Abbreviations

|

CIC |

Community Interest Company |

|

COVID |

Coronavirus Disease |

|

DfC |

Department for Communities |

|

GAA |

Gaelic Athletic Association |

|

GAC |

Gaelic Athletic Club |

|

IFA |

Irish Football Association |

|

IRFU |

Irish Rugby Football Union |

|

LRSS |

Localised Restrictions Support Scheme |

|

NICS |

Northern Ireland Civil Service |

|

RFC |

Rugby Football Club |

|

RoI |

Republic of Ireland |

|

SNI |

Sport Northern Ireland |

|

SSF |

Sports Sustainability Fund |

|

UK |

United Kingdom |

|

VfM |

Value for Money |

KEY FIGURES

|

Amount |

Detail |

|

£25m |

Funding available to the Scheme to support governing bodies, clubs and affiliated bodies |

|

£23m |

Of the £25m funding available, £23m in grant support was actually paid out to governing bodies, clubs and affiliated entities |

|

£17.9m |

Of the £23m grant support paid out, £17.9m of this was distributed across 430 sports clubs.

|

|

£5.1m |

Of the £23m grant support paid out, £5.1m of this was distributed across 22 sport governing bodies.

|

Executive Summary

- The Sports Sustainability Fund (SSF) was a scheme to provide funding to the sport sector to help it deal with the impact of COVID-19 restrictions. These restrictions saw sports clubs closed and sport events either cancelled or held behind closed doors with no spectators. These restrictions also impacted on their ability to generate income from hospitality, tourism and fundraising.

- The Scheme was co-designed by the Department for Communities (DfC), Sport NI (SNI) and a number of governing bodies and clubs. It was administered by SNI. Discussions with a number of governing bodies, clubs and the Northern Ireland Sports’ Forum suggested that the estimated financial loss to the sector was £25million. This, in turn, was the basis of the request for funding of

£25million, subsequently approved by the Executive.

- DfC has said that the COVID-19 package of support that was available for sporting organisations was developed and designed in a highly dynamic and fluid environment. Both itself and SNI faced challenges around the availability of data, timescales and resourcing. Schemes were developed urgently to support organisations during restrictions to help overcome immediate and longer term challenges.

- All recognised governing bodies and their affiliated clubs, who were able to provide financial information for at least three years prior to the COVID-19 year, could apply for the funding. Grants awarded were on the basis of net losses in 2020-21 when compared to the average income and expenditure over the previous three years.

- £15million of the funding for the Scheme was approved on 29th October 2020, with a further £10million being approved on 23rd November. The Scheme was developed through November and went live for applications in early December 2020. The applications were reviewed in line with the Scheme rules, and payments were made from February 2021.

- There was a short timescale for the development of the Scheme and it was very important that funding could be delivered to the sport sector as quickly as possible. By the time the Scheme was being developed, the sector was reporting it was seriously struggling from the large reduction in income because of COVID-19.

- DfC has highlighted that due to the very short timeframe available in which to get the funding to governing bodies and clubs, many strands of the Scheme were being developed at the same time. This included preparing the Business Case itself, the design of the Scheme and how it would actually operate in practice, and guidance notes for those wishing to apply.

- As with all schemes at the time, it is accepted it was not possible to delay payment until all checks to eliminate all risk of fraud and error and ensure maximum value for money, had been carried out. Some of these would have to be carried out post payment.

- This Scheme was successful in its aim of getting funding to the sports sector to ensure some of the losses incurred, because of the restrictions, were mitigated. Sports organisations should be in a healthier position to enable a return to full operation, in the near future.

- However, our work has identified some concerns which are now clear in hindsight and which may have been due in part to the pace at which the Scheme had to be deployed. These concerns include:

-

- No consideration of the existing financial position of organisations or risk of closure

- The Business Case set out a number of options for how the Scheme would operate. One of the shortlisted options (Option 3 – the survival option) would have taken account of the amount of reserves held by each organisation so that only the minimum grant was paid in order for the sports organisation to survive. However Option 3 was not chosen. Instead the chosen option (Option 2 - net losses) was to compensate for net losses and unavoidable costs due to COVID-19.

- In this option, the Business Case noted the aim was not simply to award funding because income had been lost, but rather to evaluate the costs that organisations had to meet to avoid administration. However, we did not see any evidence of what consideration had been given to whether funding was necessary to avoid administration, in either the rules for the Scheme or in the assessment process.

- We also noted that, while it may not have been intended, in some cases, the impact of the Scheme was to underwrite previous average profits. For

example in the largest payment made to a club, to Royal County Down Golf Club, figures provided as part of its application showed that the average annual profit in the three years to the end of 2019 was £657,000. In 2020-21 it projected a loss of £905,000 because of COVID-19. The grant payment made to it under SSF was £1,562,000 which not only paid for its projected loss for the year but returned it to the same profit level as in previous years. This would have been similar in some other clubs who had made profits between 2017 and 2020. We do not think that underwriting of profits, in effect, is appropriate for public spending.

- One of the key features and outcomes of this Scheme, as set out in the Business Case, was targeting financial need. This was defined as net losses due to COVID-19 which would result in cash flow difficulties thus leading to the imminent risk of closure. However the imminent risk of closure was not considered by DfC or SNI to be an assessment criterion for the Scheme and therefore it was not a part of either the application or assessment process.

- There was also no requirement in the Scheme to consider reserves or bank balances held by sporting organisations before paying the grants. DfC has provided a number of explanations for this, including the difficulty of assessing the liquidity of various reserves held by a large number of organisations within a very short period, as well as a desire not to penalise organisations which had been prudent over several years.

- As part of our work we selected a small number of grant claims for more detailed testing. One of these was Royal County Down Golf Club, which we selected as it was the largest single grant payment to a club, amounting to

£1.562 million which is about 6.8% of the total amount of SSF paid in Northern Ireland. In this case we found it had been paid in line with the rules set for the Scheme as it compensated for the loss of substantial green fee income. However, we also noted the accounts submitted by Royal County Down Golf Club as part of its application, showed it had a very significant bank balance and a high level of reserves at the end of December 2019. It appeared to us that the club would clearly not have been under severe financial pressure as a result of COVID-19 restrictions. As the consideration of reserves and bank balance was not part of the Scheme assessment criteria, other sports clubs and governing bodies may also have been in this situation.

