List of Abbreviations

AO Accounting Officer

BRT Belfast Rapid Transit

CDG Department of Finance Commercial Delivery Group

CEF Construction Employers Federation

CoPE Centre of Procurement Expertise

CPD Construction and Procurement Delivery

CTCC Community Treatment and Care Centre

DAERA Department of Agriculture, Environment and Rural Affairs

DE Department of Education

DfC Department for Communities

DfE Department for the Economy

DfI Department for Infrastructure

DoF Department of Finance

DoH Department of Health

DoJ Department of Justice

FBC Full Business Case

FEC Further Education College

FTC Financial Transaction Capital

GAA Gaelic Athletic Association

GBD Ulster University Greater Belfast Development

HOCS Head of the Northern Ireland Civil Service

ISNI Investment Strategy for Northern Ireland

ITT Invitation To Tender

KPI Key Performance Indicator

NICS Northern Ireland Civil Service

NIFRS Northern Ireland Fire and Rescue Service

NIPPP Northern Ireland Public Procurement Policy

OBC Outline Business Case

P3O Portfolio, Programme and Project Office

PAC Northern Ireland Assembly Public Accounts Committee

PAN Procurement Advisory Note

PCCC Primary Community Care Centre

PfG Programme for Government

SIB Strategic Investment Board Limited

SRC Southern Regional College

SRO Senior Responsible Officer

SSEC Strule Shared Education Campus

TEO The Executive Office

Key Facts

£10.6 billion of public sector capital expenditure 2019-2024.

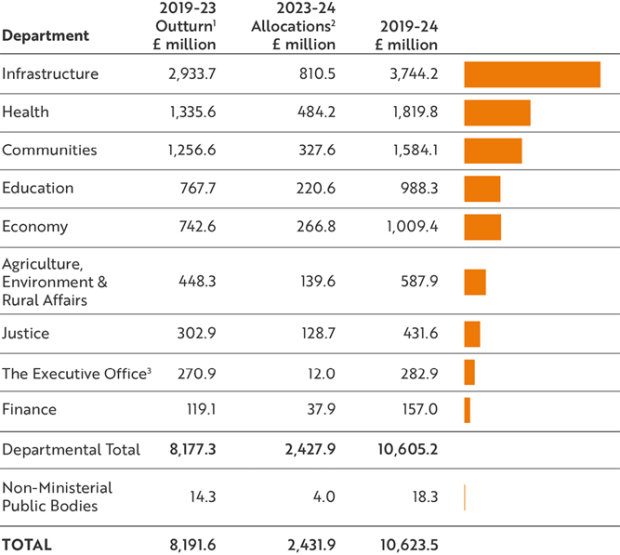

Three departments account for almost seven out of every £10 of public sector capital expenditure (2019-2024) - Infrastructure £3.7 billion; Health £1.8 billion; and Communities £1.6 billion.

Only one of the Executive’s flagship projects announced in 2015 has been fully completed.

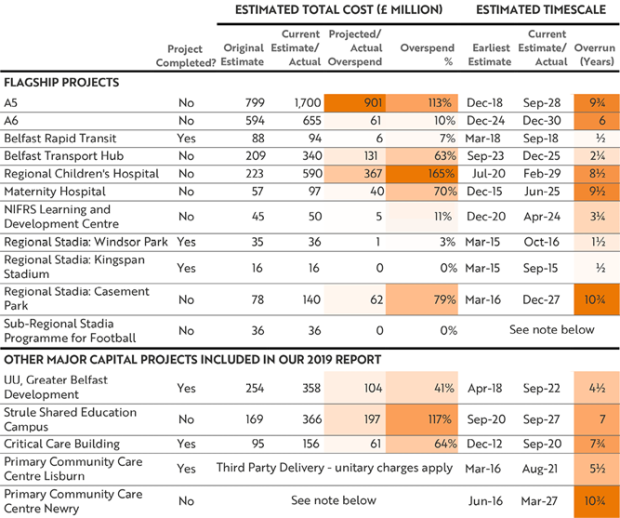

Delays and cost overruns have continued in the Executive’s seven flagship projects and the four high profile projects featured in our 2019 report. The combined estimated cost overrun is now £1.94 billion.

In the period April 2019 to August 2023:

Departments major capital projects portfolio consisted of 77 projects.

It was originally estimated to cost £5.63 billion to complete and is now expected to cost £8.08 billion, a 44 per cent increase on the original business case cost estimates.

Only 9 of the 77 projects are expected to meet both their original time and cost estimates.

41 of the 45 projects with estimated/actual cost overruns either did not or are not expected to meet their target completion dates.

Executive Summary

Executive Summary

1. In December 2019, we published our report on Major Capital Projects which presented an overview of the Northern Ireland major capital projects portfolio. For the purposes of the report we defined major as over £25 million. We examined the progress made on the delivery of 11 major capital projects, including the seven flagship projects identified in 2015 by the Northern Ireland Executive (the Executive) as its highest priority projects. We found that each of the projects examined experienced time delays and/or cost overruns when compared against original timescales and budgets. The explanations provided by departments included funding constraints, legal challenges, planning issues, limited interest from the construction industry and issues with the quality of construction.

2. The subsequent Northern Ireland Assembly’s Public Accounts Committee (PAC) report (October 2020) made 15 recommendations (see Appendix 1) aimed at: improving accountability for delivery of major capital projects; improving commissioning and delivery arrangements; and improving planning of major capital projects, with the Chair of the PAC commenting that “these important capital projects should and could have been delivered without many of the delays and excess costs.”

3. The construction industry is the second largest industry in Northern Ireland with over 10,500 businesses (14 per cent of all businesses in 2023) and an estimated 35,000 employees. Given the issues previously identified and the importance of major capital projects to the economy of Northern Ireland, we noted our intention to revisit this area.

4. This report presents the findings of our follow up review. It provides an overview of progress on the 11 major capital projects included within our 2019 report, an update on actions taken to implement previous recommendations and considers other developments in this important area of significant public expenditure. The report also includes an updated stocktake of the major capital projects portfolio across Northern Ireland government departments and a case study of a recently completed project, the Armagh campus at Southern Regional College, that demonstrates delivery to the planned cost and timetable.

Key findings

Only one of the Executive’s flagship projects announced in 2015 has been fully completed

5. In 2015, the Executive identified seven flagship infrastructure projects as its highest priority projects. We conducted a high-level review of the seven flagship projects and found that each of the seven projects has experienced, and in some cases, continues to experience, cost overruns and/or significant delays. At the time of our 2019 report, only one of the Executive’s seven flagship projects, the Belfast Rapid Transit project, had been fully completed. Whilst we recognise that progress has been made on some of the projects, and some phases of the projects have completed, it remains the case that the Belfast Rapid Transit project is the only flagship project to have fully completed. The status of each of the flagship projects is summarised below:

- A5 – This project aims to upgrade the A5 Western Transport Corridor and improve links between Londonderry, Strabane, Omagh and Aughnacloy, and with the Republic of Ireland. The project continues to be delayed. Following a third public inquiry, the Department for Infrastructure received the final advisory report from the Planning Appeals Commission and is now considering the points raised and detailed recommendations made. This project was originally planned to be completed in 2018 at a cost of £799 million. Subject to the outcome of the Planning Appeals Commission inquiry, the Department for Infrastructure’s latest estimate is for completion in 2028 at a cost of £1.7 billion.

- A6 – This project involved upgrading the A6 element of the Northwestern Transport Corridor connecting Belfast to Londonderry. It was originally expected to cost £594 million and is now expected to cost £655 million. It is substantially complete. The project was to be delivered in two sections, with the second section split in to two phases. The first section (Randalstown to Castledawson) opened in May 2021 and is expected to have a final cost of £192 million (compared to an original planned completion date of October 2020 and original estimated cost of £184 million). Phase one of section two (Dungiven to Drumahoe) was opened in April 2023 at an estimated final cost of £264 million (compared to a planned completion date of 2021 and cost of £239 million). The Department for Infrastructure told us COVID-19 had an unprecedented negative impact on delivery of the A6 scheme, and this was exacerbated on the A6 Dungiven to Drumahoe section by the impacts of Brexit, the war in Ukraine and other inflationary pressures. Phase two of section two (Caw to Drumahoe) was originally estimated to be completed by 2024 however the Department for Infrastructure told us it is on hold as works will encroach on to the illegal Mobouy waste site.

