This report has been prepared under Article 8 of the Audit (Northern Ireland) Order 1987 for presentation to the Northern Ireland Assembly in accordance with Article 11 of the Order.

K J Donnelly CB Northern Ireland Audit Office Comptroller and Auditor General 17 June 2021

The Comptroller and Auditor General is the head of the Northern Ireland Audit Office. He, and the Northern Ireland Audit Office are totally independent of Government. He certifies the accounts of all Government Departments and a wide range of other public sector bodies; and he has statutory authority to report to the Assembly on the economy, efficiency and effectiveness with which departments and other bodies have used their resources.

Glossary of Terms and List of Abbreviations

ADSL Asymmetric Digital Subscriber Line

BDUK Building Digital United Kingdom is part of the Department for Culture, Media and Sport and is responsible for delivering broadband to the UK

Broadband The term used to describe a wide range of technologies that allow high-speed, always-on access to the Internet

BT British Telecommunications plc

CMSC Westminster Culture, Media and Sport Committee

CPD Construction and Procurement Delivery

DAERA Department of Agriculture, Environment and Rural Affairs

DCMS Department for Culture, Media and Sport

Decent broadband Defined by Ofcom as a connection capable of delivering a download speed of at least 10 megabits per second (Mbps) and an upload speed of at least 1Mbps. This is the specification for the Government’s Universal Service Obligation.

DfE Department for the Economy (Northern Ireland)

DoF Department of Finance (Northern Ireland)

DRD Department for Regional Development (Northern Ireland)

DUP Democratic Unionist Party

EU European Union

ERDF European Regional Development Fund

FTTC Fibre to the Cabinet

FTTP Fibre to the Premises

Gigabit-capable Defined by the UK government as a connection that can support 1 gigabit per connection second (Gbps) download or upload speeds. 1 Gbps is equal to 1000 Mbps. Gigabit speeds can be delivered by “full-fibre” infrastructure.

HC House of Commons

ICBAN Irish Central Border Area Network Ltd (a local authority–led, cross-border development organisation)

Kbps Kilobits per second

LFFN Local Full Fibre Network

Megabits (Mb) Unit used for expressing a quantity or amount of data. Broadband speeds are expressed as an amount of data downloaded per second, usually in megabits per second (Mbps).

Mobile data services Mobile data services are typically delivered over a wide range of radio frequency spectrum bands. The G stands for the different generations of technology used. Third Generation (3G) was launched in 2003 and introduced download speeds of over 5Mbps. Fourth Generation (4G) was launched in 2012 and delivered speeds of over 10Mbps. Fifth Generation (5G) is expected to deliver much faster data speeds (10–20 Gbps), higher capacity (i.e. able to work across more devices) and lower latency (faster response times).

NAO National Audit Office

NI Northern Ireland

NGA Next Generation Access

NIAO NI Audit Office

NIBIP NI Broadband Improvement Project

NICS NI Civil Service

Ofcom The Office of Communications (UK government-approved regulatory and competition authority for the broadcasting, telecommunications and postal industries of the UK)

PAC Public Accounts Committee

RoI Republic of Ireland

RGC Rural Gigabit Connectivity

SRP2 Superfast Rollout Programme, Phase 2 - this is an extension of the NIBIP. There was no NI SRP, Phase 1

Superfast Broadband Defined as broadband with speeds greater than 30Mbps.

Superfast Broadband Programme This is the UK programme, managed by Broadband Delivery UK (BDUK), part of the Department of Digital, Culture, Media and Sport (DCMS).

The Executive The Northern Ireland Executive

UK United Kingdom

USO Universal Service Obligation will seek to ensure that everyone across the UK has a right to request a minimum broadband connection in 2020.

Broadband Definitions: (Extracted from Ofcom’s Website)

Broadband enables connection to the internet. It allows information to be carried at high speed to your personal computer, laptop, tablet, smartphone, smart TV or other web-enabled device. It has largely replaced the original ‘dial-up’ (narrowband) method of connecting to the internet. There are two types of broadband, wireless infrastructure and fixed-line.

Wireless Infrastructure

Wireless infrastructure provides internet connectivity through mobile or satellite technology. Satellite services are provided via either fixed or mobile receivers.

Fixed Wireless Access Services, where customers attach an antenna to an external wall. The wireless path is a substitute for the copper line. Satellite services deliver service to a large dish.

Fixed-Line Broadband

The three most common types of fixed-line broadband in the UK are:

1. Asymmetric Digital Subscriber Line (ADSL):

This is the most commonly available type of broadband, delivered through the copper wires of your phone line. Two types of ADSL technology are used in the UK:

- ADSL1 is capable of a maximum speed of about 8Mbps; and

- ADSL2+ is capable of a maximum speed of about 24Mbps.

Broadband speeds via both types of ADSL depend on how far you live from your telephone exchange - the further away, the lower the speeds. Actual speeds are typically much lower than the maximum speeds quoted above.

2. Cable Networks:

Cable networks use fibre optic and coaxial cables to deliver superfast broadband services (as well as TV and phone services) direct to homes.

Cable Networks use a mix of protocols over a mix of mediums to deliver service.

3. Fibre Broadband:

Fibre broadband is delivered via clusters of fibre optic cables (each one thinner than a human hair) at speeds faster than ADSL.

There are two types of superfast fibre broadband:

- ‘fibre-to-the-cabinet’ (FTTC) - with fibre optic cables running from the telephone exchange to street cabinets before using standard copper telephone wires to connect to homes. Most fibre connections in the UK are fibre-to-the-cabinet services, and are typically advertised as offering speeds of ‘up to’ 38Mbps or 76Mbps; and

- ‘fibre-to-the-premises’ (FTTP) - with fibre optic cables running directly to your home. It is faster than fibre-to-the-cabinet but currently only constitutes a minority of broadband connections. Fibre-to-the-premises broadband services can offer speeds of up to 1Gbps (i.e. 1,000Mbps).

Key Messages

Broadband access levels in Northern Ireland

NI access to broadband, at speeds of up to 30Mbps, is lower than the UK average and all other UK regions.

In 2020, NI access to ultrafast broadband, at speeds of up to 300Mbps, rose to a rate higher than the UK average. By September 2020, 56 per cent of NI premises had access to full fibre compared to an average of 18 per cent across the UK.

However, broadband access in rural areas is often much lower than that available in urban areas.

Many NI premises (schools, businesses and religious buildings) faced COVID-19 lockdown with inadequate access to internet broadband services. The Department for the Economy (DfE) told us that almost 79,000 premises in NI have been identified as eligible for intervention to improve the quality of their broadband through Project Stratum.

Competition in programmes let through the DCMS Framework and the extent to which value for money can be assessed

We do not consider that the DCMS National Framework (the framework), which applied to the Northern Ireland Broadband Improvement Programme (NIBIP) and the Superfast Rollout Programme, Phase 2 (SRP2), promoted competition. This is because, after March 2013 when Fujitsu announced it would not be bidding for any further contracts though the framework, British Telecommunications plc (BT) was left as the sole bidder available. Building Digital United Kingdom (BDUK) considers that the absence of competition reflected the lack of interest from suppliers at the time and told us that, even in cases where local bodies did not use the BDUK framework, BT was selected through open procurement.

Since BT was not prepared to agree to inspection rights, BDUK had to rely on BT to self-certify that bid costs were “internally consistent and consistent with commercial costs”. In 2013, Westminster Public Accounts Committee (PAC) concluded that this was not an adequate control.

We note that by 2015 BDUK had strengthened its value for money team and had access to detailed cost information from BT. Although BDUK was then in a position to compare bids, benchmark costs and confirm that BT’s actual costs were lower than bid costs, we agree with the National Audit Office’s view that “BDUK’s analysis shows that actual costs are lower than BT’s bid prices but do not, in themselves, assure BDUK that BT priced the contracts economically”.

Information provided by BT to UK Parliamentary Committees and the UK audit agencies on their actual costs has often been contradictory, particularly in relation to costs per cabinet which were variously reported with costs from £14,000 to £100,000. It is difficult to understand why this is the case.

Northern Ireland broadband schemes

Over the period from 2007 to 2020, DfE has provided public sector investment of just under £78 million on programmes aimed at improving broadband provision across NI.

The Next Generation Broadband (NGB) project was awarded to BT in 2009 following an open competition. This contract was awarded by the DfE and, unlike the two later schemes was not based on a national framework. In 2013, Westminster PAC noted that the NGB project was delivered by BT much more cheaply (and with less public subsidy) than several BT projects in England and 12 per cent below the average BT bid in England.

