBC and FBC documents both referred to the urgent need to replace these legacy systems to avoid their catastrophic failure. Due to the number of legacy systems being replaced we have not collated data on contract extensions required to maintain continuity of service.

The Department told us that further work in relation to data quality and clinical need for historical data, and the change in landscape from early planning to implementation, has meant that the number of main systems to be replaced reduced to 45 as the roll-out of encompass has progressed.

Some of the remaining legacy systems such as Healthcare in Prisons, Child Health Services and Children’s Social Care, are scheduled for future integration into encompass and go-live by November 2025, February 2026 and December 2026. Other legacy systems will continue to run in parallel with encompass to meet specific diagnostic and clinical requirements, whilst others cannot be replaced as encompass does not fully replicate or replace certain customised functionalities.

Cost and timeframe

The estimated costs of delivering encompass have increased considerably since the initial 2017 OBC estimate of £982.5 million. The FBC Addendum in December 2022 estimated full programme costs of £1.95 billion. The latest available estimate of full programme costs is £1.93 billion.

The implementation was originally planned on a phased go-live approach across the Trusts, commencing in April 2022 in the South Eastern Trust and the Western Trust planned to be the last to go live in April 2024.

Current position

Go-live in the South Eastern, Belfast and Northern Trusts was achieved in November 2023, June 2024 and November 2024 respectively – approximately 19 months behind schedule. A combined go-live in the Southern and Western Trusts was achieved in May 2025, 20 months and 13 months behind schedule respectively.

While the roll-out of encompass was completed across all Trusts in May 2025, there remain a number of important components to be developed to enable the future integration of critical services including Children’s Social Care, Healthcare in Prisons and Child Health Services. The timeframe for these future integrations is uncertain.

To date, none of the legacy systems replaced by encompass have been switched off and the costs of maintaining the legacy systems continue to be incurred. The cost of the legacy systems per the FBC is approximately £6.5 million a year.

The encompass Business Case did not include data archiving which is required to fully support the decommissioning of legacy systems. While the implementation of encompass facilitates the transition from 45 legacy systems, legacy system contracts are held by individual Trusts and BSO with Digital Health and Care NI commissioning and overseeing the data archiving programme. A mandate for the data archiving programme has recently been approved with anticipated costs of around £10 million. This aims to ensure that legacy system data remains accessible for clinical, legal, and audit purposes, whilst enabling the eventual decommissioning of legacy systems and replacement by encompass.

The target date for implementing a Centralised Archiving Solution is currently December 2028. Following data migration and validation, the target date for formally decommissioning legacy systems is March 2029.

Issues and Challenges

Progress at the programme initiation stage was slow

Initial pre-procurement activity on a single electronic patient record system commenced in early 2015 when a DoH working group began assessing how its development could be progressed. BSO then assumed responsibility for overseeing further progress and compiled a Strategic Outline Case in December 2015. It took almost a further two years (November 2017) before BSO developed a Procurement Strategy. An OBC for encompass was submitted in 2017 and approved in May 2018.

Procurement challenges and a sole supplier situation

In August 2018, following assessment of 12 Selection Questionnaires received from bidders, BSO shortlisted the four highest scoring bidders, the top two of which would be brought through to the next stage. Although the third placed bid was closely behind the second ranked bidder, BSO’s stated intention had been to only shortlist two bidders to the final procurement stage, with its legal advisors considering that this would deliver more focused dialogue and better final bids. However, this also significantly risked undermining competitive tension if one of the two remaining bidders withdrew, which did subsequently happen when Supplier B (the bidder ranked second) withdrew from the procurement process on 25 February 2019.

Supplier B’s withdrawal left BSO and DoH with major difficulties as a sole supplier situation had considerable potential to reduce the competitive tension previously present and undermine the value for money achievable. It was also significant because Supplier B had indicated it was trying to develop a fixed cost bid, which offered greater price certainty, and which had been adopted by BSO at an early stage as one of the Key Commercial Principles for encompass. The situation was further complicated as the procurement process was well advanced with BSO already having incurred major costs. Restarting the procurement process would bring additional expense, with no certainty of attracting new bidders.

After considering procurement and legal advice, DoH and BSO opted to enter final negotiations with the remaining sole supplier. In deciding to continue with sole supplier negotiations, DoH and BSO had taken steps to try and demonstrate that this could still deliver value for money, including obtaining assurance on the validity of the procurement process and over potential cost variables within the final tender. Around this time, BSO’s legal advisers also concluded that the final tender represented a significant shift in the HSCNI’s favour from Supplier A’s original negotiating position and was at least as beneficial as could have been achieved from a multi-bidder situation.