- Belfast Rapid Transit – The Belfast Rapid Transit project had completed at the time of our 2019 report. Originally planned to be operational in 2017-18, this was revised to 2018-19 due to funding uncertainties. The East-West Gilder route opened in September 2018. The final cost for the project was £94.4 million, some £6 million more than the approved business case. A separate project, Belfast Rapid Transit Phase 2, commenced in August 2018 to extend the Glider network. The North-South route was announced by the then Minister for Infrastructure in October 2022. The latest estimated cost of the project is expected to be £142-£148 million, of which £35 million of funding has been secured via the Belfast Region City Deal. Twenty million pounds of funding for Phase 2 from the UK government’s New Deal for Northern Ireland has been paused. Dependent on the availability of funding, the North-South service could be operational by late 2029.

- Belfast Transport Hub – The Hub will include an integrated bus and rail concourse, eight new rail platforms, 26 new bus stands, retail and commercial premises, park and ride facilities, a cycle hub and links to other transport modes. Since our previous report progress has been made on the site, however the latest cost estimate of £340 million is £131 million higher than the original estimate and the completion date has moved to the end of 2025, over two years later than originally planned. Grand Central Station is due to be operational in the final quarter of 2024.

- Maternity and Children’s Hospital – This comprises the build of a new regional children’s hospital and a new maternity hospital both on the Royal Hospitals site in Belfast. The two builds are separate however together they form the flagship Maternity and Children’s Hospital. The new maternity hospital was originally expected to be completed by the end of 2015. Whilst the new maternity hospital has been substantively built it is not operational. The latest estimated date for completion of the final phase of the Maternity Hospital is June 2025, almost 10 years late. The original cost estimate was £57 million, with costs now expected to be £97 million. The regional Children’s Hospital was originally planned to be completed and opened in July 2020 at a cost of £223 million. However, enabling works were only completed in January 2023 and it is now expected to be completed by February 2029. Estimated costs have more than doubled to £590 million.

- The Northern Ireland Fire and Rescue Service Learning and Development Centre at Cookstown - The original flagship project was for a combined training and development centre for the Northern Ireland Fire and Rescue Service, the Police Service for Northern Ireland and the Northern Ireland Prison Service at an estimated cost of £140 million. This was subsequently changed to only accommodate the Northern Ireland Fire and Rescue Service. The total cost of the revised project, for the Northern Ireland Fire and Rescue Service facilities, was estimated at £44.8 million and consisted of two phases. Phase One was initially estimated to complete in 2018 at a cost of £4.2 million. It was completed in July 2019 at a cost of £5.3 million. Phase Two was initially estimated to complete in April 2023 at a cost of £42.2 million. Phase Two works commenced in May 2022 with a revised completion date of April 2024 and a final cost estimate of £44.6 million, bringing the total costs on the project to £49.9 million, against an original estimate of £44.8 million.

- Regional Stadia Programme and Sub-Regional Stadia Programme for Football - The Executive endorsed plans for three regional stadia (football, Gaelic games and rugby) in March 2011. The Regional Stadia Programme was a key commitment in the Northern Ireland Executive 2011-15 Programme for Government (PfG), in the draft PfG for 2016-2021 and remains a priority project under the New Decade New Approach agreement. The completion of the Regional Stadia Programme development was originally envisaged to be within the 2011-12 to 2014-15 budgetary period, and delivery of the Sub-Regional Stadia Programme for Football by March 2018. As previously reported, the Kingspan Stadium was completed in 2015, within six months of the initial estimated completion date, and Windsor Park was completed in 2016 (one and a half years later than originally planned). Both were completed broadly in line with their original costs. The third regional stadium, Casement Park, has been the subject of two judicial reviews against its planning permission. The applicant was not successful in the more recent judicial review and planning permission was upheld. Originally estimated to cost £77.5 million, the most recent cost estimates were in the range of £112 million - £140 million with completion expected by the end of 2027, more than 10 years later than originally planned. Casement Park was verified as one of the host stadia when the UK and Ireland were announced as hosts of the UEFA Euro 2028 competition in October 2023. Progress on the Sub-Regional Stadia for Football programme has been limited, with no final approvals having been given prior to the collapse of the Executive in 2022. A revised Strategic Outline Case for the scheme is in the process of being developed. No capital expenditure has been incurred on this project and the Department for Communities told us that the timeline to complete the project remains unknown.

Delays and cost overruns have continued in the other projects included in our 2019 report

6. In addition to the seven flagship projects, our 2019 report also included case studies on four other major capital projects which we knew had experienced problems. These were the Critical Care Centre at the Royal Victoria Hospital, Belfast; the Lisburn and Newry Primary Community Care Centres; the Ulster University, Greater Belfast Development; and the Strule Shared Education Campus in Omagh.

- Critical Care Centre – As previously reported, this was originally planned as a six-storey building costing £33 million with a completion date in mid-2005. Through design and specification changes the Centre became a 10-storey building with a planned delivery date of 2012 at a cost of £95 million. In October 2012, one month before the scheduled handover date, corrosion was found in the sealed water systems which resulted in handover being delayed until April 2015. During post contract works, issues were identified with the drainage and theatre ventilation system. In January 2020 additional expenditure was approved including, a hybrid operating theatre and additional works to ventilation systems, increasing the overall approved spend to £156.5 million. The Department of Health told us that the project completed in September 2020. All levels in the building have been operational since 2020, however floors 7-9 cannot be used for their original intended purpose as maternity wards until a link corridor, due by June 2025, is built to connect to the new regional Maternity Hospital. Total expenditure to August 2023 reached £155.8 million, and an additional £0.3 million is profiled to be spent in 2024-25 to equip the Maternity floors 7-9 prior to occupation.

- The Lisburn and Newry Primary Community Care Centres - Due to capital funding constraints and the desire to fast track their construction, the two Primary Community Care Centres (PCCCs) were to be built and funded by the private sector and paid for annually over a 25-year term by the health trusts through their revenue budget. They were originally planned to be operational by March 2016 at a total combined cost of almost £80 million. The Lisburn PCCC became operational in February 2023, with service charges to date close to estimates. The construction of Newry PCCC has not yet commenced, and the private sector development approach has been abandoned after the contractor pulled out in November 2021. The latest capital cost estimate for the Newry PCCC is £88.3 million with construction due to begin in April 2025 and complete in March 2027.

- Ulster University, Greater Belfast Development - The University’s project to expand its Belfast campus at a cost of £254 million by April 2018 (with a view to opening for students in September 2018) experienced a number of setbacks in the construction of the last two of four new blocks including: the discovery of latent defects in the build completed under the basement contract of one of the blocks; the collapse of one of two companies in the joint venture to complete the last phase of the build; and the need to reorganise and secure additional and alternative sources of funding for the project following the European Investment Bank withdrawal of a £150 million loan facility in February 2017 because of project delays. The University opened the final phase of the development in September 2022. Final costs are estimated to be £364 million.

- Strule Shared Education Campus in Omagh – The project for a shared education campus originally had an estimated cost of £153.2 million and an opening date for the schools as September 2020. To date only one school has been completed, the Arvalee Special School which was opened in 2016. While preparatory work for the main build, the five post-primary schools, was completed in 2019 and there have been two separate procurement competitions for the main build, the work has not commenced. Costs are now estimated at £366 million, more than double the original estimate, with full campus opening planned for September 2027, seven years late.

7. In 2019 the cost overruns for the seven flagship projects and the four high profile projects detailed above were estimated to be £700 million. Based on current estimates provided by departments, the total estimated cost overruns are now close to £1.94 billion.