The later contracts to deliver the NIBIP and the SRP2 were awarded using the DCMS/BDUK National Framework and went to BT as the only bidder available at that stage. Confidentiality clauses prevented DfE from comparing BT bids against those it had provided to other UK bids. As an alternative, BDUK prepared bid comparison reports for DfE which assessed the relative value for money of bids compared to those received by other local authorities. As above, we do not consider that this provides assurance that BT bids are priced economically.

Under the NIBIP, DfE estimated, in its Invitation to Tender (ITT) document, that the funding available would provide improved access for almost 117,600 premises. However BT’s initial bid anticipated providing improved access to just short of 46,000. Despite the massive variation from DfE’s estimates, DfE and BDUK considered that the initial bid represented value for money. BT subsequently submitted a revised bid which lowered the expected delivery level to 45,259 premises. The project objective was revised from providing universal access (that is 100 per cent) to speeds of at least 2Mbps, to a target of 96 per cent having access to speeds of at least 2Mbps by 2015. BT actually delivered improved broadband access to 37,500 premises (following change control amendments which resulted in the removal of almost 8,500 premises from the project). This is lower than BT’s initial and revised bids and significantly less than DfE original estimates.

Take-up (i.e. the number of premises taking up the opportunity to connect to the new faster broadband) on the NIBIP (66 per cent) and SRP2 (33 per cent) greatly exceeded expectations (of 20 per cent) raising concerns over the need for public sector intervention. As a result, DfE is entitled to some clawback of BT profits. BDUK estimates that take-up clawback of £14 million is due to DfE from BT (£6.4 million in respect of the NIBIP scheme and £7.6 million in respect of the SRP2). To date, £1.7 million relating to NIBIP take-up clawback has been received by DfE.

By March 2020, BT accounts identified that it had provided for £619 million, held as deferred income, which is due to be paid back in respect of clawback to local bodies across the UK to reinvest in broadband.

Project Stratum

Project Stratum is a new project awarded in November 2020 which is expected to provide fibre to the premises broadband to just over 76,000 premises, mainly in rural areas. The total cost to the public sector of the project will be £165 million. The DCMS Framework Agreement lapsed in 2016, before Project Stratum was procured. Project Stratum was procured using the Public Contracts Regulations 2015 and was fully managed by CPD2.

DfE’s Internal Audit has examined the management, control and governance arrangements operating over Project Stratum and concluded that it was being well managed and that project documentation is of a high calibre. We note this assurance. DfE has also told us that, for Project Stratum, it is satisfied that it has been procured in line with best practice with appropriate assessment of costs and options and that the contractual obligations placed on the winning bidder, in terms of the provision of information, include mechanisms that are fully in line the National Broadband Scheme guidance and will allow DfE to assess value for money.

We intend to separately report on the award of the contract for Project Stratum later this year.

Executive Summary

1. The internet has transformed the way we live. Most of us now rely on it to communicate, work, learn, bank, shop and access entertainment. Our reliance on the internet has become more apparent during the COVID-19 pandemic as we adhere to social distancing and isolation regulations. Those with no, or poor, internet access have faced considerable frustration and isolation over the past months. The Department for the Economy (DfE) told us that through Project Stratum, just over 76,000 premises currently unable to access broadband services of 30 Mbps (mainly in rural areas) will have access to fibre to the premises broadband.

2. Telecommunications is a United Kingdom (UK) reserved matter. As a result, it has not been devolved to the Northern Ireland Executive (the Executive) but is controlled centrally by the UK Department for Digital, Culture, Media & Sport (DCMS). Building Digital UK (BDUK), a directorate within DCMS, has responsibility for the management, governance and oversight of programmes delivering improved broadband across the UK. Under the Communications Act 2003 (Clause 149), the DfE has limited powers to intervene in cases where there is evidence of market failure. Any intervention must avoid distorting the telecommunications market.

On broadband access levels in Northern Ireland

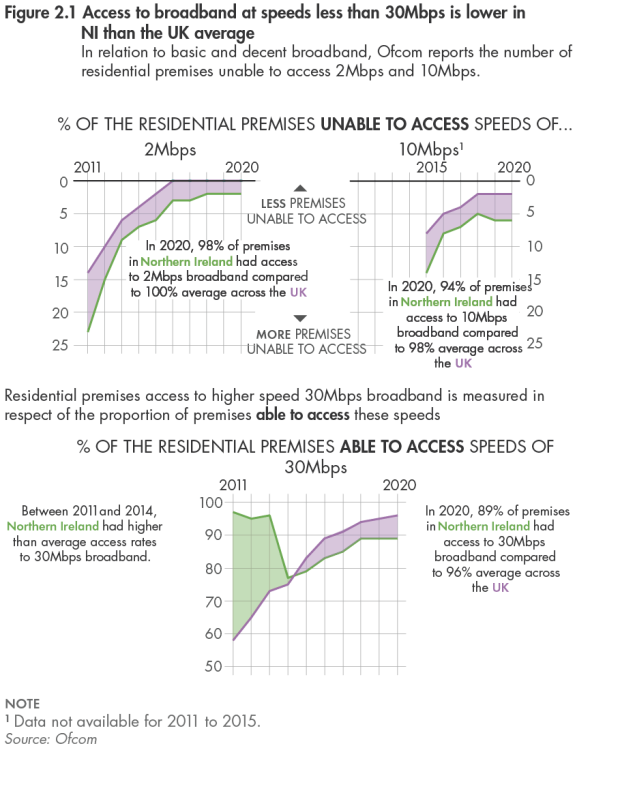

3. By 2020, 98 per cent of Northern Ireland (NI) premises were able to access broadband services of 2Mbps. This was lower than the average of 100 per cent across the UK. In terms of ‘decent’ broadband services, 94 per cent of NI premises were able to receive 10Mbps. Again this was lower than the UK average of 98 per cent.

4. In relation to access to superfast broadband, by 2020, 89 per cent of NI premises were able to access broadband services of 30Mbps. This was lower than the UK average of 96 per cent.

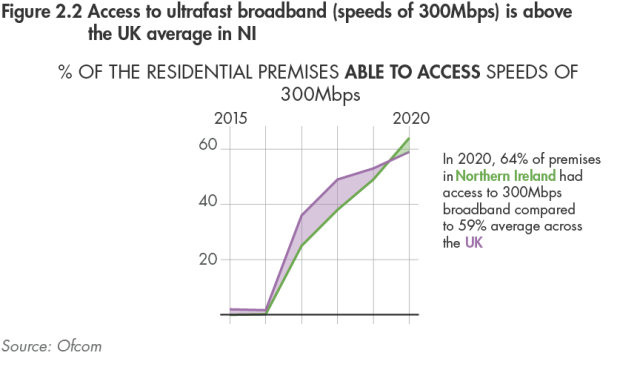

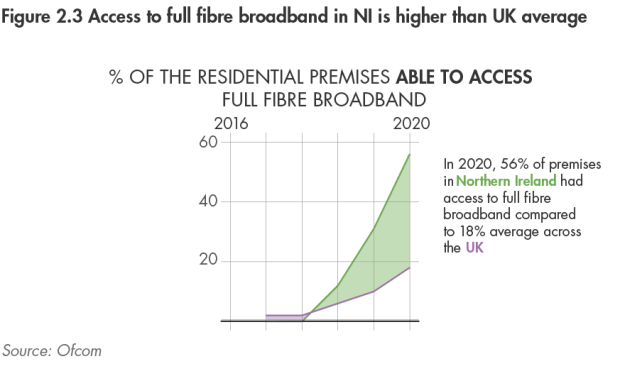

5. In terms of ultrafast and full fibre, by 2020 NI broadband access levels were higher than the UK averages. By that stage, 64 per cent of NI premises had access to ultrafast compared to an average of 59 per cent across the UK while 56 per cent had access to full fibre compared to 18 per cent across the UK. According to Ofcom, the higher full fibre access percentage in NI reflects substantial private sector investment from Virgin Media and Openreach.