- Finally we also received information relating to the grants provided to Crusaders Football Club. In this case it was suggested that Crusaders’ grant had included a substantial amount to compensate them for a loss of European income despite not having qualified for Europe in the COVID-19 year. This was partially correct as the accounts for the previous three years that were submitted with the grant application included an average of around £470,000 as income from European Competition. However the scheme only compensates for net losses and the club have pointed out that there would also have been a significant amount of expenditure incurred on participation in European competition and this was not separately identifiable in the accounts that were submitted. Therefore while the club have received some funding under the scheme in respect of European Competition that it had not qualified for, it is not possible to say how much this was without further analysis.

-

- Other sources of government COVID-19 funding may not have been recorded

- Applicants for grants under the Scheme were required to disclose any other sources of government COVID-19 grant funding so that this could be deducted from any amounts due under SSF. Sporting bodies could have received funding from a range of sources such as the Localised Restrictions Support Scheme (LRSS), Business Support Grants and the furlough scheme. At the time the grant applications were evaluated, this was not something which was checked by Sport NI. DfC has said this was a conscious decision due to the short time available to get funding out to the sector and because many COVID-19 support schemes were being run at the same time. SNI has confirmed it intends to retrospectively complete a review of applications before the end of June 2021 and this could result in clawback of grant, if necessary.

-

- Northern Ireland and the Republic of Ireland appear to have provided considerably higher COVID 19 support to sporting organisations than in the rest of the UK

- All jurisdictions provided support of one kind or another to sporting organisations who lost income due to COVID-19. Our analysis of grant support to sporting organisations, provided by each sports council, per head of population, shows that the level of support in Northern Ireland

was similar to the Republic of Ireland but considerably higher than in England, Scotland and Wales.

-

- There was no cap on the amount that could be paid to sporting organisations or clubs

- DfC and SNI considered that a cap on individual awards to governing bodies or clubs was not required. This was because they thought a cap would have made it more difficult to ensure a diverse range of sporting interests could have been supported.

- We found that other jurisdictions operated their Schemes differently by, in many cases, dividing funding into `pots’ of support, so that grants could be concentrated on key areas. This was not done in Northern Ireland and in practice this appears to have mainly benefited the golf sector. For example, in England the total pot allocated to golf was limited to

£2.55million which, when it was allocated, amounted to £10,000 per club. Similarly, in the Republic of Ireland1 the total for golf was €2.8 million which meant a maximum of €25,000 for any one club. Scotland did not fund the golf sector at all as the governing body did not apply and in Wales £110,000 was given to 31 community clubs, with the largest single award being £5,000. In Northern Ireland the amount received by Golf Ireland was £4.2 million which was shared among 25 golf clubs, with four receiving in excess of £250,000 including one receiving £1.562 million.

Sports’ Sustainability Fund Introduction

- In response to the COVID-19 pandemic, Sport NI (SNI) launched a number of Schemes to help support sports clubs and governing bodies. In addition to the Sports Sustainability Fund (SSF), sporting bodies could apply to the Sports Hardship Fund (£2.3million) and the COVID Safe Sports Pack (£0.8million) Fund. Further details of these Schemes are included in Appendix 1. The main scheme examined in this report is SSF. It allowed for funding of up to £25 million to be provided to the sports sector. The actual funding paid to sports clubs and governing bodies under the Scheme was £23million2.

- The Department for Communities (DfC) has said that the COVID-19 package of support that was available for sporting organisations was developed and designed in a highly dynamic and fluid environment. Both itself and SNI faced challenges around the availability of data, timescales and resourcing. Schemes were developed urgently to support organisations during restrictions to help overcome immediate and longer term challenges.

- The Department for Communities (DfC) prepared the Business Case and rules for this Scheme within a tight timeframe due to the perceived urgency for funding in the sports sector. The Minister met with the various sports bodies in mid-October 2020; the first £15million of funding was approved by the Executive through the October monitoring round; the remaining £10million was allocated to DfC in November and was officially included in its budget in the January monitoring round; and the Scheme was formally launched by the DfC Minister on 3rd December 2020. Applications closed on 20th January 2021 and, following review by SNI, payment of the grant awards were made from the end of February 2021 onwards.

- The Business Case was noted by the Minister on 16 November 2020 and it set out the overall aim of the Scheme as:

“… to ensure that the sports sector in NI, representative of the diverse range of sporting interests for all its citizens, and of geographic spread, remains in place after the COVID-19 crisis has passed. The COVID-19 Sports Sustainability Fund will support this aim by providing financial support to sports Governing Bodies, clubs and sporting entities who:

- Have lost income and opportunities to generate income due to the restrictions put in place by the Executive to control COVID-19;

- Have continued to provide opportunities to spectate at events (in limited numbers) or through the broadcasting of events which have been played behind closed doors; and

- Have net losses that will lead to financial stress resulting in significant challenges of being able to cover unavoidable costs until 31 March 2021.”

Scheme Development

- DfC prepared the Business Case, whilst SNI fed into it but was mainly involved with separately designing the Scheme. DfC and SNI have said that from the beginning of the lockdown restrictions in March 2020, they were both in regular contact with governing bodies and so their views were considered as part of the Business Case and also in the design of the Scheme. A timeline of the Scheme is given at Appendix 2.

- Details provided in the Business Case of the estimated need are listed in Appendix 3. The estimated need shown here (£19million) was based on actual figures received by SNI from the larger governing bodies. Through its discussions with a selection of governing bodies throughout the year, DfC and SNI believed the total estimated need was approximately £25m. However it was also recognised that the environment in which the sports sector was operating was uncertain and the future direction of restrictions was difficult to predict. It is notable that Golf Ireland, which ended up being the third largest beneficiary of the SSF Scheme, did not feature in this list of estimated need.

- The Business Case included seven options (a list of which is at Appendix 4). These were subsequently reduced to three shortlisted options:

- Option 1: Do nothing;

- Option 2: Net loss and unavoidable costs scheme for governing bodies and clubs. The Business Case notes this option was “to address financial hardship and not simply award funding to sports organisations because they have lost

income. This option seeks to evaluate in a proportionate way the costs which the sports organisations must meet to avoid administration.”