Inefficient governance and delivery structures remain in place in Northern Ireland

8. In 2019 we reported that the existing governance and delivery structures within the Northern Ireland public sector are not conducive to maximising the achievement of value for money. A series of reviews of the roles of the Procurement Board, Construction and Procurement Delivery (CPD), the Strategic Investment Board (SIB) and commissioning entities have highlighted that current commissioning and delivery arrangements in Northern Ireland are not fit for purpose. We recommended considering the potential benefits of alternative commissioning and delivery models, however to date there has been no notable transformation of commissioning and delivery arrangements in Northern Ireland.

Several of the recommendations previously made by the PAC have not progressed

9. In its report on Major Capital Projects, the PAC found it unacceptable that in Northern Ireland, the Head of the Civil Service (HOCS) sits outside the formal chain of public accountability. In line with arrangements in Scotland and Wales, the PAC strongly believed that the HOCS should have personal responsibility for the propriety and regularity of all government finance and the economic, efficient and effective use of related resources. Another key recommendation intended to improve accountability required the HOCS to show leadership by taking a much more proactive role in monitoring delivery of public sector projects and challenging departments where performance is not in line with approved plans.

10. In Northern Ireland, departments are separate legal entities under the direction of their own Ministers and responsibility for the delivery of capital projects rests with individual Senior Responsible Officers (SROs), the Accounting Officer and Minister. Therefore, in its response to the PAC recommendations, the Executive questioned what authority the HOCS could exert over other departments. Scotland and Wales operate under a different constitutional position in that they have collective Ministers and no separate departmental corporations. The Executive advised that revising the role of the Northern Ireland HOCS to mirror the role in Scotland and Wales, would not sit easily within the current constitutional position in Northern Ireland. As a result, under the current arrangements in Northern Ireland, the HOCS continues to be limited in her ability to challenge departments on their performance in delivering major capital projects.

11. The PAC also recommended that serious consideration be given to appointing a single oversight body or creating an independent advisory body with responsibility for central monitoring of major capital projects. The Executive responded that such a body could undermine individual departments’ accountability and responsibility and also undermine the role of the Centres of Procurement Expertise, and it was not persuaded on the appointment of a single oversight body with responsibility for central monitoring of major capital projects. As such, unlike other jurisdictions, in Northern Ireland there is still no single oversight body responsible for monitoring delivery of major capital projects.

Some changes have been made since we last reported in 2019

12. The recommendations noted above have not been implemented in the manner intended by the PAC. However, a number of changes have been actioned since our 2019 report which have the potential to bring some improvements to the monitoring, oversight and delivery of major capital projects. Since June 2022, regular progress reporting on major capital projects has been brought to the Northern Ireland Civil Service (NICS) Board every six months. In addition, three new independent non-executive members were appointed to the NICS Board in February 2023. Whilst this is not an additional oversight layer adding scrutiny, challenge or accountability, it is intended to increase transparency and to identify common themes which are causing delays to the delivery of projects.

13. There is now more regular scrutiny from individual Accounting Officers, and revised policy and guidance on best practice in project delivery has included the establishment of Departmental Portfolio, Programme and Project offices (P3Os). P3Os are intended to ensure visibility, and provide support for governance, oversight and reporting on programme/project delivery and assurance. A P3O Forum has been established to assist departments to share best practice, develop learning, support the project delivery function and to strengthen reporting. Since February 2021, the P3O Forum has met twice a year and all departments attend.

14. Other developments include clarifying policy and guidance, an increased focus on ensuring that better information is captured and the implementation of new procurement policies, including a Scoring Social Value Policy in June 2022.

The right people with the right skills must be in place from the initiation stages of a project

15. The SRO appointment letter was revised in 2021, and again in 2023, providing clarity on the role and responsibility of the SRO and, in addition, work is ongoing to develop the capacity and capability within the NICS through the development of the NICS Project Delivery Profession. Whilst these efforts to clarify roles and responsibilities and develop capacity and capability are welcome, some stakeholders continue to express concerns that staff are lacking depth of experience and that skills gaps are wider than project management, commenting that a lack of expertise at early stages impacts on project specifications, costings and timetables. It is essential that the right people, with the right skills, and ideally experience, are in place from the outset of a project.

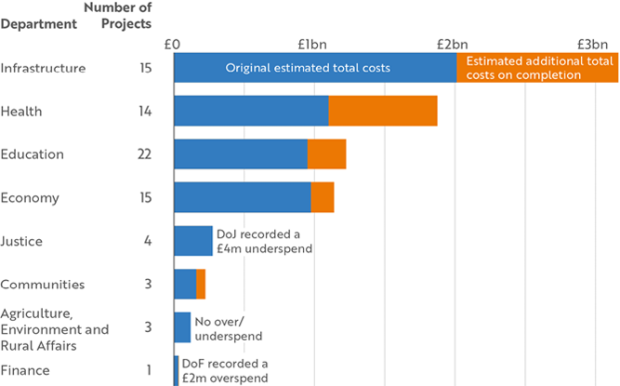

Cost and time overruns continue to persist throughout the major capital projects portfolio

16. In the period from 1 April 2019 to 31 August 2023, departments managed 77 major capital projects (excluding local government and housing association projects). The majority of projects, including those approved since our 2019 report, have experienced increases in the original estimated costs, and/or changes in the estimated completion dates. The total estimated cost on completion of the 77 current major capital projects is £8.08 billion, against an original estimated total cost of £5.63 billion. That is an increase of £2.45 billion on the original approved costs and represents additional funding that could have been invested elsewhere to improve public services.

More still needs to be done to identify, and crucially mitigate, the root causes of delays

17. SIB is undertaking work to identify the root causes of delay and cost overruns in the projects included within our 2019 report. This work is nearing completion and in our view its findings and the action taken by departments to learn from and address those findings and any associated recommendations has the potential to improve the efficiency and effectiveness of the system for the planning and delivery of major capital projects.

Overall conclusion

18. We recognise that major capital projects are complex. Project delivery problems are not unique to Northern Ireland and the absence of multi-year budgets, impacts on departments’ ability to plan, finance and invest in the delivery of major capital projects. However, it is extremely disappointing that issues have persisted in the 11 high-profile major capital projects which we previously reported on in 2019. Of these 11 projects, seven were flagship projects announced by the Executive in 2015, which had protected budgets for a five-year period. Only one of the seven flagship projects has been fully completed. It is not just these high-profile projects which have experienced issues - delays and cost overruns continue to occur frequently throughout the major capital projects portfolio. Given the scale of delays and cost overruns, we are left with the clear impression that departments are not achieving value for money in the delivery of these major capital projects. As major capital projects run over the course of several years, it will take time to fully assess the impact of the actions that have been taken so far to improve delivery in Northern Ireland. However, given the lack of substantive progress since our last report, we are of the view that immediate action is needed to prevent further cost overruns and delays.

19. Over the past ten years a series of reviews by bodies including SIB, the Confederation of British Industry and the Organisation for Economic Co-operation and Development have highlighted significant weaknesses in the commissioning and delivery system for major capital projects in Northern Ireland, and the need for substantial reform including:

- eliminating unnecessary duplication in administrative functions and institutional frameworks;

- improving project prioritisation;

- reducing bureaucracy by focusing more on “within budget” and “on time” delivery, rather than on process; and

- driving better deals by increasing innovation.

However, there is little evidence of change. Key stakeholders have expressed frustration and disappointment with the perceived reluctance to embrace change. Failure to make fundamental reforms to the commissioning and delivery system for major capital projects is enabling the substantial cost and time overruns identified in this report to continue and is impacting on the quality of public services provided to citizens throughout Northern Ireland.

Recommendation

Fundamental reforms to the commissioning and delivery system for major capital projects must be implemented to ensure value for money is achieved and public services are improved. To drive change and ensure delivery we urgently recommend the establishment of a comprehensive transformation project including the development of a clear framework to ensure accountability and delivery of major capital projects in Northern Ireland. This should include:

- Revisiting the recommendations from the previous reviews by SIB, the Confederation of British Industry and the Organisation for Economic Co-operation and Development. Where those recommendations have the potential to bring about improvements in the commissioning and delivery of major capital projects, they must be implemented without further delay;

- Understanding in detail the issues besetting the delivery of these major capital projects as informed by the root cause work of SIB. The action taken to address and mitigate these issues will be an important step in improving project delivery;

- Full consideration of alternative delivery models, resourced with appropriately skilled staff; and

- The roles and responsibilities of all bodies involved in the commissioning and delivery of major capital projects must be reviewed, clarified and streamlined.