The bid from the sole supplier was accepted and the contract was signed in May 2020.

It is important to acknowledge that DoH and BSO clearly had to make hard decisions when the sole supplier situation arose at a critical and advanced stage of the procurement and did take steps to try and demonstrate that value for money could still be achieved from this situation. However, Supplier B’s withdrawal ultimately removed competitive tension from the process and potentially damaged the prospects of achieving best value. It is also difficult to see how anyone could definitively conclude that a single tender situation produced at least as beneficial an outcome as that achievable from a multi-bidder situation as the legal advisors could not be sure what Supplier B’s final bid might have looked like.

The estimated costs of delivering encompass have increased significantly

The 2017 OBC estimated the costs of delivering encompass at £982.5 million.

Following acceptance of the final bid, BSO submitted the FBC to DoF in December 2019. Total cost estimates had risen by 64 per cent to £1.61 billion over a twelve-year period between 2019-20 and 2030-31.

BSO then continued working with the successful contractor to better understand the supplier methodology and the pathway for implementing encompass across the HSC sector. By late 2020, BSO had identified that the FBC had considerably under-estimated the costs of encompass. In early 2022, it recognised that costs would exceed approved FBC levels by more than 10 per cent, therefore further DoF approval of expenditure was required. An addendum document submitted to DoF in November 2022 outlined that total FBC costs would increase by £334.4 million (20.7 per cent) from £1.61 billion to £1.95 billion. DoF approved the FBC Addendum in December 2022.

The encompass contract was signed on a time and material basis rather than a fixed cost model

A key commercial principle which BSO had established for encompass had been to agree a fixed implementation price with the contractor to help bring price certainty. Supplier B had been working to try and compile a bid on this basis before it withdrew from the procurement process, and in final negotiations with BSO, Supplier A had also indicated its willingness to submit a fixed cost bid. However, BSO instead formed the view at this stage that a time and materials (T&M) model would secure better value for money.

In explaining when and why its preferred option for implementation costs had changed from fixed price to a time and materials basis, BSO told us that Supplier A’s approach to implementation costs had been consistent throughout the procurement and that the detailed information available to it on implementation costs against estimates provided it with sufficient oversight to help mitigate the risk of cost overruns. It also stated that it had negotiated heavily on payment profile during final negotiations, and that whilst Supplier A was willing to offer a fixed price it considered that the premium likely associated with this meant that a T&M model would secure better value. However, as BSO did not also request a fixed price quote for comparison purposes, it is difficult to meaningfully conclude that this would have been the case.

COVID-19 and capacity and capability constraints mean that go-live was behind schedule in all five HSC Trusts

Challenges emerged in late 2020, including the significant impact of COVID-19, and difficulties in recruiting the large numbers of people and skills sets required to progress implementation of the programme.

Go- live in the South Eastern, Belfast and Northern Trusts was delayed. To try and minimise overall delays, the encompass programme board decided to combine go-live at the Southern Trust and Western Trust by May 2025, rather than separately as initially planned. The position is summarised in the table below.

| Milestone | Envisaged date in FBC | Actual date achieved/ scheduled date | Actual/anticipated delay |

|---|---|---|---|

| South Eastern Trust go-live | April 2022 | November 2023 | 19 months |

| Belfast Trust go-live | October 2022 | June 2024 | 19 months |

| Northern Trust go-live | May 2023 | November 2024 | 18 months |

| Southern Trust go-live | September 2023 | May 2025 | 20 months |

| Western Trust go-live | April 2024 | May 2025 | 13 months |

| Post-live and optimisation | Up to June 2026 | August 2025 – September 2027 | 15 months |

Key HSC performance information which was previously routinely generated has been heavily caveated since encompass went live

The Northern Ireland Statistics and Research Agency (NISRA) has not yet been able to formally endorse the quality and robustness of data generated by encompass. Key performance data which was previously routinely available has been heavily caveated as ‘provisional official statistics in development’. This includes information on the number of people waiting for outpatient assessment, inpatient care and diagnostic tests and associated waiting times, and performance against the three key HSC cancer care waiting time standards. DoH told us that while formal validation of encompass-generated data for official statistics is ongoing, Trusts continue to access and use a wide range of operational data to manage services.

DoH has been working closely with encompass stakeholders to achieve full and formal publication of this data but cannot yet provide a firm date. Until NISRA has been able to complete the required checks on data quality, any statistics which are published from encompass, will continue to be caveated. In addition, as encompass is further rolled out, the need to monitor, review and validate data initially produced across each Trust and to obtain NISRA assurance for this brings uncertainty over the extent to which non-availability of data will recur across other trusts, and how long this might endure.