- Option 3: Survival Scheme. The Business Case said this Scheme would “provide the minimum amount of financial stimulus that the sports organisations need to survive. Payment to cover the shortfall in funding needed to cover unavoidable costs would permit sports organisations to retain up to three months’ worth of reserves where all other funding sources have been exhausted (including reserves in excess of what is needed to cover three months’ worth of expenditure).”

- The assessment of the options concluded that both Options 2 and 3 would cost at least £25million. DfC believed there was a possibility that the Scheme may be over subscribed and that the total level of loss in the sector could exceed

£25million. Option 2 (the net loss scheme), DfC believed would have greater non-monetary benefits (Appendix 5) and so it was the preferred Option. In our view, Option 3 (the survival Scheme) was likely to have been the cheaper of the two options because it considered the existing reserves of the organisations.

However this was not taken into account in the Business Case which judged both options equal on cost. DFC has noted, due to the timeframe available, Option 3 would have had to rely on governing bodies and clubs self-assessing the minimum of finance needed and the level of reserves required to cover three months’ expenditure. This would then have necessitated additional post payment checking by SNI to verify the self-assessment. In terms of the non- monetary benefits, Option 2 was chosen because:

- It was felt this option would put the sports sector in a better position to aid the recovery out of COVID-19, for example, clubs would be better able to contribute to the health and wellbeing of society. Whilst Option 3 would do this too, it was felt this would not be to the same extent.

- It was also believed that when lockdown restrictions were lifted, Option 2 would allow clubs to meet the immediate needs of their current membership and to be in a position to grow their membership. Option 3 would not provide for this development but would have to focus attention on the immediate needs of current members, with little ability to grow.

- Finally, DfC felt that Option 2 would allow sports clubs to contribute to community relations, as in pre-COVID times. Option 3, with less money, would require clubs to re-prioritise activities, resulting in a reduced ability to contribute to community relations work.

- According to the Business Case, Option 2, the net loss scheme, was intended to identify the costs that sports organisations needed to meet to avoid administration rather than award funding for lost income. However we could see no evidence that the possibility of administration was considered as a criterion. DfC believes that this option was the one which would sustain the sector and enable it to play a vital role in getting Northern Ireland active again as it emerges from COVID-19.

Scheme Administration

- It was decided that, due to its existing expertise in awarding and paying grants, the Scheme itself should be administered by SNI on behalf of DfC.

- The Scheme was set up so that:

- It was open to all recognised3 governing bodies and their affiliated clubs and organisations4.

- SNI assessed every governing body’s own claim and all applications from clubs where there were 14 clubs or fewer. After this, it sampled applications from clubs, aiming to cover 20 per cent of the value and number of claims. If errors were found, the sample was extended. The only clubs not 100 per cent assessed were those affiliated to Cricket Ireland, Irish Football Association (IFA) and Swim Ulster. In terms of monetary value, 95 per cent (£21.9million) of the total awards were assessed.

3 The governing body must be on the UK Recognition List, per the UK Recognition Policy as implemented by UK sports councils. The governing body or club must also be able to provide three years’ financial information.

4 As all governing bodies and clubs could apply then the Scheme did not cause any concerns in respect of section 75, however see the section on communication - paragraphs 50-52

- Some of the key figures and features within the grant scheme included:

|

Point |

Key Facts and Figures |

|

* |

582 claims were submitted to the Scheme. |

|

* |

A total of just over £23m was awarded. Appendix 6 shows the breakdown of the £23m over the governing bodies (including their affiliated clubs/organisations). |

|

* |

Of the total amount awarded, £5.1m was given to 22 governing bodies with 430 clubs/organisations receiving £17.9m. |

|

* |

The largest single club award was £1.562m to Royal County Down Golf Club (around 6.8% of the total grant awarded). |

|

* |

No sport was to receive priority consideration; all would be considered equally. The £25m budget was not divided up into separate ‘pots’ for specific sports with higher profiles. |

|

* |

All affiliated clubs and organisations had to submit their claims to SNI via their governing body. |

|

* |

The governing body was responsible for sense checking the information, amalgamating all claims it had received together with its own claim and submitting that to SNI. |

|

* |

Grants were to be awarded through SNI, based on an evidenced demonstration of need. |

|

* |

Payments were made to governing bodies to cover their own claim and that of each of their affiliated clubs/organisations. |

|

* |

Governing bodies then had five days to pass on grant funding to each affiliated club/organisation. |

|

* |

All amounts awarded to governing bodies and their affiliated clubs/organisations have since been published on the SNI website. |

Demonstration of Need and the Assessment Process

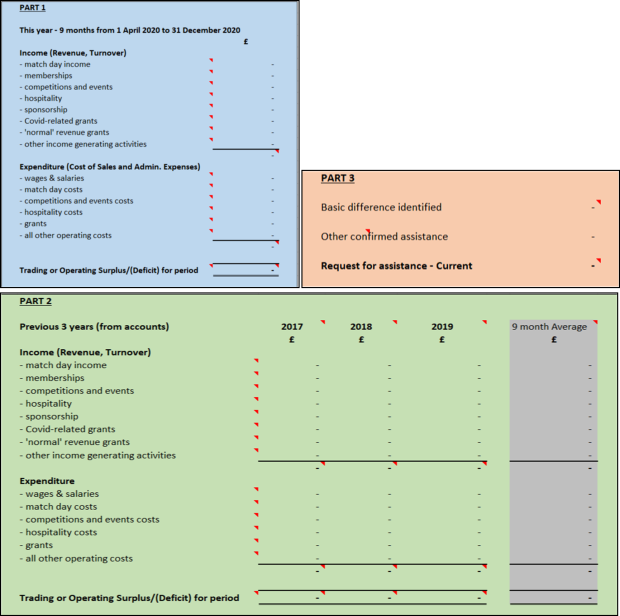

- The need of each club/governing body for grant funding was assessed via the completion of an application form which looked at trading/operating expenditure and income from the three years’ accounts prior to COVID-19. From this, the income and expenditure for an average pre–COVID-19 year was calculated. This information had to come from the body’s accounts (which did not have to be audited but did have to be approved5). Any club/governing body which did not produce accounts and had not been in existence for three years prior to 2020 could not apply to the Scheme as DfC/SNI did not believe need could be properly assessed. The accounts supporting the application form had to be submitted with it.