Part One: Introduction and Background

Introduction and Background

This report presents an update on the Northern Ireland major capital projects portfolio and reviews departmental progress in delivering a number of significant projects

1.1 In December 2019, we published our report on Major Capital Projects which presented an overview of the Northern Ireland major capital projects portfolio. We examined the progress made on the delivery of 11 major capital projects, including the seven flagship projects identified in 2015 by the Northern Ireland Executive (the Executive) as its highest priority projects. We found that each of the projects examined suffered time delays and/or cost overruns when compared against original timescales and budgets. The explanations provided by departments included funding constraints, legal challenges, planning issues, limited interest from the construction industry and issues with the quality of construction.

1.2 The subsequent Northern Ireland Assembly’s Public Accounts Committee (PAC) report (October 2020) made 15 recommendations (see Appendix 1) aimed at improving accountability for the delivery of major capital projects; improving commissioning and delivery arrangements; and improving planning of major capital projects.

Scope and Structure of this report

1.3 Given the importance of major capital projects to the Northern Ireland economy we gave an undertaking to revisit the topic. This report presents the findings of our follow up review. It provides an overview of progress on the 11 major capital projects included within our 2019 report; an update on actions taken to implement previous recommendations; and considers other developments in this important area of significant public expenditure, including an overview of the construction industry and the strategic context in which capital projects are being delivered. The report also includes a case study of a recently completed project, the Armagh campus at Southern Regional College, that demonstrates delivery to the planned cost and timetable. For the purposes of this report, we have defined major as over £25 million, with a focus on major construction projects, and excluded projects relating to local government and housing associations (this is consistent with our approach in 2019). Our Methodology is set out in Appendix 2.

1.4 The structure of this report is as follows:

- Part One sets out the relevant roles and responsibilities for the commissioning and delivery of major capital projects in Northern Ireland and provides an overview of capital spend by Northern Ireland departments from 2019-2024. It also includes an overview of the current environment within which departments and the construction sector are operating.

- Part Two provides updates on the 11 case studies included within our 2019 report.

- Part Three includes details of the departmental major capital portfolio as at 31 August 2023. It also, includes a case study of a recently completed major capital project that demonstrates delivery to planned cost and timetable.

- Part Four considers the progress on implementing previous recommendations to improve the delivery of major capital projects.

A number of public bodies have a role to play in the commissioning and delivery of major capital projects in Northern Ireland

1.5 Individual departments are accountable for their major capital projects but will work with a range of other bodies that have responsibilities for the policy, strategy and guidance on procurement and project delivery in Northern Ireland. These include the Procurement Board, the Strategic Investment Board (SIB) and the Department of Finance (DoF). The roles and responsibilities of these bodies are set out below.

Figure 1: Central Roles and Responsibilities in delivering major capital projects

The Procurement Board

- Under the Northern Ireland Public Procurement Policy (NIPPP), the Procurement Board is assigned responsibilities in relation to the development and dissemination of policy; monitoring policy compliance; setting performance targets; and monitoring the performance of public bodies against these.

- The Procurement Board was reconstituted in December 2020 to comprise public sector procurement experts (Heads of Centres of Procurement Expertise (CoPE)) and representatives of external suppliers and the voluntary sector.

- It is chaired by the Minister of Finance and last met on 28 September 2022. (Ministers ceased to hold office on 28 October 2022).

The Strategic Investment Board (SIB)

- Develops the Investment Strategy for Northern Ireland (ISNI) for the Executive. Provides advice to the Executive, departments, councils and other organisations in respect of the articulation and delivery of their major investment programmes and projects. This includes the provision of directors or managers for projects and programmes in departments/public bodies, providing specialist knowledge and skills.

- SIB has recently developed a compilers’ framework and a reviewers’ framework for business cases. The compilers’ framework, anchored in the business case five-case model, guides the creation of both Outline Business Cases (OBC) and Full Business Cases (FBC) through a comprehensive checklist offering considerations, links to guidance, and reference material. The reviewers’ framework was developed to ensure OBC and FBC City and Growth Deals are appraised in line with guidance and best practice, using existing guidance and drawing on areas identified during consultations with key stakeholders.

- SIB is currently working on a Delivery Assurance Guide aimed at delivering pertinent information to the project senior decision-makers ahead of an issue (typically) occurring. By aggregating learnings from past projects, the guide aims to ensure decision-makers can make informed decisions, mitigate risks and capitalise on lessons learned.

- ‘Championing reform’, by providing support to reform projects through work to help improve systems and processes.

- Manages the Investment Strategy for Northern Ireland (ISNI) Delivery Tracking System which provides the public and industry with details of individual contracts emerging through the government’s infrastructure plans (all bodies covered by the NIPPP are required to provide up-to-date infrastructure developments, including procurement information, for release on the ISNI Information Portal).

The Department of Finance (DoF)

- DoF, as well as maintaining responsibility for managing its own capital projects, has a central role in providing guidance on and facilitation of the Gateway Review process which provides Senior Responsible Owners and Accounting Officers with assurance on the progress of their major projects.

- DoF’s core guidance on appraisal, evaluation, approval and management of policies, programmes and projects is set out in the Northern Ireland Guide to Expenditure Appraisal and Evaluation (superseded in November 2020 by Better Business Cases Northern Ireland).

DoF Supply Division

- DoF (through its Supply Division) is required to approve the expenditure set out in project business cases where departments intend to incur expenditure on:

- IT projects over £5 million; and

- other capital projects involving over £5 million central government expenditure unless other departmental specific delegations allow.

Construction and Procurement Delivery (CPD)

- Provides policy advice to Northern Ireland departments and arm’s length bodies.

- Engages with suppliers and industry bodies through pre-market engagement.

- Provides best practice guidance. For example, the Construction Procurement Toolkit applies the themes contained within the Cabinet Office’s Construction Playbook guidance to procurements in Northern Ireland, with the aim of improving commercial focus.

Centres of Procurement Expertise (CoPE)

- Public bodies rely on the specialist skills and specific market knowledge of staff within Centres of Procurement Expertise (CoPEs) to ensure that procurement processes are designed to achieve the best possible outcomes and comply with all relevant legislation and public policy objectives.

- There are nine CoPEs distributed across the public sector in Northern Ireland:

- two CoPEs within CPD, which provide support for bodies across the public sector;

- two CoPEs within the Department of Health (DoH);

- three CoPEs within the Department for Infrastructure (DfI), providing specialist procurement support in relation to key functions of DfI; and

- two specialist CoPEs providing procurement support within specific parts of the public sector: the Education Authority and the Housing Executive.

- Of the nine CoPEs, seven can be categorised as Construction CoPEs:

- CPD Construction Division;

- DoH Health Estates;

- DfI – Northern Ireland Water;

- DfI – Translink;

- DfI – Transport and Asset Management (TRAM: formerly Roads and Rivers);

- Northern Ireland Housing Executive; and

- DE – Education Authority.

1.6 Our 2019 report recorded that our focus group comprising representatives from each of the government departments, SIB and CPD, acknowledged that there was extensive guidance available in relation to managing major capital projects, and that the experience and skills available within SIB, CPD and individual CoPEs can be easily accessed. However, issues persist in delivering major capital projects and reviews of these roles have highlighted that the arrangements are not fit for purpose. See Part Four for further details.

During the period 2019 to 2024, approximately £10.6 billion capital funding will be available to Northern Ireland government departments

1.7 In the four years since our 2019 report, Northern Ireland government departments have incurred capital expenditure of £8.2 billion (see Figure 2). A further £2.4 billion of capital funding has been allocated for the current financial year (2023-24). As shown in Figure 2, there is wide variation in the level of capital spend between government departments, with three departments, the Department for Infrastructure (DfI), the Department of Health (DoH) and the Department for Communities (DfC), accounting for almost seven out of every £10 of capital expenditure (67 per cent; 2019-24).