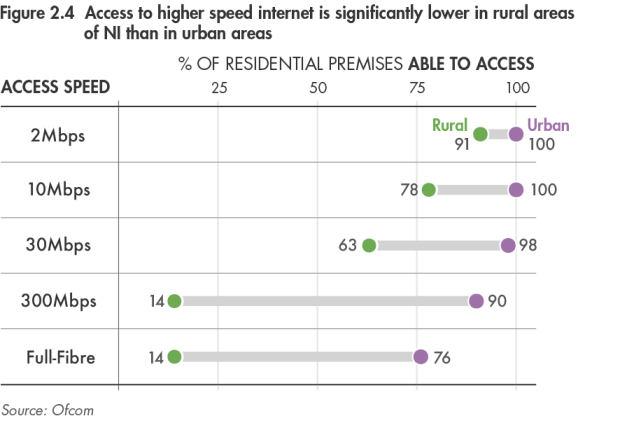

6. Access varies between urban and rural areas in all parts of the UK. In NI, by 2020, 63 per cent of rural premises had access to superfast broadband (30Mbps), compared to 98 per cent in urban areas.

7. Average download speeds in NI are also lower than across the rest of the UK. The average download speed delivered to premises in NI in 2020 was 64Mbps compared to an average of 73Mbps across the UK.

On the use of public subsidies to improve connectivity across the UK

8. Commercial internet suppliers roll out high speed internet access in areas where it is profitable to do so. This tends to be in urban areas with high population densities where investment typically leads to large increases in customer numbers. In rural areas, where the population density is much lower, commercial suppliers are more reluctant to invest because the potential to increase customer numbers and generate income is significantly less.

9. The 2010 ‘Britain’s Superfast Broadband Future’ strategy document set out the UK Government’s aim “to ensure that, by 2015, the UK had the best broadband network in Europe”. To support this aim, the Government introduced public subsidies to encourage suppliers to provide superfast broadband in areas where it would otherwise not be commercially viable to do so (mainly rural areas).

10. Responsibility for achieving this fell to DCMS. In 2010-11, DCMS (through BDUK) introduced the UK-wide state-aid Superfast Broadband Programme (formerly the Rural Broadband Programme), supported by £1.7 billion in public subsidy. This figure excludes the contribution required from the supplier.

11. While BDUK was ultimately responsible for delivery of the programme, it was accepted that, in order to address local issues, it would be more appropriate for delivery to be managed in partnership with local bodies (typically local authorities, devolved administrations (including DfE) and Local Economic Partnerships).

On the development of a UK framework to award contracts

12. To assist local bodies, BDUK developed a National Framework (the framework) which could be used on a ‘call-off’ basis. This allowed local bodies to appoint suppliers without conducting individual open tender exercises. There was early interest in the framework with nine companies pre-qualifying to bid for a place on the framework. However, three withdrew immediately and a further three withdrew during the first phase of competitive dialogue. One bid (from a consortium of small and medium-sized enterprises) failed to pass the competitive dialogue stage, leaving only two bidders (BT and Fujitsu). In June 2012, both were appointed as framework providers.

13. Fujitsu did not secure any of the early contracts let through the framework and, in March 2013, announced that it would not be bidding for any further contracts. This left BT as the sole bidder on the framework, eligible for appointment by local bodies in the absence of competition.

14. DfE and BDUK consider that this reflected the limited market at the time. BDUK also considers that its use of Bid Comparison Reports and benchmarking provided assurance that BT’s bids offered valued for money and noted that, even in cases where local bodies did not use the BDUK framework, BT was selected through open procurement.

On concerns about the framework

15. Several UK Parliamentary committees (including the Public Accounts Committee (PAC) and the Committee for Culture, Media and Sport (CMSC)) have been critical of the framework. Key concerns have included the lack of competition, limited cost transparency and the inclusion of non-disclosure agreements in contracts.

16. On a more positive note, a project assessment review of the Superfast Broadband Programme undertaken by the Major Projects Authority in 2014 concluded that: “the ‘Milestone-to-Cash’ process3, adopted for contracts awarded through the framework, should be disseminated across Whitehall, as appropriate, as an exemplar of best practice”.

17. The framework relied on three key safeguards to achieve value for money (set out below). While the creation of a framework ensured compliance with European Union (EU) state guidelines, only one supplier (BT) was successful in securing contracts in NI. With competition eliminated and BT dominating the 2012 framework, we consider that BDUK (and contracting local bodies) had limited assurance that value for money was being achieved. BDUK told us that, more recently, competition for Superfast contracts has improved with various companies other than BT securing contracts in England.

Safeguard 1: Establishing a procurement framework for potential suppliers, promoting competition.

Safeguard 2: Providing assurance that bids made by suppliers were appropriate through a call-off process and contract provisions.

Safeguard 3: Providing in-life contract mechanisms to ensure that payments reflected actual costs and to claw back, or reinvest revenue, if actual costs or take-up differs from that anticipated.

18. The inclusion of non-disclosure clauses in contracts prevented local bodies from comparing bids. BDUK prepared bid comparison reports for local bodies which considered costs against all other UK bids and assessed the extent to which value for money would be achieved. In 2013, the National Audit Office (NAO) reported that BT had not been prepared to agree to inspection rights and, as a result, BDUK relied on self-certification from BT that its costs were “internally consistent and consistent with its commercial investment”. Westminster PAC concluded, in 2013, that this was not an adequate control. BDUK considers that the BT sign-off confirming that bid costs are “internally consistent and consistent with its commercial investment” by a BT senior finance director, is a serious undertaking which is confirmed under the warranties of individual contracts.

19. Previous Parliamentary Committees have struggled to identify the nature, scale and timing of BT’s contributions and, as a result, key metrics, such as the cost per cabinet installed, have been difficult to quantify. While we note that BDUK has strengthened its value for money team and has access to detailed cost information from BT, we agree with NAO’s conclusion (in 2015), that BDUK’s confirmation that BT’s actual costs are lower than bid costs does not, in itself, provide assurance that accepted bids are priced economically.

20. Following the Westminster PAC hearing, BDUK developed and implemented the milestone to cash process to ensure that public sector payments were matched to supplier progress in delivering against the contract. This process has been endorsed by the Major Projects Authority. BDUK told us that its actual cost comparison reports for projects, which include costs on all other local body broadband projects, identify any outlying costs for further investigation. In relation to NI projects, BDUK’s actual cost comparison reports concluded that delivery costs reported were within acceptable parameters.

On clawback due from BT and estimated take-up rates

21. Clawback comes into play in cases where BT spends less than expected on its planned capital or where customer take-up exceeds predictions. The contracts for the Northern Ireland Broadband Improvement Project (NIBIP) and the Superfast Rollout Programme, Phase 2 (SRP2) included arrangements for calculating and recovering take-up clawback.

22. BT reported that its actual incurred costs on NIBIP and SRP2 were greater than the bid costs. Since there were no cost underspends by the supplier, no clawback on this element was due.

23. Where customer take-up exceeds expectations set out at the planning stage of contracts, the financial gain is shared between DfE and BT (at a rate proportional to the relative investments made). At the planning stage of both the NIBIP and the SRP2, BT estimated that post-programme customer take-up would be around 20 per cent. By 31 December 2018, actual take-up stood at 66 per cent following the NIBIP and 33 per cent following the SRP2. DfE told us that BT’s take-up assumptions were based on European benchmarks from other national operators at the time and that it considered this to be reasonable. While the contract clawback procedures will ensure a financial return for the excess take-up, we consider that the much higher take-up rates raise questions as to whether the programmes needed public subsidy in the first place. In response DfE told us that the high costs of building broadband infrastructure in rural areas significantly reduces the commercial viability for investors.

24. Take-up reviews are carried out at specified contractual points and any clawback due is credited to an Investment Fund (maintained by BT). Clawback paid into the Investment Fund by BT accrues interest at the Bank of England base rate plus 2 per cent, until the day it is repaid to the Local Body.

25. In relation to the NIBIP, BT has released take-up clawback of £1.7 million. This was invested in SRP2. At 31 March 2020, BT accounts included deferred income of £619 million in recognition of the likelihood that take-up on individual UK contracts will exceed predictions. BDUK estimates that take-up clawback of £14 million is due to DfE from BT (£6.4 million in respect of the NIBIP scheme and £7.6 million in respect of the SRP2). DfE told us it will continue to work with BDUK and Openreach to consider options for use of the Investment Fund.

On DfE’s most recent broadband programmes

26. Since 2007, the DfE has managed a number of projects to improve NI broadband provision, leveraging public sector investment of just under £78 million.

27. An early NI project (the Next Generation Broadband project), commissioned in 2009 and prior to the development of the BDUK framework, was awarded to BT after an open tender exercise. The total investment of £48 million included £18 million in public subsidy and £30 million from BT. In 2013, the NAO identified that, through this programme, BT prices were considerably lower (around 12 per cent) than those local bodies were able to secure through the BDUK framework. Two subsequent programmes, the NIBIP and the SRP2 were awarded to BT through the framework.