- Each body also had to provide information for the first nine months of the 2020-21 financial year, together with a projection for the final three months, if grant was needed for this period. Both sets of figures should have been approved via a management committee or similar. This split provided SNI with a mechanism to ensure that the overall £25million funding ceiling was not breached. This meant that grants would be awarded based firstly on the nine months figures and then, if there was sufficient funding left over, the final three months of the year would be considered.

- The average year referred to in paragraph 23 was then split pro rata into nine and three months respectively and compared to the corresponding figures for the 2020-21 COVID-19 year. From this comparison, the loss or the `need’ for grant could be calculated. This was then the amount paid to the governing bodies/clubs.

- Applicants for these grants were required to declare any other COVID-19 funding received. However SNI has said that it was not possible to carry out checks to identify that all COVID-19 support had been declared (apart from its own Hardship Scheme) before the payments were made. This was because information was not always easily available or was not up to date on databases such as the Government Funding Database. The letter of offer for the grant

5 `Approved’ meant having gone through the normal process for producing accounts. This could range from audited accounts being presented and accepted at an AGM through to accounts produced by a treasurer and being approved by members.

makes specific provision for the grant to be clawed back if any information provided by the claimants is found to be incorrect. Checking is to be done by data matching with other Schemes offering COVID-19 support such as Localised Restrictions Support Scheme/Business Support Grant Scheme/furlough and by reviewing the Government Funding Database. This review is expected to be completed by the end of June 2021.

- We were aware that the Department for the Economy’s (DfE) Business Support Grant Scheme, which closed in May 2020, had paid £25,000 to a range of applicants. We obtained details of these grants and found that 76 sports clubs which had claimed grants under SSF had also received £1.9m under the Business Support Scheme. From this, we selected a sample of 10 out of the 76 to check if they had correctly deducted this support from their SSF claim and found that all 10 had done this correctly. Despite this, we consider that SNI should have sought this list from DfE before it made the grant payments under its SSF Scheme. It is important that this is checked for all clubs/governing bodies as part of SNI’s forthcoming review. DfC has highlighted that the application form did have a declaration signed by two officials which confirmed that:

- They had read and understood the guidelines and criteria and agreed to comply with them in full.

- All information provided as part of the application process was truthful and accurate.

- They had fully disclosed all relevant facts and information and would notify SNI of any material changes in circumstances which may impact on the application.

Imminent risk of closure and viability

- The Business Case lists a number of what are called key features and outcomes. These are listed at Appendix 7 and include that the Scheme was to:

“Deliver a Sustainability Fund Scheme that targets financial need, defined as net losses as a direct result of COVID-19 and face significant challenges to cover unavoidable costs with sports organisations experiencing significant reductions

with income, facing ongoing fixed/operational costs and therefore experiencing cash flow difficulties leading to the imminent threat of closure.”

- The issue of what is meant by the `imminent threat of closure’ has been discussed in the media and also by the Communities Committee at its hearing on 1 April 2021. DfC has explained it did not consider this term to be an assessment criterion. Rather, it considered that the provision of grant funding to sporting bodies, at this time, was a way to try and avoid clubs and governing bodies either not surviving at all or not being in a position to open properly when restrictions were lifted, which may subsequently lead them to close.

- DfC highlighted information provided on Northern Ireland sporting bodies from an organisation called Sported6, who published research in September 2020 suggesting;

“that more than three out of four sports organisations are not confident that they will exist in six months’ time – this has risen from one in four before COVID-19.”

- Whilst DfC does not consider the `imminent threat of closure’ to be an assessment criterion, the Business Case also noted under consideration of the

`Viability’ of the Scheme that:

`A key risk to achieving Value for Money (VfM) is the potential for financial support being provided to sports clubs or organisations which are likely to close anyway. In this context, it will be important to ensure that the funding Scheme for the sports sector includes a proportionate assessment of an organisation’s viability to ensure that public funds are not wasted on supporting an organisation that is likely to fail even with the support. Each organisation that applies for grant funding will be subjected to a financial evaluation to ensure that they were viable before the crisis began…the process will examine financial accounts to ensure that grants awarded under this Scheme go to organisations that are likely to remain in existence.’

6 Sported is a charity which is UK based and provides expertise, resources and support to organisations involved in the development of sport. It has 221 members in NI and the membership is not limited to sporting clubs but includes organisations such as community groups, youth clubs etc. https://sported.org.uk/our- work/what-we-do/where-we-are/northern-ireland/

- Having reviewed and considered the application and assessment process outlined above, it is not clear how any judgment on existing and continuing financial viability was made.

Other Sources of Funding

- In considering whether the SSF Scheme would displace funding available from elsewhere, the Business Case lists the possible sources of funding which might be open to clubs and governing bodies and states:

“Appropriate declarations will demonstrate that all reasonable steps have been taken to protect the financial health of the sporting organisation including applying for other sources of funding”.

It goes on to say that all non-government sources of funding should be exhausted before SSF grant is awarded. However, the declarations signed as part of the SSF application process do not include the positive declaration required above. (See Appendix 8 for copy of blank application form). It is therefore unclear how assessment of the SSF applications considered the above requirement. DfC has said that for the vast majority of applications the funding provided will have been fundamental for sustaining either the governing body or the club and will represent a position whereby all other sources of COVID-19 funding have been exhausted. In the time available to SNI, DfC believe it would have been very difficult to complete individual assessments but it is acknowledged that for the significant claims, a more detailed analysis in this area would have been beneficial, including an explicit declaration to this effect.

Requirement to consider the Additionality of the Scheme

- In considering the additionality of the Scheme, i.e. what would happen if this funding were not available, the application and assessment process detailed in the Business Case sought to establish:

- “The appropriate amount of funding that is needed to sustain an organisation that has accumulated net losses as a direct result of COVID-19 and face significant challenges to cover unavoidable costs up to 31 March 2021.