Figure 2: Gross capital expenditure by NI government departments 2019-2024

Source: Department of Finance

Notes:

1 The outturn figures include expenditure from capital budget allocations and spend generated from capital receipts. Provisional outturn figure for 2022-23 (as at December 2023), DoF are awaiting HM Treasury approval for final outturn figures.

2 Reflects the Secretary of State NI Budget 2023-24 position announced 27 April 2023. Amounts include budget allocations and planned expenditure to be funded by forecast capital receipts. An extra £38 million of Financial Transaction Capital (FTC) is held centrally by DoF for allocation. FTC is funding allocated to the Executive by the UK Government. While the Executive has discretion over the FTC allocations to projects, it can only be deployed as a loan to, or equity investment in, a capital project delivered by a private sector entity.

3 The Executive Office expenditure figures includes FTC loan amounts that it administers and distributes to the recipients for some capital projects, where the departments do not have the legal powers to distribute FTC themselves.

Major capital projects are one of many competing priorities for capital funding

1.8 Departments’ capital planning and spend will reflect, amongst other things, the Executive’s Investment Strategy for Northern Ireland (ISNI) (paragraph 1.14) and Minister’s priorities, alongside ongoing capital commitments and structural maintenance, set within the parameters of the annual capital budget allocations and the budgetary outlook. Priority areas for capital spend can change year on year.

1.9 As shown in Figure 2, DfI has the highest level of capital spend, accounting for over one third of the total capital spend from 2019-2024. DfI is responsible for the maintenance, development and planning of critical infrastructure in Northern Ireland and the management of over £43 billion of water and transport public assets (includes DfI, NI Water and Translink). It has three very different areas of responsibility competing for capital investment: roads; public transport (bus and rail public transport provided by Translink); and water (water and sewage services provided by NI Water), and within each of those areas of responsibility there are further competing priorities.

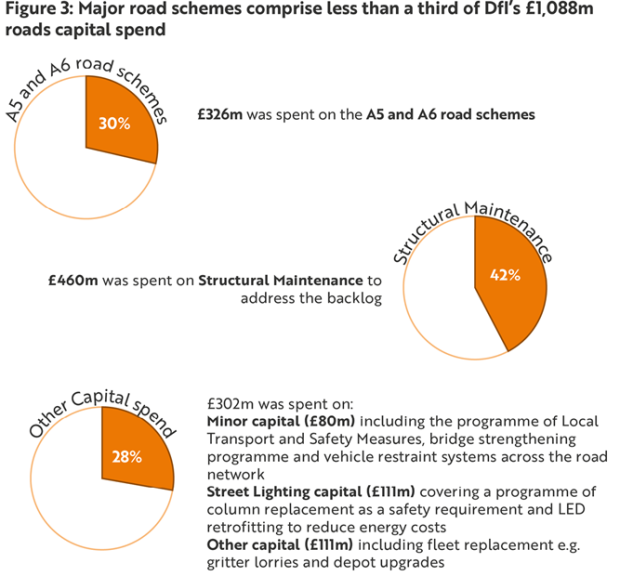

1.10 For example, as shown in Figure 3, DfI roads capital funding is spread over five main categories of spend, including A5/A6 road schemes, minor capital, fleet replacement and depot upgrades, street lighting and structural maintenance. Over the five year period 2019-20 to 2023-24, DfI capital spend associated with roads has been £1,088 million; however less than one third of that spend was on major road schemes.

Source: Department for Infrastructure

1.11 Recently DfI substantially revised its plans for the development and delivery of major road schemes. DfI advised that this was necessary due to the challenging budgetary position, along with constrained resources and commitments under the Climate Change (NI) Act 2022. DfI told us that this combination of factors has changed the landscape considerably, meaning delivery of the major roads programme as previously set out is no longer sustainable nor appropriate. Priorities include the closing out of projects that have been recently constructed, as well as the continued development of the Executive’s flagship schemes (the A5, Case Study 1; and the A6, Case Study 2) and those with City and Growth Deals. The prioritisation exercise is being kept under review and any revisions are subject to approval by the Infrastructure Minister. Future major works programmes will be informed by DfI’s emerging transport plans and a decision by the Infrastructure Minister.

The absence of a functioning government has impacted on major strategic and policy decision making

1.12 The Programme for Government (PfG) sets out the Executive’s priorities in a long term, strategic plan that drives changes to laws, the delivery of public services and investment in future projects. The PfG is to be underpinned by a number of key Executive strategies, including an investment strategy. The previous investment strategy, 2011-21, outlined plans to invest a total of £13.3 billion over the period 2011-12 to 2020-21. Over 40 per cent of the planned investment related to Health and Infrastructure. SIB told us that the actual investment in the period was £15 billion. The key achievements of the last investment strategy are summarised in Appendix 3.

1.13 The consultation on the PfG 2021 closed on 22 March 2021 and, following analysis of the responses, was expected to lead to the development of more detailed action plans and further engagement with stakeholders and delivery parties. However, following the collapse of the Executive in 2022 the PfG remains in draft.

1.14 SIB, on behalf of Ministers, developed a draft Investment Strategy Northern Ireland (ISNI), Infrastructure 2050, which sets out the key objectives for infrastructure investment in the region for the next thirty years. Implementation of the strategy was to be through a rolling 10-year investment plan that defines and prioritises the individual programmes and projects that need to be delivered. This was to be matched to a financial plan that will show how these will be funded. The draft Infrastructure 2050 was published for consultation in January 2022 but, following the collapse of the Executive in 2022, the strategy remains in draft. SIB told us that a final version of the strategy is currently being prepared, and will bring attention to the following areas:

- the need to invest more in the management of our assets to prevent asset failure;

- how infrastructure investment must change in light of obligations under the Climate Change (NI) Act 2022;

- the strategically significant programmes and projects that will be prioritised over the next ten years;

- the enabling actions that are necessary to overcome barriers that hinder effective infrastructure investment. This covers four broad themes of funding; the planning system; infrastructure planning and delivery capacity; and preparedness for decarbonisation; and

- the governance and monitoring arrangements that are appropriate (for the implementation and delivery of the strategy).

The timescales for approval and publication remain uncertain.

1.15 Following the collapse of the Executive, eight Executive Ministers continued in post until 28 October 2022 when all ministers automatically ceased to hold office under the Northern Ireland Act 1998, as amended in February 2022. The decision-making powers then transferred to departments’ permanent secretaries; however, they are obliged to follow the policies of their former minister and are unable to make any new or far-reaching policy decisions on functions of the department. The Executive was restored in February 2024.

The construction sector is an important part of the Northern Ireland economy however it continues to face challenges including skills shortages, financial pressures and political uncertainty

1.16 In the period since our 2019 report the Northern Ireland economy, like all other economies, has been impacted by a number of economic shocks, including the COVID- 19 pandemic. As a result of the pandemic there has been a period of significant shortages and delays in delivery, and volatility in the cost of construction materials, affecting the delivery of government construction projects. Where contractors could not have anticipated these delays or price pressures and allowed for them in their tender, there was a risk that this could lead to late completion and/or ultimately contractor failure. In response, the Executive approved Procurement Advisory Note, PAN 01/21, Construction Material Costs during Pandemic Recovery (3 August 2021).

1.17 The Procurement Advisory Note allowed departments to consider, on existing contracts, contractor’s evidence that there was a significant delay in the supply of construction material impacting the completion date or key performance indicator (KPI) and/or that the impact of inflation is higher in specific element(s) of the contract than a diligent contractor could reasonably have anticipated. Where the contractor’s evidence is compelling, the department should work with the contractor to identify suitable alternative materials or agree an acceptable change to completion date or KPI, and where the evidence of inflation is compelling, the department should apply a net price adjustment (all sums payable as a result of a net price adjustment were to be the defined cost i.e. not subject to any mark up for profit, overhead or other fee) for inflation to impacted elements of the price. For future contracts, departments should include an inflationary price adjustment clause and were expected to review material availability and estimated delivery times during design stage to aid delivery of a realistic works programme and should take cognisance of increasing prices when setting budgets for future projects. The Procurement Advisory Note was withdrawn for new tenders submitted after 1 January 2022. The Construction Employers Federation (CEF) has reported that in the Northern Ireland public sector market since the introduction of PAN 01/21, at least £38 million has been paid out to firms on existing public sector contracts to help with inflationary pressures and materials delays.