28. The contract for the NIBIP was signed in February 2014 and offered £19.3 million in public subsidy. BT’s final bid specified its plans to provide additional funding of £4.4 million. This increased available funding through the programme to £23.7 million. For this, BT proposed improving connectivity to a guaranteed 45,259 premises. This fell considerably short of DfE’s original expectations that the programme would reach almost 117,600 premises. In effect, the shortfall in coverage meant that the original scheme objective (to provide universal access to speed of at least 2Mbps) had to be amended (to refer to providing 2Mbps to 96 per cent of premises).

29. DfE acknowledges that projected delivery fell short of its original expectations, but considers that its economists verified that the bid represented value for money by approving the award of the contract. Given the shortfall in delivery, we cannot conclude that the NIBIP achieved value for money.

30. The contract for the SRP2 was awarded in February 2015 and initially offered £14.5 million in public subsidies. While DfE anticipated that the available subsidy would not be sufficient to meet the UK target of providing access to superfast broadband to 95 per cent of premises, it envisaged that it would facilitate the provision of increased connectivity to 20,947 premises, equating to 84 per cent across NI.

31. Again, DfE awarded the contract to BT using the framework. In its bid, BT committed to providing additional funding of £3.3 million, using public sector subsidy of £14.5 million. With a total programme provision of £17.8 million, BT anticipated that superfast broadband could be provided to 38,921 NI premises (increasing access across NI to superfast broadband to 87 per cent). BDUK is currently estimating that BT’s capital investment under SRP2 will be in the region of £11.4 million. DfE told us that is not in a position to tell us details of the final project outcomes or actual total costs since BDUK has not completed its final stage assurance process.

On assurance over BT costs

32. Over the period from 2013 to 2016, BT provided conflicting evidence to various Parliamentary Committees on the cost of the cabinets installed with estimates varying from £26,500 to £100,000.

33. BDUK informed us that, in March 2014, it began preparing Actual Cost Comparison Reports across its superfast programmes. Given this, it is difficult to understand why precise, consistent information on key metrics could not be provided to Parliament Committees.

34. DfE told us that, on the basis of information provided by BDUK in relation to NIBIP, the average cost per cabinet was £19,700 compared to a UK average cost of £15,500 per cabinet. The SRP2 cost per cabinet will not be confirmed until BDUK completes its final assurance process.

On DfE plans through Project Stratum

35. By 2018, approximately 89 per cent of premises in NI had access to superfast services. DfE developed plans to introduce Project Stratum, funded under the Confidence and Supply Agreement with additional assistance from the Department of Agriculture, Environment and Rural Affairs (DAERA), to extend Next Generation Access (NGA) broadband infrastructure across NI. DfE told us that 97 per cent of the premises to be targeted are rural, located in communities of fewer than 1,000 people and open countryside.

36. Initial plans identified that the project would reach 97,000 premises. That figure was subsequently reduced to around 79,000 premises, following a major refresh of data held by infrastructure providers which indicated that some premises were (or would be) able to access services with speeds of at least 300Mbps. DfE told us that there was no reduction in the expected total cost of the project because the Outline Business Case estimated that the original funding might only be sufficient to deliver improvements to approximately 74,000 premises. The contract was awarded to Fibrus Networks Limited in November 2020 and anticipates that fibre to the premises broadband will be available to just over 76,000 premises, mainly in rural areas.

37. We understand that DfE’s Internal Audit Unit has reviewed Project Stratum and concluded that its procurement has been well managed. In achieving this we note the steps taken by DfE to ensure that appropriate expertise was secured during the early stages of Project Stratum.

38. DfE has told us that, for Project Stratum, it is satisfied that the procurement was in line with best practice in the assessment of costs and options and that the contractual obligations placed on the winning bidder, in terms of the provision of information, include mechanisms that are fully in line the National Broadband Scheme guidance and will allow DfE to assess value for money. We intend to report separately on the award of the Project Stratum later this year.

Value for money conclusion

In our opinion, it is not possible to verify that value for money was achieved through the NI broadband projects procured using the BDUK framework.

We consider that the use of the BDUK framework which, by the time it was used in NI, had only one bidder (BT), seriously limited competition. However, we also note that a number of other Great Britain projects, let outside of the BDUK framework, were awarded to BT through open competition.

While we recognise that BDUK and DfE had procedures in place to examine bids and costs and that assurances were obtained from BT, in our opinion these controls were not sufficient to verify that BT’s bid costs were economically priced, internally consistent, consistent with its commercial investment or that value for money was achieved.

Performance through the NIBIP fell well below DfE’s original expectations of delivering broadband to 117,600 premises and, in fact, only ended up improving broadband access to 37,500 premises. This was also below the outputs specified in BT’s initial and revised bids. Given this disappointing performance, it is not possible for us to conclude that the NIBIP delivered value for money.

Performance through the SRP2 cannot yet be assessed since BDUK has not completed its final stage assurance process to confirm final project outcomes and actual costs.

Actual take-up rates following the NIBIP and SRP2 programmes were higher than anticipated. DfE told us that BT’s estimates were based on European benchmarks at the time. While clawback is earned by DfE in cases where take-up exceeds expectations, in our view, the high take-up level calls into question whether public subsidy was required.

At 31 March 2020, BT Accounts reported deferred income of £619 million in recognition that take-up has been much higher than expected right across the UK over the period of the contracts. BDUK estimates that £14 million in take-up clawback is due to NI. BT has repaid £1.7 million to DfE which leaves a further £12.3 million outstanding. We welcome assurances from DfE that it will continue working with BT to consider options for use of the Investment Fund.

We note DfE’s assurance that, in relation to Project Stratum, it has built in appropriate controls to ensure full transparency over costs. This will allow DfE to calculate key metrics, benchmark and assessment the extent to which value for money is achieved.

We intend to report on the award of the contract for Project Stratum in 2021.

Recommendation 1

The BDUK framework was compatible with EU regulations and provided a mechanism for local bodies to award contracts on a ‘call-off’ basis and therefore avoid expensive, individual open tender exercises. However, following the withdrawal of seven of the nine companies which pre-qualified to bid, and Fujitsu’s March 2013 announcement that it would not be bidding for any further contracts through the BDUK framework, BT was left with no competition.

We recommend that for future procurements exercises, in the event that only one bidder remains on a framework, consideration is given to the impact on the market of awarding all contracts to that bidder and assessing how, in such cases, the achievement of value for money can be objectively measured.

Recommendation 2

In the absence of competition, local bodies were not in any position to evaluate BT bids. As an alternative, BDUK prepared bid comparison reports for local bodies. NAO and Westminster PAC have both been critical of BT bids which they concluded lacked detail, relied on self-certification that costs were consistent with commercial investment and were economically priced and contained non-disclosure agreement clauses.

We note that by 2015, BDUK had strengthened its value for money team and had access to detailed cost information from BT. Although BDUK was then in a position to compare bids and confirm that BT’s actual costs were lower than bid costs, we agree with NAO’s view that while BDUK’s analysis did not, in itself, provide assurance that BT priced the contracts economically.

We recommend that, for future contracts, departments secure appropriate inspection rights to detailed data so that bids can be fully assessed. We also recommend that non-disclosure clauses are omitted from contracts.

Recommendation 3

We note that in several of the contracts let through the framework, take-up was estimated at 20 per cent. Actual take-up however has been considerably higher (66 per cent on the NIBIP and 33 per cent on the SRP2). While we acknowledge that DCMS (and ultimately DfE) shares in a percentage of any gain, in our view, predictions on take-up should be more accurate.

We recommend that for future programmes, contracting authorities ensure they have the necessary information to allow them to produce more accurate predictions on take-up.

Recommendation 4

The BT framework bid for, and actual delivery under, the NIBIP fell considerably short of DfE’s initial expectations. This indicates that either DfE’s initial planning was totally inaccurate or BT’s bid and performance represented poor value for money. While we note that BDUK and DfE’s technical consultants considered that the final BT bid offered value for money, it is difficult to understand how preliminary DfE expectations could have been so far out.

We recommend that, where the use of frameworks is not mandated, departments take time to consider whether it would be in their best interests to consider and negotiate through alternative procurement methods, for example through open competition.