- The extent to which the sports organisation has put in place credible measures to adapt their services and mitigate the loss of income.

- Other sources of finance that may be available to the organisation to cover the shortfall.”

- The first bullet point above requires that funding goes to organisations facing significant challenges in covering unavoidable costs. It is unclear to us how this was assessed as part of the application process. Some clubs and governing bodies will have had sufficient resources to cover their unavoidable costs due to lockdown restrictions. This is examined later in this report.

- Regarding the second point and the work that was done to check whether credible measures were in place to mitigate losses, it appears that this was not something that was specifically checked as part of the application process. Instead, DfC and SNI relied on declarations made by a senior post holder in each organisation as part of the grant application.

- Finally, the third point above looks at the potential for other sources of finance to mitigate the loss. As part of the application process, clubs and governing bodies were required to include other sources of funding they had received relating to COVID-19 from wherever they had been received. This would include other grants/loans/furlough which were then taken into account when determining the level of grant to be awarded. However as already discussed, no cross checking to other sources of government funding was carried out prior to the calculation of the awards.

Use of Reserves

- Another important issue when considering `additionality’ is whether organisations which already have significant reserves or bank balances need the same extent of additional funding, as they could be expected to use their reserves before receiving any public monies. This matter was considered as part of the Business Case, in which one of the three shortlisted options required bodies to use all reserves, apart from the equivalent of three months essential expenditure, before claiming any grants under the SSF Scheme. This particular option was not chosen and one of the reasons was the difficulty of assessing what three months of essential expenditure looked like in a way that was fair and transparent.

- The Business Case also noted:

“The existence of reserves and a reserves policy is a sign of prudent financial and resource management and may be indicative of a resilient organisation, such organisations may be better placed to cope with unforeseen shocks and financial concerns Sports organisations that have put time and resources into

developing reserves and policy surrounding this may feel they are being disadvantaged for their prudent resource management if support is focussed on those sports organisations that have shown less concern for the development of adequate reserves.”

- SNI and DfC have also stated that reserves which a club or governing body might show in their accounts might not be useable, for example, some may be restricted in terms of how they can be used or may not be readily transferable into cash. They have said that this difficulty and the lack of time available to financially assess each and every organisation in terms of its reserves when there was considerable pressure to get funding out to the sports sector, meant that an assessment of reserves was not possible.

Review of Grants Awarded

- In order to assess the application and vouching process, we selected a sample of claims covering a range of criteria. Please see Appendix 9 for the sample selected and the rationale for each. The sample selected included two claims that had been the subject of considerable public interest.

- As noted above, this club received the largest grant of any individual club of

£1.562 million. The original application was for £1.7 million and was reduced upon assessment by SNI because it identified a non-recurrent tax refund included in the 2018 year. The basis of the grant claim was mostly due to lost green fee income. This is a considerable source of revenue to the golf club in normal years and usually comes from tourists in the area. Our review of the club’s application showed that it had considerable reserves and a large bank balance at December 2019. Although this was not considered by DfC/SNI to determine how much grant should be awarded, it appears unlikely to us that

the club would have been under any serious financial pressure to March 2021, even given the substantial loss of green fee income.

- As with all grant applications under the SSF Scheme, the claim was based on identifying the net loss projected for 2020-21 compared to the average over the previous three years. In Royal County Down Golf Club’s case, its claim to SNI showed it had made an average annual profit of £657,000 from 2017 to the end of 2019 but projected a loss of £905,000 in 2020-21 due to the impact of COVID-19 restrictions. The grant payment made to it of £1,562,000 not only covered the projected loss but also returned the club to its average profit level of £657,000.

- The methodology used by the SSF Scheme of compensating for net losses means this will be the same for all clubs or governing bodies who had made profits in the previous three years. While we accept that the Scheme was not set up specifically to underwrite the profits of clubs, this is what has actually happened in some instances. We do not think it is appropriate for public money to be spent in this way.

Cycling Ireland

- Cycling Ireland originally submitted a claim for £400,000 covering itself and 121 clubs. However it failed to follow the required guidance and did not use the application form nor supply appropriate supporting documentation. The initial figure claimed was merely an estimate based on lost income as opposed to net losses. SNI queried this and allowed Cycling Ireland to amend the details and to resubmit the application form. This resubmitted claim had to be adjusted so that it only covered the Northern Ireland members and resulted in £14,600 being paid to Cycling Ireland.

- We examined a further four claims and did not find any issues with the application and assessment process, although some benefitted, on a much lesser scale, from the profit underwriting issue referred to above. Each of these was found to have been processed in line with the Scheme rules.

Crusaders Football Club

- During the course of the audit we became aware of information relating to the grant awarded to Crusaders’ Football Club. The information raised concerns surrounding the treatment of European competition income in the application and assessment process. The club was awarded a grant of £540,241 and in its application it included the income it had received through qualifying for European competition in the three years preceding COVID-19. This income averaged at just over £474,000 per year.

- However the scheme only compensates for net losses and the club have pointed out there would have been a significant amount of expenditure incurred on participation in European Competition. This expenditure is not separately recorded in the accounts of the club and therefore it is not possible to calculate, without further analysis, what the grant paid to the club in relation to the net loss from European income was. SNI believes it is likely that the expenditure incurred would largely offset the competition income earned and so would have had little impact on the overall grant awarded.

- SNI told us that the issue of what might be thought of as novel or non-recurrent income and expenditure was considered but as it was a highly subjective matter and in order to ensure consistency and objectivity it was decided not to exclude anything such as competition income/prize money/broadcasting rights etc. The possibility of being compensated for net income lost from competitions which clubs had qualified for in the years before the COVID-19 year, but had not done so in that year, does not solely relate to Crusaders, but potentially may also impact on other clubs in various sports.

Communication of the Scheme

- The various governing bodies and the Northern Ireland Sports’ Forum had been in ongoing discussion with DfC and SNI since the initial lockdown in March 2020. Between the time just before launching the Scheme and its closure, SNI hosted five online governing body workshops to answer any questions they may have had on the Scheme. It was always envisaged that the governing bodies would be the key source of communication between SNI and clubs.