1.18 While there have been fluctuations in construction industry activity since 2019, the sector remains Northern Ireland’s second largest industry, behind agriculture. In 2023, the construction industry comprised 10,515 businesses (14 per cent of all businesses), with an estimated 35,000 employees. In the 12 months to June 2023 the construction sector output was some £3.9 billion of which £1.2 billion (30 per cent) was from the infrastructure sub-sector (the other two sub-sectors are housing and ‘other’ works). The public sector accounted for just over half (£607 million) of the infrastructure output. The Department for the Economy (DfE), in its Economic Commentary – Summer 2023 noted that construction output growth was 6.5 per cent higher in Quarter 1 2023 than Quarter 1 2022, however, it also highlighted a number of challenges including continuing political uncertainty impacting on market conditions, and skills shortages.

1.19 Similarly, the CEF Construction Survey of members, January to June 2023 has highlighted the key challenges of: political uncertainty/no functioning Northern Ireland Executive; lack of pipeline [of work] in Northern Ireland; inflation; and access to skilled labour. Whilst CEF recognised some positives going forward, including the opportunities presented by the City and Growth Deals and the Shared Island Funds, it stressed the need for a restored and fully functioning Executive and Assembly which can chart a forward path of public investment. CEF commented that, “… Many government clients entered this financial year with no discretionary expenditure – leading to the cancellation of huge swathes of tendering activity. When you add to this the context of our overall public capital investment being at the same level annually as it was, in cash terms, as 2007-08 then we face a very difficult period ahead.”

Findings from our other work since 2019 that are relevant to the successful delivery of major capital projects

1.20 Our November 2020 report on Capacity and Capability in the Northern Ireland Civil Service noted that many specialist activities in the Northern Ireland Civil Service (NICS), such as project management, and contract management are carried out by general service staff without specific skills or qualifications. The report concluded that more needs to be done to prioritise the identification and development of the skills, knowledge and experience which are key to the delivery of modern public services. Issues with capacity and capability across the NICS remain and continue to impact on the successful delivery of major capital projects. It is essential that the right people, with the right skills, are in place from the outset of a project. (See paragraphs 4.14-4.16).

1.21 In April 2023, our report on Public Procurement in Northern Ireland examined the arrangements in place to ensure the overall effectiveness of procurement across the public sector. The report acknowledged recent action taken to improve how procurement works including: the reconstitution of the Procurement Board with a new membership; the development of new procurement policies, including social value; and changes to the training and guidance available to public sector staff involved in procurement with new commercial training and new toolkit guidance introduced. However, we concluded that the structures and arrangements to provide leadership, governance and accountability in public sector procurement are not working effectively. This links directly to the issues previously raised highlighting the need to transform the commissioning and delivery arrangements for major capital projects in Northern Ireland. (See paragraphs 1.5-1.6 and Part Four).

1.22 In June 2023, we reported on the Northern Ireland Food Animal information System, a project within the Department of Agriculture, Environment and Rural Affairs which was planned to be operational by December 2018 at an estimated total cost of £58 million. However, the system will not be ready until 2024, with a projected overspend of £17 million. This includes £11 million associated with a 5-year contract extension not covered by the original business case. Our report highlighted some key issues and lessons which have direct read across to the major capital projects covered in this report:

- Demonstrating commitment – decisive action was taken following the results of the 2019 gateway review. This was an important factor in re-building confidence amongst the key stakeholders. However, earlier intervention at a senior level in the Department may have prevented the project from drifting into failure in the first place.

- Team resources – the Project team should have the right skills, experience and capacity to manage the project.

- Flexibility – being prepared to stop, re-evaluate and proceed with a different approach is often overlooked in favour of pressing on with added vigour when projects don’t go to plan.

Part Two: Progress on the 11 case studies included in our 2019 report

Progress on the 11 case studies included in our 2019 report

2.1 In 2015, the Northern Ireland Executive identified seven infrastructure flagship projects as its highest priority projects and allocated funding over a five-year period from 2016-17 to 2020-21. The flagship projects and the funding commitment are shown in Figure 4. In 2019 we reported our findings from a high-level review of these seven major capital flagship projects along with four additional projects which we knew had experienced problems (the Critical Care Centre at the Royal Victoria Hospital; Primary Community Care Centres (at Lisburn and Newry); Ulster University, Greater Belfast Development; and Strule Shared Education Campus). We found that each of the projects examined suffered time delays and/or cost overruns when compared against the original timescales and budgets.

Figure 4: The Executive’s seven flagship projects and funding commitment

Source: Written Statement to the Northern Ireland Assembly by the Finance Minister - Budget 2016-17, 17 December 2015

Notes:

1 The figures quoted represent the amounts in the Ministerial Statement rather than the amounts incurred. Full expenditure details are provided in the respective case studies.

2 In 2016, the Desertcreat flagship (a combined public services college for Northern Ireland Fire and Rescue Service (NIFRS), Police Service of Northern Ireland (PSNI) and the Northern Ireland Prison Service (NIPS)) was re-designated as the NIFRS Learning and Development Centre project at Desertcreat with an estimated capital cost of £44.8 million. The project was rebranded to Learning and Development Centre, Cookstown in 2019.

2.2 Since 2019, there has been mixed progress in delivering these 11 major capital projects, with many of the projects not yet fully complete and continuing to suffer further time delays and increased costs. At the time of our 2019 report, only one of the Executive’s seven flagship projects had been completed. None of the other six flagship projects have fully completed to date. In 2019 the cost overruns for the seven flagship projects and the four high profile projects considered in our report were estimated to be £700 million. Based on current estimates provided by departments, the total estimated cost overruns are now close to £1.94 billion. Figure 5 summarises the progress, and more detail on each of the 11 projects is provided in the case studies (see Case Studies 1- 11).

Figure 5: Summary of Performance of the flagship and four other major capital projects at 31 August 2023 against Outline Business Cases

Source: NIAO summary of information provided by departments.

Notes:

A6: the A6 project is now largely complete except for the final section (3.1 miles of the total 28 miles) which has been placed on hold.

Sub-Regional Stadia Progamme for Football: no timescale information is available as an OBC has not been completed, however, as reported in 2019, original plans endorsed by the Executive in March 2011 envisaged delivery of the Sub-Regional Stadia Programme for Football by March 2018.

Primary Community Care Centre Lisburn: delivered by third party development. Annual unitary service charges apply.

Primary Community Care Centre Newry: originally planned to be delivered through third party development by June 2016. This approach has since been abandoned and the project has been superseded by the Newry Community Treatment and Care Centre (CTCC) project which will follow a standard procurement route. The latest capital cost estimate for the Newry CTCC is £88.3 million with an estimated completion by March 2027.

Case Study 1: A5 - An Executive Flagship project

2.3 The A5 project was brought to the point of construction on schedule in August 2012 and was to be completed by December 2018 at a cost of £799 million. It is currently expected to be delivered in September 2028, subject to the outcome of the Planning Appeals Commission inquiry, at a cost of £1.7 billion.

A5

The A5 is one of five key transport corridors identified in the Regional Transportation Strategy for Northern Ireland (with the A5 being the Western Transport Corridor). The scheme is a proposed 55 miles of predominantly dual carriageway, and is anticipated to improve strategic links between Londonderry, Strabane, Omagh and Aughnacloy, and with the Republic of Ireland. It would be the largest road scheme ever undertaken in Northern Ireland.

Our December 2019 report noted that the scheme has been beset by a series of funding difficulties and legal challenges. By March 2019 the latest estimated costs for the A5 project had risen to £1,100 million (from an original estimate of £799 million), with costs incurred by March 2019 of £80 million. The estimated completion date had also stretched to 2028, from the original target of 2018.