We note assurances from DfE that the contract for Project Stratum, which was awarded after the BDUK framework lapsed, was procured using the Restricted Procurement Procedure pursuant to Regulation 28 of the Public Contracts Regulations 2015 and was fully managed by the Department of Finance’s Construction and Procurement Delivery (CPD) in line with the National Broadband Scheme 2016, with State aid Assurance provided by BDUK as the National Competency Centre.

Part One: Introduction and Background

Telecommunications is a reserved matter and has not been devolved to the Northern Ireland Executive

1.1 Telecommunications is a United Kingdom (UK) reserved matter. It has not been devolved to the Northern Ireland Executive (the Executive) but is controlled centrally by the UK Department for Digital, Culture, Media & Sport (DCMS).

1.2 Under the Communications Act 2003, the Department for the Economy Northern Ireland (DfE) has limited powers to intervene where there is evidence of market failure. This has to be undertaken with caution in order to avoid distortion of the market and comply with European regulations.

The internet plays an important role across all aspects of modern day life and the UK Government recognises digital connectivity as an essential utility

1.3 Broadband is a term used to describe ‘always on’ internet access. Fibre optical cable is now replacing copper along the existing telephone access in order to increase capacity and quality of service. Broadband provision is measured in millions of bits (megabits) per second (Mbps). Provision of 10Mbps and above is referred to as ‘decent’ broadband, 30Mbps and above as ‘superfast’ and 300Mbps and above as ‘ultrafast’. Full fibre broadband can offer speeds of 1 Gigabit per second (Gbps).

1.4 Commercial operators are rolling out superfast, ultrafast and full fibre broadband where it is profitable to do so. In urban areas, where population density is high, operators will invest in infrastructure because it is likely that they can generate additional income by increasing their customer numbers. The commercial case for providing superfast broadband services to the remaining, primarily rural, communities is less attractive because of the low population density. In order to improve connectivity across the UK, the Government offers public subsidies to suppliers willing to provide superfast broadband in commercially unattractive areas (typically rural areas).

1.5 In its 2017 Digital Strategy, the UK Government acknowledged that “broadband and mobile must be treated as the fourth utility, with everyone benefitting from improved connectivity”. In 2018, the National Infrastructure Commission, the Government’s independent advisor on the UK’s infrastructure needs, stated that digital connectivity was now “an essential utility, as central to the UK’s society and economy as electricity or water supply”.

1.6 Digital connectivity offers considerable benefits to consumers, businesses and the Government. Figure 1.1 outlines some of the main benefits.

Figure 1.1 Key benefits of digital connectivity to consumers, business and government

|

Consumer |

Business |

Government |

|---|---|---|

|

• Equality of access; • Access to online media and media downloads; • Access to online services including retail, government and banking; • Entertainment choices (including TV on demand); and • Improved social interaction through social media. |

• Improved online presence; • Improved procurement opportunities; • Increased efficiency and productivity; • Additional sales; • Streamlined recruitment and funding opportunities; and • Improved marketing. |

• Lower cost transactions; • Improved public access to information and services; • Flexible working arrangements for staff; • Easier tracking of services; and • Improved opportunities for benchmarking and identifying best practice. |

Source: NIAO

The need for reliable broadband has been more apparent during the COVID-19 crisis

1.7 The COVID-19 pandemic forced all but essential workers in NI to stay at home. Many have now been working from home, learning or studying from home or receiving home-schooling while practicing social distancing or self-isolating. With so many people at home during the day, all wanting to be online at the same time for a range of activities, the need to have a fast and reliable broadband connection has never been clearer.

1.8 In traditional fibre-to-the-cabinet (FTTC) technologies, it is generally accepted that cabinets can deliver around 30 Mbps over a distance of up to 1,200 metres. Service deteriorates for premises further than 1,200 metres from the cabinet. Fastest speeds are achieved where customers are located physically close to the infrastructure (green cabinets along the side of the road).

1.9 The frustration of having a slow home internet connection has escalated since the outbreak of the pandemic. The Ulster Farmers’ Union has reported that the lack of broadband is impacting on the lives of its members in rural communities, creating feelings of heightened anxiety and fear.

1.10 In July 2020, it was reported by local media that a number of homes and other premises (schools, businesses and religious buildings) in NI faced lockdown with inadequate access to internet broadband services. DfE told us that almost 79,000 premises have been identified as being eligible for assistance to improve their broadband service under Project Stratum (see paragraph 1.42 to 1.44). DfE confirmed that it “fully appreciates the significant challenges faced by citizens across Northern Ireland as a result of the COVID-19 crisis”.

1.11 Commenting on coverage during the pandemic, the Rural Community Network identified that broadband was particularly poor in rural areas of Fermanagh, west Tyrone and south Derry. The Participation and the Practice of Rights organisation highlighted that “The very first requirement in an emergency like COVID-19 is effective communication” and identified that excessive costs had excluded vulnerable people from important government advice during the lockdown.

1.12 A number of rural residents also explained their internet problems to us:

- One rural resident, who is currently working from home while home-schooling three children explained that, with broadband speeds of 6-7Mbps, the internet signal is unreliable and frequently fails, the computer stalls and it is difficult to remotely join and participate in work-related meetings.

- One rural resident, living at the end of the line from the exchange, explained that, despite having tried several options, they can only achieve a maximum broadband speed of 8Mbps. Again the solution is unreliable and can’t cope when more than two people require internet access.

- Another rural resident explained that their internet experiences regular drops and poor download and upload speeds. While this always caused problems for the family business, frustration has escalated during the current COVID-19 pandemic. One member of the household, a teacher, has been completely unable to engage in zoom lessons.

- One resident trying to run a farm business, carry out pharmacy work and home-school three young children during the pandemic has opted for a satellite broadband system since broadband through the phone-line is not available. The resident described the satellite system used as slow, unreliable and expensive.

- Another resident, living just two miles outside Dungannon town centre, told us that he cancelled his broadband service because it was not possible to achieve a download speed of more than 1Mbps.

1.13 It is now a very real possibility that home-working will become much more common. However, for those living in rural areas it is unlikely that they will be in a position to avail of the benefits (such as flexibility, reduced travel time and costs) if their internet service is poor.

Europe 2020 acknowledges the importance of broadband deployment for the economy

1.14 The ‘Europe 2020’ strategy sets out the European Union’s (EU’s) agenda for growth and jobs for the period 2010 to 2022. It advocates smart, sustainable and inclusive growth to overcome the structural weaknesses in Europe’s economy, improve competitiveness and productivity and underpin a sustainable economy. Europe 2020 underlines the importance of, and sets targets for, broadband deployment.

1.15 Key objectives include the need to:

- Bring basic broadband to all Europeans by 2013;

- Ensure that, by 2020, all Europeans have access to much higher internet speeds (of above 30Mbps); and

- Ensure that, by 2020, 50 per cent or more, of European households subscribe to internet connections of above 100Mbps.

DCMS offers subsidies to commercial suppliers through its Superfast Broadband Programme

1.16 In line with ‘Europe 2020’ the UK government has made broadband internet provision a priority. Building Digital UK (BDUK), a directorate within DCMS, is responsible for the management, governance and oversight of programmes delivering improved broadband across the UK.

1.17 On 6 December 2010, the UK Government launched ‘Britain’s Superfast Broadband Future’, which aimed to ensure that, by 2015, the UK had the best broadband network in Europe. To achieve this, BDUK put in place a country-wide, state-aid scheme to support various broadband projects – the Superfast Broadband Programme (formerly the Rural Broadband Programme).

1.18 While BDUK is responsible for delivery of the programme, local bodies (including DfE in NI) manage procurements in their areas. To assist them, BDUK developed a framework which allows local bodies to award contracts without completing expensive, individual open tender exercises. Local bodies were free to procure from outside the framework. BDUK offers advice and supports local bodies during the procurement and contract management processes.

1.19 Public investment in telecommunications infrastructure must comply with the UK’s State Aid Framework. Local bodies are generally required to provide matched funding to the central government grant. This additional funding can be sourced from public sector budgets, the EU or private investment. Individual projects use a ‘gap funding’ model - the gap is the level of public sector subsidy required to make a project commercially viable to suppliers.

In 2016, Ofcom set out plans to improve telecoms quality and coverage so that UK consumers and businesses receive the best possible phone and broadband services

1.20 BT (then British Telecom plc) separated from the Post Office in 1981 and was privatised in 1984. The telecoms access infrastructure transferred to BT as part of the privatisation. In 2005, Ofcom identified that, in the interest of increasing competition, BT should be providing its competitors with equality of access to the infrastructure it owns by virtue of the privatisation. Openreach was created to make sure all communications providers could access the network fairly.