- In addition, SNI:

- provided a contact email address for any questions about applications;

- worked closely with DfC so that external messaging was consistent, clear and timely; and

- produced guidance notes and frequently asked questions.

- All communications were either by phone or online because of the pandemic. This did raise a concern that people in rural areas or in an older demographic might have been indirectly discriminated against by not having the awareness of the Scheme in the first place or the financial and technological knowledge to complete an application for their club. However SNI has said that it is satisfied that the sporting sector has a strong technological knowledge and younger age base, demonstrated by the fact that the Chief Medical Officer and the Department of Health sought SNI’s support to get the safe COVID-19 messages out to the general public through the sports sector. There is no evidence of clubs not being able to access this fund or any other sports COVID-19 funding scheme due to lack of access to technology or technological knowledge. SNI has recognised that there may possibly be some rural disparities and have said it is working collaboratively with other funders in the DfC family to close any gap which may have arisen during COVID-19.

Comparison with Other Jurisdictions

- As part of the design and development of SSF, both SNI and DfC have said they communicated regularly with counterparts in other jurisdictions and considered the various approaches taken by them. However, Schemes were being developed and devised at the same time in all parts of the UK and so they could not wait to see how they worked in practice. At the Communities Committee on 1st April 2021, SNI Chief Executive also stated that the Scheme designed for Northern Ireland had to be specific to the evidenced need on the ground.

- Appendix 10 contains details of the Schemes in place in other jurisdictions (including those administered by Sport Ireland) which have been funded solely via additional funding from each region’s sports council. A calculation of the additional support provided in each area by head of population (excluding any loan elements) is shown in Figure 2 below.

- The level of support through additional COVID-19 grant funding, on a per head basis, is very similar between Northern Ireland and the Republic of Ireland. However the support is much greater than in Wales and Scotland and hugely greater than in England. We have only included grant funding in this analysis and deliberately excluded loan funding as this will eventually have to be repaid by the sports bodies receiving it. In particular we note that Sport England provided £250million of loans and this has not been included in the table above.

- Whilst the above is a high level comparison of the Covid-19 response to Sports organisations within the different jurisdictions, DfC and SNI believe it is not possible to undertake any form of robust analysis due to the differences between the jurisdictions. Some of these differences they note are:

- Different jurisdictions focus on different sports, for example, gaelic games is widespread in Northern Ireland and the Republic of Ireland but not in the other jurisdictions.

- Historic governance complexities regarding how sports are organised, i.e. all Ireland, UK-wide or Northern Ireland only basis.

- All other jurisdictions also have larger populations and this brings with it economies of scale and also, it feels a more mature level of professionalism in some sports, than in Northern Ireland. This may have meant that governing bodies/clubs could rely more on paid employees rather than volunteers and so may have been able to avail of the furlough scheme to a greater degree than their Northern Ireland counterparts.

- Lastly, the restrictions were not the same in all areas.

Consideration of a Cap on the Level of Award

- The overall aim in the Business Case was to “ensure that the sports sector in NI, representative of the diverse range of sporting interests for all its citizens, and of geographic spread, remains in place after the COVID-19 crisis has passed”. With that in mind, the Department and SNI did consider setting a cap on individual awards to governing bodies or to clubs. However, they felt that introducing a cap for funding would have been extremely difficult to administer given the:

- Diverse nature of the eligible field.

- Range in the estimated level of financial losses that the various governing bodies and clubs were articulating at the time. The range of governing bodies included the very biggest to the smallest. In terms of clubs, the scheme aimed to cover the needs of grassroots clubs, large amateur organisations and full time professional entities including Ulster Rugby and the Belfast Giants.

- On the basis of the information available at the time, DfC and SNI believed that setting an appropriate upper limit would have led to some organisations receiving insufficient funding to be sustained. The largest payments were made to the three largest governing bodies i.e. IFA (£1.7million), IRFU (£1.5million) and GAA (£1.45million) and would have been well in excess of any cap which would have been set.

- Also, by the 23rd November the Scheme had a budget of £25million which was roughly equal to the value of losses that governing bodies believed the sports sector as a whole would face, should a scheme not be introduced. The Business Case did note that if the value of the applications turned out to be greater than the budget, then awards would have been limited to the net losses of the first nine months of 2020-21. As all governing bodies and their affiliated clubs could apply, it was believed this would ensure a spread of grant funding over all sports in need and also over the whole of NI. This was an outcome set out in the Business Case. DfC also highlighted that funding had to be distributed quickly, transparently and fairly to bodies. Appendix 11 contains some further analysis of the spread of funding over Northern Ireland counties.

- While other jurisdictions ran their sports support schemes differently from each other, the amount of funding was typically split into a number of ‘pots’ of

support for individual sports with funding concentrated on key areas. This was not done in Northern Ireland. In practice these pots meant that the amounts which could be received by individual clubs in those sports was limited. This decision appears to have significantly benefited golf. In Northern Ireland, 25 golf clubs and the governing body shared a total of £4.2 million under this Scheme, with four clubs receiving in excess of £250,000 and one receiving

£1.562million. In the other jurisdictions, golf received the following:

- In England £2.55million was allocated to golf with a maximum of £10,000 for any one club.

- In the Republic of Ireland7 the total pot available was €2.8 million with a maximum of €25,000 each.

- In Wales a total of £110,000 was awarded to 31 golf clubs and almost

£65,000 to the governing body for golf. The largest single award to a club was £5,000.

- In Scotland no grant funding was provided to golf. All grants were awarded to governing bodies and to clubs via their governing body. The governing body for golf in Scotland did not apply for funding.

Post Programme Review

- The Business Case requires that a ‘Programme Evaluation Review’ be carried out. This will be done by SNI and will include a lessons learned report and the results of a survey which is to be carried out of the sports sector. This will aim to assess the success of the Scheme in light of its overall objective. A Post Project Evaluation will also be carried out by an independent person appointed by SNI. This stage should be completed by the end of September 2021.

7 In the Republic of Ireland a scheme from Failte Ireland allows for a grant to individual ‘tourism golf courses’ of 7.5% of green fees lost up to up to €200,000 less any funding already received under other schemes.