Lessons to be shared

- The need to have the right people with the right skills in place in project teams.

- The importance of taking all possible steps to maintain competitive tensions throughout a procurement process. Particular caution should be exercised over only shortlisting two bids to final procurement stages.

- The need for a suitably detailed understanding of a programme/project to inform a robust FBC and cost and time estimates prior to contract signature.

- The need for a clear understanding of the nature, extent and costs of legacy systems to be replaced and a clear plan to achieve this.

Case Study 2 – Department of Finance – Integr8 programme

Integr8 is a central government IT-enabled transformation programme, led by the Department of Finance. It aims to transform how Finance and Human Resources (HR) shared services are delivered across the NICS and will replace the existing HR Connect and Account NI systems with a single cloud-based solution. It will also establish a new organisational structure within DoF to replace existing shared services provision for both.

Overview

Background

The Public Sector Shared Services Programme (PSSSP) was established in 2016 to examine the potential development of next generation HR, Payroll, Finance, IT and Procurement and Logistics shared services for all public sector organisations in Northern Ireland. The aim of the PSSSP was to look more strategically across traditional public sector boundaries at the potential to implement next generation shared services which provide efficient, cost-effective and high-quality services.

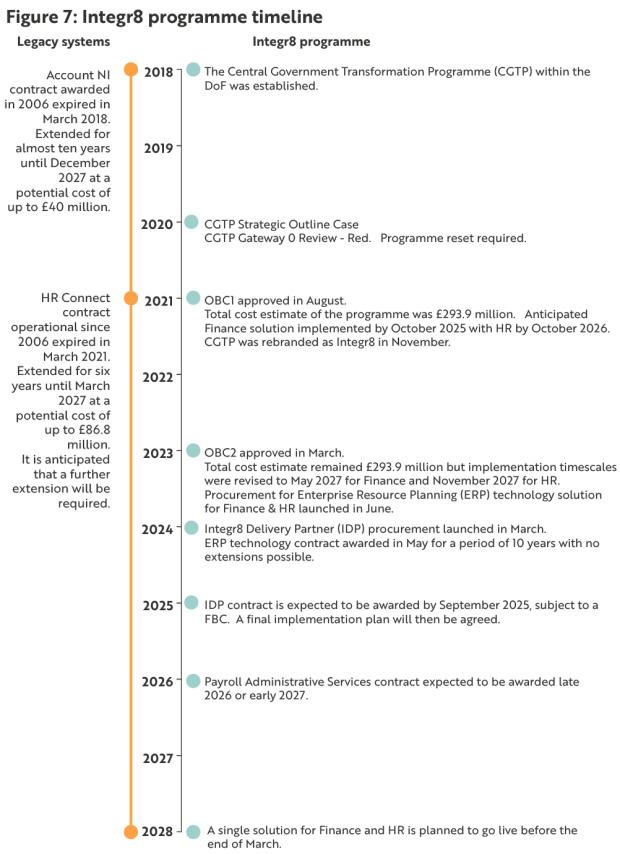

The Central Government Transformation Programme (CGTP) within DoF was established in 2018 in response to the recommendations of the PSSSP. The CGTP focused on transforming the future delivery of Finance, HR & Payroll services for central government bodies in Northern Ireland. The CGTP was rebranded to Integr8 in November 2021.

Integr8 is leading in the design and development of an integrated operating model. The scope includes procuring the following services:

- Integrated, cloud-based Enterprise Resource Planning (ERP) solution.

- Systems implementation partner, known as Integr8 Delivery Partner (IDP).

- IT service management software.

- Managed service provision.

- Payroll Administrative Services (PAS).

- Client-side advisory support, known as Business Transformation Partner (BTP).

Each procurement will have a FBC. Each FBC submitted for approval will include updates on all key changes and developments since approval of the OBC, and the preceding approved FBC. The iterations will cumulatively provide the complete FBC for the programme once the procurements are completed.

Other key activities required to deliver the new operating model such as HR policy and delivery, are outside the scope of Integr8.

Contract extensions for legacy systems to maintain continuity of service

A significant driving force for the Programme was the need to replace the existing HR Connect and Account NI systems, which are increasingly outdated, expensive to sustain and no longer fit for purpose. The CGTP was established in September 2018. That is after the original contract expiration dates had passed for both HR Connect and Account NI.

The NIAO previously expressed concerns on the lack of progress in preparing for replacement Finance, HR and Payroll systems and in our annual audits highlighted the need to develop and agree concrete plans to ensure replacement services are procured and developed which are best fit for purpose and bring transformation.