1.21 Eleven years later, in 2016, Ofcom identified that Openreach’s governance lacked independence from BT. As a result, Ofcom concluded that there remained an incentive for Openreach to make decisions in the interests of BT. Ofcom recommended an overhaul of Openreach’s governance and increased transparency in order to strengthen its independence from BT.

1.22 Under pressure from Ofcom, Openreach Limited was incorporated as a wholly owned subsidiary of BT in 2017. The separation of Openreach marked a transformation in BT’s approach to investment in full fibre.

1.23 Arrangements in NI differed slightly. BT Northern Ireland was not integrated into Openreach in 2017 but remained a standalone BT plc business unit. On 1 October 2018, BT’s Northern Ireland Networks (Engineering Division) (which builds and maintains the copper and fibre lines which run from telephone exchanges to the vast majority of local premises) was renamed Openreach Northern Ireland. Whilst the Northern Ireland Networks team now reports into Openreach, it remains part of BT plc and has maintained its local management team, strategic responsibilities and organisational structure. Openreach Northern Ireland is now investing commercially in full fibre in areas where BT previously sought subsidy for a FTTC service (which costs much less).

The 2018 Future Telecoms Infrastructure Review report sets full-fibre and 5G out as the long-term answer to providing broadband access across the UK

1.24 The 2018 Future Telecoms Infrastructure Review report, produced by DCMS, notes that over the coming decades, “fixed and mobile networks will be the enabling infrastructure that drives economic growth”. The report sets full fibre (and 5G) out as the long-term answer to providing the speed, resilience and reliability that consumers want and businesses need in order to grow.

1.25 While the report identified the UK as a world leader in superfast connectivity, it noted that full fibre coverage was low at only 4 per cent, lagging behind current world leaders like South Korea (c.99 per cent), and Japan (c.97 per cent).

1.26 The report set out the latest government targets to provide:

- 15 million premises with a connection to full fibre by 2025, with coverage across all parts of the UK by 2033 (estimated to cost around £30 billion); and

- 5G coverage to the majority of the population by 2027.

The Universal Service Obligation (USO) (2020) will give eligible consumers and businesses a legal right to request a broadband connection of at least 10Mbps and upload speeds of at least 1Mbps

1.27 The Digital Economy Act 2017 established a UK-wide minimum standard for access to broadband. The Universal Service Obligation (USO) provides eligible consumers and businesses with a legal right to request a broadband connection of at least 10Mbps and upload speeds of at least 1Mbps. The USO is intended to cater for the final two per cent of premises (around 620,000 UK premises) (England 434,000, NI 39,500, Scotland 99,000 and Wales 47,000) which remain without broadband access.

1.28 Since 20 March 2020, consumers and businesses are eligible to request a connection under the USO if:

- they do not have access to a decent broadband connection (i.e. 10Mbps), or

- the only available decent broadband connection costs more than £45 per month; and

- the connection will cost no more than £3,400 to build. In cases where connection costs are expected to exceed this limit, the customer can choose to pay the excess.

1.29 The USO is intended to act as a “safety net” for areas where superfast or full-fibre deployment may take some time to deliver. It was anticipated that, by the end of 2020, around 98 per cent of premises across the UK would have access to fixed line “superfast broadband”. BT and KCOM (in East Yorkshire) are the designated Universal Service Providers responsible for taking requests for connection and building the necessary infrastructure to deliver them.

1.30 Although requests for a connection can currently be made, the scheme is not fully operational. The funding mechanism has yet to be tested and will be subject to further Ofcom consultation once a supplier submits an application for funding. It is not yet clear how public and industry funding will interact.

1.31 While the introduction of the USO was welcomed by many, it has attracted several criticisms as follows:

- The USO specification of 10 Mbps is too low given that it was modelled on the minimum standard for an average family and not a business.

- The cap on the cost of connections (£3,400) places a cost penalty on isolated rural customers and will “not be enough to get to the final few”.

- The figures quoted by Government under-report the number of homes receiving less than the minimum service.

- Reliance on alternative technologies, such as Fixed Wireless Access, to deliver the USO, might impose a ceiling on the services premises could receive and therefore “distort the developing rural superfast broadband market”, delivering a “second class service”.

- The precise details of the costs which will fall to industry have not been determined and arrangements may take some time to finalise.

- Implementing the broadband USO might happen at the expense of completing other activity (such as the BDUK Superfast Broadband Programme).

In NI, public sector subsidies of just under £78 million have been provided to increase the provision of superfast broadband services

1.32 The Northern Ireland Draft Programme for Government 2016-2020 included (as Measure 24) the need to improve internet connectivity by increasing the number of premises with access to broadband services in excess of 30 Mbps.

1.33 The Northern Ireland Draft Industrial Strategy (Economy 2030) sets out the Northern Ireland Executive’s (the Executive’s) objective to “become Europe’s best connected region for broadband by 2030 by further extending broadband coverage through the Northern Ireland Broadband Improvement Project and Superfast Rollout Programme, and further new interventions that will enhance broadband speeds and mobile coverage across Northern Ireland as part of a new Digital Infrastructure Strategy”.

1.34 Government intervention in broadband typically covers either investing in availability or subsidising take-up. Investing in availability enables providers to upgrade infrastructure in areas where it is not commercially viable while subsidising take-up involves offering vouchers to customers to help with the cost of installing satellite and fibre installation.

1.35 Since 2007, DfE has undertaken a number of projects (including those set out in Figure 1.2) to improve broadband provision across NI, leveraging public sector investment of just under £78 million. By 2020, approximately 89 per cent of NI premises had access to, at least, superfast broadband service (30Mbps).

1.36 As part of the national Superfast Broadband Programme, DfE has managed the:

- Northern Ireland Broadband Improvement Project (NIBIP) – this is part of a larger, national Broadband Improvement Programme, which involves laying fibre optic telephone lines from existing exchanges to new, small broadband exchanges in rural areas. The NI build phase, costing £17.7 million in public subsidy (see paragraph 4.22), was completed in September 2016. The take-up phase is expected to be completed in March 2023; and

- Superfast Rollout Programme, Phase 2 (SRP2) – this is an extension of the NIBIP and involves laying new fibre optic telephone lines to cabinets (green cabinets at the side of roads), and in some cases to premises, in areas across NI. The build phase, costing £17.4 million in public subsidy (see paragraphs 4.34 and 4.36), was completed in September 2018. The take-up under this project runs until December 2024.

Figure 1.2: Government funded Broadband projects in Northern Ireland

|

Project |

Period Covered |

Total Grant Funding |

Project Completed |

Objective/ Number of premises passed |

|---|---|---|---|---|

|

Next Generation Broadband Project |

Nov 2009 - Dec 2013 |

Public Subsidy £19.6 million |

Yes |

Access to next generation broadband speeds was provided for 85 per cent of business premises, by building new fibre infrastructure. |

|

Super Connected Cities |

Mar 2014 - Mar 2016 |

£5.8 million paid by DCMS |

Yes |

2,424 |

|

Northern Ireland Broadband Improvement Project (NIBIP) |

Feb 2014 - Sept 2016 (build complete) Sept 2016 to March 2023 (take-up continues) |

Public Subsidy £17.7 million |

No |

37,500 |

|

Superfast Rollout Programme, Phase 2 (SRP2) |

Feb 2015- April 2019 (build complete) April 2019 – Dec 2024 (take-up continues) |

Public Subsidy £17.4 million (to be confirmed by BDUK) |

No |

Final cost information is not yet available from BDUK. |

Source: DfE

1.37 Broadband support has also been made available to NI homes and/or businesses through the Better Broadband Voucher Scheme, the Gigabit Voucher Scheme, the Rural Gigabit Connectivity Programme, the Local Full Fibre Network Programme and the City Deals Initiative. Appendix 1 provides further detail on each of these schemes and programmes.

The contract for the £165 million Project Stratum was awarded in November 2020 and will improve broadband connectivity for just over 76,000 predominantly rural premises in NI

1.38 The 2018 Ofcom Connected Nations report identified that, by the end of June 2018, approximately 88 per cent of premises in NI had access to superfast services.

1.39 Under the terms of the Confidence and Supply Agreement (the Agreement) between the Conservative and Unionist Party and the Democratic Unionist Party (DUP), the UK Government and the DUP agreed to work together. Both the UK Government and the Executive recognised the integral role of digital infrastructure in opening new opportunities for growth and connectivity. In recognition of the challenges that remain in NI in providing access to broadband and mobile services, the UK government agreed to contribute £75 million per year for two years (£150 million) to provide ultra-fast broadband in NI.