Conclusions

- This was an important Scheme, ensuring that the significant losses incurred by sports in Northern Ireland were addressed and that sport, with its huge health and societal benefits, would be in a position to continue after the COVID-19 pandemic.

- The Scheme had to be developed and rolled out in a short time period. The funding was not approved through the Executive until the end of October and November, while the Scheme design started at the beginning of October. There was, therefore, insufficient time to perfectly refine the scheme and any delay for refinement may have prevented its aims being met. The Scheme is an example of partnership working between a sponsor Department and its Arms-Length Body, with DfC having the overall lead and keeping overall responsibility, whilst drawing on the expertise of SNI for designing and administering a grants Scheme to a sector it knows well. The end recipients, as represented by governing bodies, were involved in advance and throughout, to try and devise a scheme that would achieve its aim.

- There are however, some matters around an apparent disconnect between the requirements of the Business Case and how the Scheme has operated. These include:

- The Business Case included as a key feature and outcome that the Scheme would prevent clubs having to face the ‘imminent risk of closure’. Whilst we accept that this was not described as an assessment criterion, it does seem to have been one of the objectives of the Scheme. The Business Case highlights that the assessment process would ensure that funding went only to bodies who were financially viable before the pandemic and who were likely to remain so afterwards but again it appears that this was not assessed.

- The Business Case also notes that governing bodies/clubs should have exhausted all other forms of COVID-19 funding before receiving SFF however it is not clear how this was confirmed.

- The Business Case considered three shortlisted options. One of these, which was not selected, was to set the scheme up to provide the minimum stimulus

that the sports bodies needed to survive. It would have limited any grant to the shortfall in funding needed to cover unavoidable costs while permitting them to retain up to three months’ worth of reserves. This option was not selected, mainly because the non-monetary benefits of the preferred option were greater. In reaching this decision, DfC worked on the assumption that this option and the preferred option would both use up the total funding available of £25million. It is not clear how this assumption was reached as it seems to us that the option to provide the minimum stimulus to survive would have been cheaper.

- The decision was taken at the outset of the scheme not to set aside funding for certain key sports but rather to allow all sports who could demonstrate losses, to be treated equally. This was a critical decision, and not one followed in other jurisdictions where they limited the amounts that could be granted to certain sectors which would have had a corresponding impact on the amounts which would have been paid to individual clubs. In Northern Ireland. Golf has been a particular beneficiary of this decision, with four clubs receiving in excess of £250,000 when the maximum received in other parts of the UK or the Republic of Ireland was much less.

- The scheme was set up to provide funding to cover net losses. The outcome of this for some sporting bodies has been to ensure that profits made in previous years have been maintained in the COVID-19 restricted year. While we believe this is an unintended consequence of the Scheme, we consider it to be inappropriate for the public sector to underwrite profits in this way.

- It was not possible to check claims prior to payment to ensure that account had been taken of other government funding that clubs had already received. In particular, our analysis has shown that 76 sports clubs received £1.9million from the DfE’s Business Support Grant Scheme in May 2020 and then received support from SSF. While these applicants may have declared these grants as part of their application, this was not something that was checked by SNI at the time the grants were paid, even though this information would have been available. SNI have said that data matching is to be carried out against all sources of government funding before the end of June 2021 and if any claims have been overpaid then it will be possible to claw back monies. It is important that this happens.

Appendix 1 (Para. 11)

In addition to SSF, SNI provided the following COVID 19 support to sports bodies:

- £2.3m Sports Hardship Fund

-

- Over 1,600 applications to the Sports Hardship Fund. Following assessment of eligibility, SNI has now distributed small grants (up to

£3,000) to around 915 sports clubs and community sport organisations, with around 430 of these clubs applying for the ‘top up’ award of

£1,000, totalling almost £2.3m and representing 48 different sports; and

- £0.8m Covid Safe Sports packs

-

- Providing practical support to sports clubs and community sports organisations in response to a need identified by them in the Build Back Better stakeholder survey (May 2020). SNI has undertaken a major procurement exercise (approx. £1m) to distribute equipment packs to sports clubs to assist them in managing a safe re-opening of and return to sports facilities and sports’ participation. More than 1,289 sports clubs & organisations have applied, representing 54 different sports.

Appendix 2 – Timeline of the Sports Sustainability Fund (Para. 15)

|

Date |

Event |

|

23 March 2020 |

Northern Ireland enters a national lockdown. All sporting activities ceased |

|

14 April 2020 |

Sports Hardship Fund launched |

|

19 October 2020 |

DfC Minister met with over 70 senior representatives from a broad range of governing bodies and sporting organisations and heard at first hand the concerns that they all had for their individual sports |

|

26 October 2020 |

The Department began drafting the SSF Business Case |

|

29 October 2020 |

The NI Executive agreed a £15m fund as part of the October Monitoring Round, to be used to support the sports sector |

|

05 November 2020 |

Sports Hardship Fund application window ended |

|

11 November 2020 |

DfC wrote to SNI confirming availability of £15m budget for the SSF and that they should ensure full spend of this budget by 31 March 2021 |

|

11 November 2020 |

First Governing Body SSF Workshop held – 80 GBs signed up to attend |

|

13 November 2020 |

Original Business Case approved by the Senior Responsible Officer, Deputy Secretary at DfC, which was for funding up to £25m but reflected that only £15m had been secured at this point |

|

16 November 2020 |

Submission to Minister seeking her agreement to the Sports Sustainability Fund and the plans to continue to provide support via the Sports Hardship Fund |

|

16 November 2020 |

Ministerial approval given to first Business Case |

|

23 November 2020 |

An additional £10m was allocated to this fund in November and was then formally included in DfC’s budget through the January Monitoring Round. Bringing the total funds available for the SSF to £25m |

|

03 December 2020 |

Date of Ministerial announcement |

|

04 December 2020 |

The £25m Sports Sustainability Fund is launched |

|

04 December 2020 |

Second Governing Body SSF Workshop held – 76 GBs signed up to attend |

|

09 December 2020 |

Third Governing Body SSF Workshop held – 61 GBs signed up to attend |

|

06 January 2021 |

Fourth Governing Body SSF Workshop held – 44 GBs signed up to attend |

|

13 January 2021 |

Fifth Governing Body SSF Workshop held – 14 GBs signed up to attend |

|

20 January 2021 |

Closing date for SSF applications |

|

21 January 2021 |

V2 of the Business Case approved by the Senior Responsible Officer, Deputy Secretary at DfC (NB: Only difference between V1 and V2 was the addition of £10m funding to bring the total funding available to £25m) |

|

25 February 2021 |

DfC Minister announced that the first funding awards from the SSF had been issued |

|

03 March 2021 |

SSF Awards list published on Sport NI website |

*Note that DoF approval was not required and the Business Case was not considered by the Communities Committee, although there was of course other correspondence on the Scheme.