Since the publication of our 2019 report, a third public inquiry into the A5 scheme was administered by the Planning Appeals Commission in February and March 2020 at the request of DfI. An interim report from the Planning Appeals Commission was provided to DfI in September 2020 adjourning the inquiry as, in the Planning Appeals Commission’s opinion, important issues could not be considered until DfI addressed information gaps. This interim report was not publicly available when it was presented to DfI in September 2020, however in March 2021 DfI published the interim report along with an Interim Departmental Statement reviewing the findings of the interim report. DfI rejected 4 of the 30 recommendations raised by the Commissioner in the September 2020 interim report. The rejected recommendations concerned the scope and phasing of the scheme as well as procedures around significant archaeological finds, should those be encountered after scheme authorisation.

A further commitment made by DfI in response to the interim report was to proceed with the development of a new Environmental Statement Addendum. This new Environmental Statement Addendum (the second Addendum since the 2016 Environmental Statement) was published in March 2022 and open for public consultation until May 2022.

DfI also published for consultation several new and updated reports in November 2022 as Supplementary Information to the March 2022 Environmental Statement Addendum. The public inquiry into the A5 scheme was scheduled to reopen in January 2023, however following objections DfI told us the Planning Appeals Commission concluded that that there was insufficient time for members of the public to respond to the November 2022 consultation. The January 2023 inquiry was therefore postponed.

The Planning Appeals Commission requested that DfI produce and consult on longitudinal profiles and cross sections over the full length of the scheme. A public consultation on this information commenced in January 2023 and concluded in March 2023. The public inquiry was reconvened in late May 2023 and closed in early June 2023. DfI received the final advisory Report on the Public Inquiry proceedings from the Planning Appeals Commission on 31 October 2023. DfI told us the project team is now considering the points raised and detailed recommendations made by the Planning Appeals Commission before the next steps can be taken.

A cost estimate for the scheme was prepared in November 2022 that calculated the further cost of the project at £1.6 billion. In consultation with DoF, DfI told us the 2017 OBC has been replaced with a new OBC incorporating the revised cost estimate which was approved by DoF in May 2023. An indicative timeline by DfI estimates that a formal decision to proceed with the scheme could potentially be made in Spring 2024, and on that basis, subject to the completion of all statutory processes and environmental assessments, the availability of funding and no further legal challenges, construction works could commence later in 2024.

Costs have continued to be incurred on the scheme, with total spend to August 2023 of £96.8 million (a £16.5 million increase since March 2019 when we last reported). Costs to date plus the revised estimate for the project going forward of £1.6 billion bring the total estimated costs of this project to £1.7 billion.

Source: NIAO summary of information provided by the Department for Infrastructure

Case Study 2: A6 - An Executive Flagship project

2.4 The A6 project is now largely complete except for the final section (3.1 miles of the total 28 miles). Originally estimated to cost £594 million it is now estimated to cost £655 million on completion.

A6

This project involves upgrading the A6 element of the North Western Transport Corridor connecting Belfast to Londonderry with a series of dual carriageways. The project achieved flagship status in the 2016 Budget.

The project was to be delivered in two sections, with the second section split into two phases. Section one involves 9.1 miles of dual carriageway between Randalstown and Castledawson, either side of the Toome Bypass. Section two is being taken forward in two phases, 15.8 miles bypassing Dungiven to Drumahoe and 3.1 miles from Drumahoe to Caw, and will in total provide 18.9 miles of dual carriageway between Dungiven and Londonderry.

Our 2019 report noted that by March 2019 the latest estimated costs for the A6 project had decreased to £583 million (from an original £594 million), with costs incurred by March 2019 of £174 million. Progress on the project had been delayed because of a lack of funding and extended legal challenge around environmental issues.

The project has progressed significantly since our 2019 report. Section one (Randalstown to Castledawson) was originally scheduled for completion in 2020. The target date was subsequently revised to 2021 and the road fully opened in May 2021. Expenditure on the phase to the end of August 2023 was £186 million and DfI has forecast further spend of £5 million until 2028-29 bringing the latest cost estimate for the phase to £191.7 million (compared to a budgeted £184 million).

Construction of phase one for section two (Dungiven to Drumahoe) commenced in September 2018. It was originally planned for completion in 2021, with the completion date subsequently revised to 2022. The dual carriageway opened in April 2023 and contractual completion was achieved in November 2023. DfI told us that delays were due to the impact of COVID-19, circumstances outside of the contractor’s control such as adverse weather conditions, poorer contractor productivity than expected and supply chain issues. DfI told us it has applied the clauses in the contract to recover delay damages where appropriate. Final costs for the phase are estimated to be £264 million (against an original budgeted cost of £239 million), with £250.6 million of spend incurred by the end of August 2023. DfI told us there is a significant amount of uncertainty over the final outturn costs given the number of items in dispute and the final cost will be determined by the outcome of dispute resolution mechanisms.

Phase two of section two (Caw to Drumahoe) was notionally estimated to be completed by 2024, however no funding had been identified. It was placed on hold in March 2019 and remains so. Part of the works on this phase will encroach on to the illegal Mobuoy waste site. This illegal waste site was identified by the Northern Ireland Environment Agency (NIEA) in 2013, with the resulting legal proceedings culminating in a prosecution in 2023. DfI told us it is working with the NIEA and other stakeholders to progress the remediation of this site. DfI also told us delivery of this phase of the A6 will depend on a range of factors, including the completion of the remediation of the Mobuoy waste site, and future budget settlements as the phase is not part of the Dungiven to Drumahoe contract. As such, DfI told us that it is unable to confirm a programme for Phase two at present. By the end of August 2023, £6.8 million had been spent on this section of the project.

Source: NIAO summary of information provided by the Department for Infrastructure

Case Study 3: Belfast Rapid Transit - An Executive Flagship project

2.5 The Belfast Rapid Transit (BRT) project East-West route opened in September 2018, later than its original operational target of 2017-18. Final costs of £94.4 million were some £6 million more than the business case approval. A new and separate project, BRT Phase 2, commenced in August 2018 to extend the Glider network.

Belfast Rapid Transit

The development of a high quality, high capacity, accessible rapid transit network in Belfast was originally proposed in the 2002-2012 Regional Transport Strategy. The Northern Ireland Executive endorsed the design and construction of a proposed rapid transit network in Belfast in November 2008, and an Outline Business Case (OBC) was approved in August 2012. The OBC estimated that the total cost at £98.5 million and completion in 2017-18. Following various changes to the project in September 2013 and as a result of funding uncertainties, the estimated cost was reduced to £87.9 million, and the completion date was revised to 2018-19. Works on the project commenced in May 2014, and in December 2015 the project was given flagship status.

The Belfast Rapid Transit (BRT) services, operated by Translink under the brand name Glider, commenced on 3 September 2018. The final cost of the project was £94.4 million. DfI told us that the cost variance partly arose due to the addition of the Colin Connect Transport Hub with DfI contributing £1.0 million of part funding to this initiative developed under The Executive Office’s Urban Villages Programme.

The second stage of the post project evaluation, which will consider the benefits realised from the project, was due by December 2021. DfI told us that due to the impact of the COVID-19 pandemic on public transport travel patterns, this had been deferred until public transport patronage had stabilised. Therefore, the second stage of the post project evaluation is now planned for completion by November 2024.

BRT Phase 2

A separate project, BRT Phase 2, was commenced in August 2018 to extend the Glider network. An interim OBC was submitted to the Belfast Region City Deal Partners in August 2020 which estimated the cost of the project to be £142-£148 million, of which only £35 million of funding has been secured via the Belfast Region City Deal. DfI told us that £20 million of funding from the UK government as part of the New Deal for Northern Ireland has been paused.

Following a public consultation between July and October 2021, a preferred route for the extension of the service north and south of Belfast was announced in October 2022 by the then Minister for Infrastructure. The consultation pack prepared by DfI identified several potential suitable routes, however it considered extensions of the southern route beyond Cairnshill Park & Ride route to Carryduff and the northern route beyond the O’Neill Road into Glengormley as unsuitable. The then Minister’s decision in October 2022 overruled these considerations, deciding that these routes should be followed subject to feasibility, which DfI told us is in progress. This second phase of BRT also encompasses an extension to the existing G2 Glider network to link with Queen’s University and Belfast City Hospital.