1.40 DfE developed plans to introduce Project Stratum, using the £150 million Confidence and Supply Agreement money and additional assistance of £15 million from the Department of Agriculture, Environment and Rural Affairs (DAERA), to extend Next Generation Access broadband infrastructure across NI. As an initial step, DfE carried out an industry consultation stage (over the period from 19 June 2018 to 27 July 2018) to establish existing and planned (within the next 3 years) coverage of broadband infrastructure across NI.

1.41 Following this, on 3 December 2018, DfE opened a consultation to assess the availability of broadband services across NI. The consultation set out the proposed intervention areas for Project Stratum and invited stakeholders to comment on the proposals. This allowed broadband infrastructure operators to review (and, where necessary, correct) DfE’s mapping, and allowed citizens to identify whether or not their postcode was correctly categorised in terms of broadband infrastructure access.

1.42 DfE announced on 16 December 2019, in its response to the public consultation, that it had identified 97,000 premises in rural areas which were to be eligible to benefit from improved broadband connectivity under Project Stratum. The £165 million project seeks to improve connectivity for those unable to access broadband services of 30 Mbps or greater. The finalised intervention area was quality assured by Building Digital UK’s (BDUK’s) National Competence Centre (NCC) for approval against the state aid framework. The main focus of Project Stratum is to address broadband connectivity challenges common to rural areas and to correct a connectivity gap that exists in NI compared with the rest of the UK.

1.43 Following this announcement, DfE was informed of a data refresh exercise (completed in January 2020) completed by a number of infrastructure suppliers which had, along with other updates, impacted on the intervention area. Given the updated information, the number of premises requiring intervention under Project Stratum was reduced to just below 79,000 premises. DfE told us that 97 per cent of the premises to be targeted are rural, located in communities of fewer than 1,000 people and open countryside.

1.44 DfE confirmed that just over 76,000 predominantly rural premises will benefit from the project. The procurement for the project was launched on 11 July 2019 and contract was awarded in November 2020. DfE has told us that Project Stratum used an open procurement with restricted procedure, fully managed by Construction, Procurement and Delivery (CPD), which resulted in significant industry engagement, and a competitive procurement with two credible responses to the Invitation to Tender.

1.45 In May 2018 independent consultants (commissioned by BT) produced the Deployment of Fibre to the Premises (FTTP) in rural NI report. This report provided an independent economic appraisal of the net benefits that could arise from the funding under Project Stratum. The report highlighted that (as at 2017):

- Despite the high proportion of FTTC penetration, the proportion of premises with sub-24Mbps download speeds was one of the highest in any UK region.

- The largest benefits will accrue in Fermanagh, Omagh and Mid Ulster, where the roll-out plans are focussed.

1.46 The report concluded that the proposed fibre investment will help to realise several of the goals set out in DfE’s Draft Industrial Strategy including reducing economic inactivity, improving collaboration, increasing global competitiveness and supporting digital–intensive sectors. It estimated that around £8 benefit would be realised for every £1 spent. The total benefits to the NI economy, up to 2033, are estimated to be £1.2 billion for the subsidy cost (estimated at that time to be around £150 million).

Audit agencies across the UK and Parliamentary Committees have been critical of projects procured through the Superfast Broadband Programme

National Audit Office and the Westminster Public Accounts Committee (further detail is set out at Appendix 2)

1.47 In 2013, the National Audit Office (NAO) reported that “The [Rural Broadband Programme]… funding contributed by BT has, so far, been lower than originally modelled – the Department (DCMS in England) now expects…[BT] to provide just 23 per cent of the overall projected funding of £1.5 billion, some £207 million less than it modelled in 2011. At the same time, by the end of the programme, BT is likely to have benefited from £1.2 billion of public money”. The report concluded that the Superfast Broadband Programme (previously the Rural Broadband Programme) lacked competitive tension and strong assurance over costs.

It noted that ensuring value for money would rely heavily on the quality of the in-life contract controls.

1.48 The Westminster Committee of Public Accounts (PAC) held a hearing in July 2013 and a follow up hearing in January 2014 on this topic. PAC concerns, set out in two reports, included the lack of competition in contracts and the extent to which contracts delivered value for money. Issues identified included a lack of transparency over BT costs and limited published information about planned rural broadband coverage and speed.

1.49 In January 2015, NAO published The Superfast (Rural) Broadband Programme: Update. This outlined progress on the specific issues the Westminster PAC raised and provided a brief update on the programme’s overall progress. NAO reported that, since the PAC session more information was available on broadband coverage, BDUK had identified (from a small-scale trial cost comparison) that BT’s costs were around 20 per cent less than the estimated costs of an alternative supplier and BDUK had calculated that BT’s actual phase 1 costs were 38 per cent lower than expected in its financial model.

1.50 NAO noted that BDUK had not omitted confidentially clauses from its contracts and highlighted that the limited competition witnessed in phase 1 of the programme continued through phase 2. NAO concluded that this reinforced BT’s already strong position in the wholesale market for broadband infrastructure costs.

1.51 On 16 October 2020, NAO published its “Improving Broadband” report which considered what the Superfast Programme has delivered and how the UK’s broadband infrastructure held up during the COVID-19 pandemic. NAO concluded that the Superfast Programme has extended the nation’s broadband connectivity and delivered benefits. Better broadband helped communities to work and study from home and stay connected during the COVID-19 pandemic. However, NAO concluded that, in managing the trade-off between coverage and speed, the UK has a broadband network which is not fully future-proof and, less than a decade after launching its Superfast Programme, the government has identified the need to upgrade it.

1.52 NAO confirmed that the government has set a very challenging timeline in promising nationwide connectivity (gigabit capable with speeds of at least 1,000Mbps) by 2025 but highlighted the importance of setting a realistic target and testing whether this is achievable. The report noted that DCMS is working towards finalising plans for its Future Programme to support nationwide gigabit coverage and identified that the Department will need to manage the tension between meeting a timeframe and serving those in greatest need. NAO cautioned that, failing to do so, risks widening the rural divide.

1.53 NAO identified that DCMS still has much to do to mobilise and deliver a substantial programme and noted that while it has applied some learning from the Superfast Programme, it has moved away from some of its more successful aspects in order to meet the challenging timeline. Moving forward, NAO highlighted the need for DCMS to consider and mitigate any new risks arising.

The Westminster Environment, Food and Rural Affairs Committee

1.54 On 18 September 2019, the Westminster Environment, Food and Rural Affairs Committee (the EFRA Select Committee) published its report “An Update on Rural Connectivity”. This followed a previous EFRA Select Committee report in 2015 which had expressed concern that poor broadband in rural areas risked causing harm to the rural economy and rural communities.

1.55 The EFRA Select Committee remained unconvinced that the Government had fully grasped the extent of the problem, the scale of the challenge, or the wider cost of poor connectivity for rural communities and economies.

1.56 In summary, the report concluded that:

- Government policy has barely kept pace with the rate of technological change and has failed to reduce the digital divide between urban and rural areas.

- Delivering a “digital-by-default” strategy for public services, before solving the issue of poor connectivity in rural areas, has worsened the impact of the digital divide. In the Committee’s view, those ‘hardest to reach’ should have been given priority.

- The current specification for the Universal Service Obligation is inadequate, is not truly “universal” and its minimum speed of 10Mbps will be obsolete soon after introduction.

- It is currently unclear how the Government intends to meet its accelerated target of universal full-fibre broadband by 2025.

- A “rural roaming” solution is needed to tackle partial “not-spots” in mobile coverage in the absence of a forthcoming agreement between Government and Mobile Network Operators.

1.57 Contrary to the state aid applications which specify the use of gap funding for rural areas, DCMS accepted that rural areas had not been prioritised in the rollout of superfast broadband between 2015 and 2018.

The Westminster Culture, Media and Sport Committee

1.58 On 18 July 2016, the Westminster Culture, Media and Sport Committee (CMSC) published a report which expressed concern that the UK was not adequately investing in critical telecoms infrastructure; the Superfast Broadband Programme appeared to have tackled easier-to-reach premises first; had not delivered coverage to whole areas; and provided limited transparency over Openreach’s costs and deployment plans.

1.59 A number of witnesses, who provided evidence to the CMSC, suggested that at least some of the planned full-fibre upgrades could be funded by existing money owed from BT in respect of clawback. Witness reports identified, for example:

- that “by some calculations, there were…… hundreds of millions of pounds of underspend sitting in BT’s accounts as capital deferral”. Another witness reported that BT’s “accounting treatment” aided “cost recovery but not network build in rural areas”.