The HR Connect contract was for 15 years to March 2021. It has been extended for six years until March 2027 to ensure continuity of service. The value of this extension is £86.6 million. It is anticipated that a further extension will be required.

The Account NI contract, awarded in 2006 for 12 years, has been extended for almost ten years until December 2027 to ensure continuity of service. The value of this extension is £40 million.

Cost and timeframe

OBC1 was approved in August 2021. The Business Transformation Partner (BTP) was appointed shortly afterwards to work alongside the internal Integr8 programme team to develop the future operating model, for both Finance and HR, and prepare for the launch of various procurements required to support the investment decision.

OBC included estimated costs of £294 million over the lifetime of the whole programme including the Integr8 programme team, replacement finance and HR systems, and associated contracts. The implementation date for Finance was expected to be October 2025, with HR and Payroll following a year later in October 2026.

Following programme reset and rebranding, OBC2 was approved in March 2023. The estimated total cost of the programme was unchanged, but implementation timescales were revised to May 2027 for Finance and November 2027 for HR and Payroll.

£93 million of the estimated overall costs reflect the cost incurred by DoF to deliver the bulk of the programme from 2022 until go-live in 2027-28 and includes: internal Integr8 programme staffing; BTP advisers; and the design/build/test elements of the technology solution (ERP) and the Integr8 Delivery Partner (IDP).

Current position

The contract was awarded for the enabling ERP technology in May 2024 for a period of 10 years with no extensions. In line with the Integr8 Procurement Strategy, a further two FBCs are required to support the investment decision for a Payroll Administrative Services contract and a Systems Implementation Partner.

The FBC for the Payroll Administrative Services contract is expected to be completed late 2026 or early 2027.

The FBC for the Systems Implementation Partner, known as the Integr8 Delivery Partner (IDP) is underway and is expected to be finalised subject to Gateway 3 in summer 2025. The contract is expected to be awarded by September 2025, and a final implementation plan will then be agreed.

The Department is planning for a phased roll-out of finance and HR services with all go-lives completed within an overall implementation period of 30 months from contract award and transitioning into steady-state business-as-usual by March 2028. This is dependent on the outworkings of the IDP procurement.

Issues and challenges

There were delays at the programme initiation stage and a Gateway review recommended a reset

Although the CGTP was established in September 2018, it was March 2020 before a Strategic Outline Case was prepared.

A Gateway review in May 2020 resulted in a very Red rating. The review found that the programme had made little progress and was not on course for successful delivery. It highlighted critical issues including:

- The principal governance mechanism, the programme board, was ineffective and not representative of functions/departments beyond DoF.

- Despite having been in existence for almost two years at that point, there was a lack of clarity on the scope of the programme, outcomes, the preferred approach and procurement route options.

- There were capacity and capability issues.

The Gateway review recommended that the programme be reset.

The Assurance of Action Plans Gateway review which followed in 2021 found there had been a robust and extensive response to all the recommendations made and the Delivery Confidence had improved to Amber.

There are ongoing capacity, capability and funding challenges

The programme has continued to face resourcing challenges. The 2020 Gateway review highlighted issues with capacity and capability as a result of resource constraints across the NICS and the impact of COVID-19. Particular areas of expertise considered to be lacking at that time included business change management, project management, communication, technical knowledge and business case development.

The recruitment, development and retention of suitably skilled and experienced team members continues to require ongoing focus. Challenges also include ensuring that the SRO is able to dedicate the time required by the programme.

Insufficient budget and funding uncertainty associated with in-year funding resulted in key activities having to be delayed and the need for replanning, changes to timelines and funding profiles. For example, delayed and reduced budget allocation meant some of the expert resources recruited to the internal team could not be retained in one financial year, but then a round of re-hiring was needed in the following financial year. Progress on the programme had to be significantly slowed down between February and December 2023 due to insufficient funding. This involved the Business Transformation Partner being stood down and recruitment for the internal team being paused during this period. This impacted on the programme in terms of cost and delayed timescales.

Resourcing issues outside the Integr8 team also present risks including a lack of capacity across other departments to provide subject matter experts to engage with the Integr8 team, and the ability of departments to manage the additional work that programme implementation will bring along with delivery of business-as-usual.

Driving standardisation across multiple organisations will require significant engagement, communication and change management

Deviations from the standard processes in the procured solution will incur change costs and will likely be more costly to maintain. Therefore, the Programme has recognised the need to drive standardisation across integrated services to maximise the benefits of the cloud-based ERP solution, and ‘Adopt not Adapt’ is a key element within the Programme’s design principles. This is reflected in cost estimates which assume that there will be limited changes to the core ‘off the shelf’ product.