DfI published a list of prioritised major road schemes in August 2023 which included Belfast Rapid Transit Phase 2. An accompanying document noted that, dependent on the availability of funding, the North-South Glider service could be operational in late 2029.

Source: NIAO summary of information provided by the Department for Infrastructure

Case Study 4: Belfast Transport Hub – An Executive Flagship project

2.6 Significant progress has been made on the Belfast Transport Hub’s eight-hectare site since we reported in 2019. However, the completion date is now estimated as late 2025, over two years later than originally planned, and the latest cost estimates of £340 million are £131 million higher than the original estimate included in the 2017 OBC.

Belfast Transport Hub

The Belfast Transport Hub (the Hub) is a transport-led regeneration project planned to be a key driver of economic growth and prosperity for Belfast and Northern Ireland. The first element of the project relates to the development of a new integrated public transport hub to replace the existing Europa bus centre and Great Victoria Street train station. The Hub will include an integrated bus and rail concourse, eight new rail platforms, 26 new bus stands, retail and commercial premises, park and ride facilities, a cycle hub, and links to other transport modes.

Following development of the Hub, a regeneration project will commence to develop opportunities for a range of commercial and residential users. These regeneration projects are to be brought together on an eight-hectare site in Belfast city centre named Weavers Cross. As with our 2019 report, this case study considers the first element of the project – the Hub.

The OBC (2017) estimated project completion costs of £208.9 million and a completion date of September 2023 (subject to securing planning permission by September 2017). Planning permission was received in March 2019. At that stage OBC costs were reviewed and increased to £227.2 million, and the completion date was revised to July 2025, with the station opening at the end of 2024.

Since our previous report, significant progress has been made on the development of the Hub. Enabling works on the site began in 2020, which included site clearance, utility diversions, ecology surveys, ground remediation, watercourse and drainage activities. Translink also progressed procurement for the main works, with the contract awarded to a joint venture in August 2021. The main works phase of construction began in February 2022, with the structural steel frame completed in June 2023. DfI told us it expects the Hub to be completed by the end of 2025. Key interim milestones remaining are the completion of the busway bridge by late 2023, which will allow access to the Hub for buses from the Broadway roundabout near the Westlink, and the operational opening of the Hub and completion of the rail systems by the end of 2024.

Estimated costs have risen significantly since our previous report. The full business case was approved in November 2021 and included costs of £294.6 million, however the impact of extraordinary inflation has further increased predicted costs. DfI told us the latest cost estimate for the project is now approximately £340 million, although this is subject to uncertainty. The potential impact of this extraordinary inflation is the greatest risk to the project according to DfI and is being monitored regularly. Costs incurred to 31 August 2023 on the project were £148.5 million.

Source: NIAO summary of information provided by the Department for Infrastructure

Case Study 5: Maternity and Children’s Hospital – An Executive Flagship project to create a new regional children’s hospital for Northen Ireland and a new maternity hospital, both on the Royal Hospitals site, Belfast

2.7 Case Study 5A – The Regional Maternity Hospital. The original planned completion date for the new hospital was December 2015, however work did not commence until November 2017. The latest estimated date for completion of the final phase of the hospital is June 2025, almost 10 years later than the original date, at an estimated cost of £97.1 million compared to the original estimate of £57.2 million.

Regional Maternity Hospital

In December 1999, it was proposed that maternity services should be located in a new hospital on the Royal Hospitals site. By 2005, plans emerged for a new, combined Women’s and Children’s Hospital. However, this idea was shelved because of capital funding constraints. A review, initiated by the Minister in June 2010, identified that the top three floors of the Critical Care Centre could be used to provide maternity postnatal beds by 2015, at a cost of £8.2 million. The cost of a new maternity hospital, providing the remainder of the accommodation, was estimated at just under £49 million (£57.2 million in total).

The planned regional maternity hospital project is being delivered in three phases – the construction of a new maternity building at the Royal Hospitals site (Phase One); the demolition of the existing neonatal wing of the existing maternity building (Phase Two); and the construction of a bridge link to the Critical Care Centre (Phase Three).

While separate from the Children’s Hospital project at the Royal Hospitals site, there are some interdependencies between the two projects and the two together form an integral part of the ‘flagship’ Maternity and Children’s Hospital project. Designation as a flagship project alleviated the funding constraints and provided certainty over funding.

Work on Phase One of the project, the new maternity building, commenced in November 2017. At the time of our 2019 report Phase One was on track for completion in August 2020. Phase Two was expected to be completed in March 2021 and Phase Three in September 2021.

DoH told us that Pseudomonas bacteria was detected in the water system during the commissioning process for Phase One. Stakeholders are working to resolve the issue and DoH told us an independent expert was commissioned to review the system and provide advice. The latest anticipated handover date is now March 2024, with commissioning due to be completed by August 2024.

DoH told us the Phase Two demolitions work cannot proceed until the existing neo-natal unit has been vacated and the service moved to the new building. Once the new building is occupied, the demolition can proceed to make way for the construction of the new link bridge. The programme of work to complete Phases Two and Three is estimated to commence in May 2024 and complete in June 2025.

DoH advised us that delays to the project can also be attributed to the impact of COVID-19 on construction, changes in standards and guidance, and the complexity of working on a live hospital site.

Our previous report noted that by March 2019 the latest estimated costs for the project had risen to £74 million (the original estimate was £57.2 million). In February 2022, an addendum to the full business case was approved, with the budget increased to £97.1 million. DoH told us the latest cost estimate for the project on completion is £97.1 million and by the end of August 2023 spend on the project had reached £89.5 million.

Source: NIAO summary of information provided by the Department of Health

2.8 Case Study 5B – The Regional Children’s Hospital. Enabling site works were completed in January 2023 in preparation for the main construction works, however, following a main works procurement exercise the approval of the full business case remains outstanding. The latest cost estimate is £589.6 million; more than double the original cost estimate of £223 million, and the project is expected to be completed nine years late, in 2029.

Regional Children’s Hospital

The development of a standalone Regional Children’s Hospital emerged when earlier plans for a combined Women’s and Children’s Hospital could not progress because of funding constraints. Following the decision to develop a separate Maternity Hospital, plans for a new Children’s Hospital at the Royal Hospitals site in Belfast were announced in October 2013. The Children’s Hospital was to serve the acute paediatric needs of Greater Belfast and provide regional specialist paediatric services to the wider population of Northern Ireland.

Plans anticipated that the Regional Children’s Hospital would be completed, and opened, in July 2020, at a cost of £223 million. Formal DoH approval to proceed with the project was provided in February 2014. The Children’s Hospital, along with the new Maternity Hospital, was announced as the ‘flagship’ Maternity and Children’s Hospital project identified in the 2016-17 NI Executive budget. Funding of £242.7 million was allocated to the flagship project (that is both elements of the project) over the five years 2016-17 to 2020-21.

An addendum to the business case was approved by DoH and DoF in October 2018. This set out the rationale for a 59 per cent increase in project costs (from £223 million to £353.9 million). The additional costs were attributable, in the main, to design changes reflecting changes in guidance and legislation and inflationary uplift of approximately £80 million.

A planning application was submitted in August 2018 and planning permission was received in April 2019. Following a procurement exercise launched in May 2021, a single tender application was received for the project in April 2022. We had previously reported in 2019 that procurement was scheduled to run from July 2019 to June 2020. DoH attributed the almost two-year delay in issuing the invitation to tender to internal peer review of works information. We were told that a full review of tender packages using Subject Matter Experts, was initiated by the Belfast Health and Social Care Trust (BHSCT) and DoH Health Estates, as a result of a number of high-profile health projects throughout the UK having experienced significant impacts on cost, time and outcomes due to inconsistencies and errors in their tender documents.

While only one bid was received it was considered a competitive bid by DoF’s Construction and Procurement Delivery Health Projects Division. A full business case for the project was submitted by the BHSCT to DoH in July 2022 and a final business case was submitted in August 2023, with affordability the main concern.