- a “lack of transparency” regarding the management of the clawback highlighted “the need for a nationwide integrated approach”.. “to ensure an efficient usage of public subsidies.”

1.60 The CMSC concluded that the target of 2033 for universal full-fibre roll out lacked urgency and ambition and welcomed a revised commitment from the Prime Minister to achieve universal full-fibre broadband by 2025. However, the UK Digital Minister subsequently told CMSC that “to have the whole country connected to full-fibre by 2025 is not physically possible”. CMSC remained sceptical as to whether the target could be achieved without substantial new, long-term, public investment and potentially controversial regulatory reforms.

Bytel Report (NI Audit Office)

1.61 On 3 March 2015 we published our report on the Cross-Border Broadband Initiative: The Bytel project. We reported that:

- A review, completed in March 2012, had identified serious weaknesses in the management and oversight of the project and found that 97 per cent of the expenditure was irregular.

- The assessment and appraisal processes were not sufficiently robust.

- There were significant concerns over the valuation, existence, ownership and completion of the assets and infrastructure referred to in certain claims.

- The project delivered poor value for money.

Over the last 18 months, we published two reports which have highlighted concerns over departmental management of contracts with BT

Management of the NI Direct Strategic Partner Project – helping to deliver Digital Transformation

1.62 In June 2019 we published our report on Management of the NI Direct Strategic Partner Project – helping to deliver Digital Transformation. This report identified that expenditure of £110 million will be incurred through a contract which was let to BT for £50 million. Ineffective financial controls within the Department of Finance (DoF) led to a situation where the actual costs incurred were not actively monitored.

1.63 In addition, since alternative mechanisms for service provision had not been explored, DoF had no option but to extend the contract for an additional three year period.

The Landweb Project: An Update

1.64 In 2008 we published a report on Transforming Land Registers: The LandWeb Project. A subsequent PAC report identified concerns with the project and concluded that better value for money could secured.

1.65 On 16 June 2020, we published an update report on the LandWeb Project. The update report was prompted by concerns from an anonymous member of the public that the project was wasting public money. In summary, although the supplier (BT) provided a fully functional and consistent IT service, we found no evidence to clearly demonstrate that the LandWeb project has delivered value for money.

1.66 We concluded that the extension of the LandWeb Concession Agreement for an additional two year period (to July 2021) in the absence of alternative mechanisms for service provision was indicative of poor strategic planning by the Department, reflecting similar concerns outlined in our report on ‘Management of the NI Direct Strategic Partner Project - helping to deliver Digital Transformation’ published in June 2019.

Scope of this report

1.67 In June 2016, the Irish Central Border Area Network (ICBAN) Ltd published “Fibre at a Crossroads – Part 1”. That report recommended completion of “true up” (or audit) of the level of DfE subsidies and the actual capital funding contributions from BT. The report highlighted that if actual costs incurred on broadband projects were lower than anticipated and subscriber take-up was higher than anticipated, then public subsidies paid to BT were likely to have been higher than necessary. ICBAN’s view was that, if that additional subsidy could be recovered from BT, then funds would be available to invest further into the rural areas of NI.

1.68 ICBAN produced “Fibre at a Crossroads – Part 2” in June 2017. Part 2 explored the funding issue in more detail. The report included a number of conclusions, including that:

- BT’s commercial investment covers less than half of premises in NI;

- A substantial proportion of the £60 million paid to BT in public subsidies appears to have been used to cover commercially viable investments (that is, in populated urban areas); and

- Gap funding principles (see paragraph 1.19) were not applied appropriately in NI.

1.69 The report noted that “answers to questions posed by MLAs in the NI Assembly to the Minister for the Economy confirm that £60 million of subsidies have been paid to BT. The Minister however noted that the Department have no direct knowledge of BT’s own investment” and noted that “Ofcom NI have confirmed to the author of this report that they have no detailed knowledge of BT’s commercial investment or matched funding in next generation access services in NI”.

1.70 This resonates with information provided by the UK Minister of State for Digital in response to a House of Commons Question in October 2016. The Minister stated that “BDUK does not hold data on BT’s total capital investment to date in the Superfast Broadband Programme. As each project completes, BT is required to confirm that either its contracted capital commitment is fully drawn down, or that any unused capital contribution is committed to an investment fund which is managed by the Local Body to support further delivery”.

1.71 The ICBAN reports recommended that the “appropriate NI institutions, NI Audit Office and Public Accounts Committee…conduct a comprehensive audit of BT’s commercial investment in NI and its contribution to the subsidised programme.”

1.72 This report considers the concerns raised in the Fibre to a Crossroads publications. It provides a high level overview of the progress made in improving NI broadband access and examines the extent to which DfE can demonstrate that its broadband procurements have achieved value for money:

- Part 2 sets out and compares broadband access across the UK;

- Part 3 examines the DCMS National Framework for broadband provision; and

- Part 4 looks at the management of broadband provision in NI.

1.73 Details of our methodology are set out at Appendix 3.

Part Two: Broadband Coverage across Northern Ireland and the UK

Ofcom provides updates on broadband provision access across the UK each year

2.1 The Digital Economy Act 2010 placed a duty on Ofcom to report to the UK Secretary of State for Culture, Media and Sport every three years on the state of the communications infrastructure. Since 2011, Ofcom has been publishing annual reports which set out UK-wide information on the coverage and performance of fixed broadband and mobile networks. Information presented in each publication is collected from network providers.

2.2 Government targets over the period since 2011 have changed and been upgraded as broadband technology has evolved and demand for access to that technology has increased. For example, Ofcom’s 2012 report highlighted a UK Government commitment to ensuring that, by 2015, almost all premises in the UK would be able to access a ‘basic’ broadband service (defined at that time as of at least 2Mbps). By 2015, the term ‘decent’ broadband had been introduced, referring to connections capable of delivering a download speed of at least 10Mbps and an upload speed of at least 1Mbps.

NI access to broadband, at speeds of up to 30Mbps, is lower than the UK average and all other UK regions

2.3 The Ofcom reports allow progress in improving broadband access to be monitored across the UK since 2011. While access in NI has improved significantly over the period, it lags behind all other UK regions in terms of access to broadband speeds of up to 30Mbps (superfast broadband) (Figure 2.1). By 2020:

- 98 per cent of NI residential premises were able to access broadband with a speed of 2Mbps (basic broadband) compared to an average of 100 per cent across the UK;

- 94 per cent of NI residential premises could access speeds of 10Mbps (decent broadband) compared with an average of 98 per cent across the UK; and

- 89 per cent of Northern residential premises could access superfast broadband (30Mbps) compared to 96 per cent across the UK.

In 2020, NI access to ultrafast broadband, at speeds of up to 300Mbps, rose to a rate higher than the UK average

2.4 By 2015, access enabled by new technologies was beginning to emerge. Collectively referred to ‘ultrafast’ services, these included:

- Fibre optic networks connecting premises directly to local exchanges (FTTP), transmitting data using pulses of light, removing the need for slower, copper-based cabling. A key priority for Ofcom is to encourage investment in full-fibre, which provides greater speed and reliability than copper-based telecoms networks where the quality and length of the copper to the premises can impact on both the reliability and speed of the service. A full-fibre connection, with no copper, can offer average speeds of one gigabit per second (Gbps or 1,000Mbps). It could potentially offer speeds in terabits (1,000 Gbps) in the future. There is of course a considerable cost to digging up and replacing copper cables with fibre optic cable.

- Improved computational power and technology development, enabling more efficient encoding and transmission of data across network links achieved, for example, by periodically updating network equipment to enable faster speeds over existing networks.

2.5 Figure 2.2 shows that by 2020, 64 per cent of residential premises across NI had access to ultrafast broadband (300Mbps) compared to 59 per cent across the UK. The NI rate was higher than all other UK regions (England 61 per cent, Scotland 52 per cent and Wales 37 per cent).

NI access to full fibre ultrafast broadband, is higher than the UK average and higher than the rate in any other UK region

2.6 In terms of full fibre (see Figure 2.3), since 2018 NI access has been higher than elsewhere in the UK. By 2020, 56 per cent of NI premises had access to full fibre compared to an average of 18 per cent across the UK. According to Ofcom, the higher percentage in NI reflects substantial private sector investment from Virgin Media and Openreach.

Like all UK regions, broadband access in rural areas is considerably less than that available in urban areas