Appendix 3 - Breakdown of the anticipated £25m loss in the Business Case (Para.16)

|

Governing Body |

Anticipated Loss per Business Case £ |

|

IRFU Ulster Branch |

5,970,000 |

|

IFA |

4,000,000 |

|

NIFL |

3,566,752 |

|

Ulster Council GAA |

3,414,467 |

|

Cricket Ireland |

1,312,337 |

|

Ice hockey UK |

1,200,000 |

|

2&4 Wheels Motorsport Steering Group |

200,000 |

|

Ulster Hockey |

30,000 |

|

Ladies Gaelic Football Association |

25,000 |

|

Netball NI |

14,025 |

|

Total |

19,732,581 |

Appendix 4– Options included in Business Case (Para. 17)

- Scope Option 1 - Status Quo/Do Nothing: do not provide an SSF Scheme to assist organisations impacted by the pandemic.

- Scope Option 2 - Net Loss and Unavoidable Costs Scheme for Governing Bodies and Clubs Facing Financial Hardship: payment to cover net losses as a direct result of COVID-19 which result in significant challenges to cover unavoidable costs. Governing bodies and clubs will be required to evidence financial need based on net loss and unavoidable costs, and will demonstrate efforts made to exhaust all other funding sources resulting in financial stress.

- Scope Option 3 - Survival Scheme: payment to cover shortfall in funding needed to cover unavoidable costs and permit sports clubs to retain up to three months’ worth of reserves where all other funding sources have been exhausted (including reserves in excess of what is needed to cover three months’ worth of expenditure).

- Scope Option 4 - Flat Rate Hardship Payment: flat rate payment available to all organisations that have lost income and are facing financial hardship as a result of the pandemic.

- Scope Option 5 - Income Replacement Scheme: payment to replace percentage of donations and/or trading income lost by organisations as a result of the pandemic.

- Scope Option 6 - Provision of Interest Free Loans to meet Ongoing Revenue Expenditure: provision of an interest free loan to help organisations cover the cost of ongoing revenue expenditure.

- Scope Option 7 - Provision of Financial Capability Advice: provision of financial capability advice to help sports organisations make effective decisions on the use of funds.

Appendix 5 - Non-Monetary Benefits (para 18)

|

Benefit / Cost criterion |

Weighting |

Explanation of Weighting |

Option 2 |

Option 3 |

|

Contributes to addressing the need for support to sports organisations that suffered financial losses during lockdowns and periods of restriction. |

30% |

This will be crucial in ensuring that sports can remain viable and sustainable during the lockdown period. It is vital that society has continued access to sporting services and provision which does not rely on or be readily provided by the state. |

24 |

15 |

|

Makes significant contribution to making lives better by contributing to the health and wellbeing of society. |

30% |

The overall impacts of COVID-19 and associated restrictions and lockdowns have yet to be quantified. Sport will play a key role in the health and wellbeing recovery of society both during and accelerated after the pandemic passes. |

24 |

15 |

|

Enables sports organisations to plan for increasing participation and physical activity across NI for the benefit of local communities. |

20% |

With organisations able to meet core costs to keep their sector viable, it will allow them to plan programmes and physical activity opportunities to commence as soon as restrictions are lifted. |

16 |

8 |

|

To contribute towards improved community relations and cohesion between clubs and communities. |

20% |

With clubs able to focus on the community support effort during the COVID-19 pandemic, they will be able to strengthen their role and raise their profile within their community. This has the potential to attract new members and participants to their sport in the aftermath of the pandemic. |

16 |

8 |

|

|

100% |

|

80 |

46 |

Appendix 6 – Detail of Governing Body Awards (Para 22)

Appendix 7 - Key Features and Outcomes of the Scheme as contained in the Business Case (para. 28) The key features of the Scheme and its outcomes are as follows:

-

- Ensure that, as far as possible, the range of clubs and organisations within the sports sector that currently exists here, survives through the current COVID-19 crisis and is there to support participation in sport and physical activity post the pandemic.

-

- Provide financial relief to sports governing bodies and clubs to ensure they remain viable once the current health crisis passes.

-

- Provide timely financial intervention to prevent the potential closure of sports clubs and organisations that are at risk due to COVID-19 restrictions.

-

- Ensure that financial interventions complement rather than duplicate other national and regional support packages.

-

- Ensure that funding is distributed quickly through a transparent and evidence based process that complies with NICS financial management guidance.

-

- Put cost control measures in place to ensure the Scheme’s affordability is within its current allocation of £25 million.

-

- Agree an equitable process for fund allocation where demand for financial support exceeds the available funding.

-

- Deliver a Sustainability Fund Scheme that targets financial need, defined as net losses as a direct result of COVID-19 and face significant challenges to cover unavoidable costs with sports organisations experiencing significant reductions with income, facing ongoing fixed/operational costs and therefore experiencing cash flow difficulties leading to the imminent threat of closure.

Appendix 9 – Sample Examined (Para. 41)

|

Sample No. |

Governing Body |

Club |

Amount Awarded £ |

Rationale for selection |

|

1 |

Golf Ireland |

Royal County Down |

1,562,452 |

Largest club award and subject of media scrutiny |

|

2 |

British Gymnastics |

Excel Gymnastic CIC |

0 |

No financial need demonstrated, per the programme guidelines. |

|

3 |

Cycling Ireland |

Cycling Ireland |

14,518 |

Award substantially less than requested and subject of a "Raising Concerns" communication |

|

4 |

Irish Football Association |

Irish Football Association |

1,715,431 |

Largest governing body award |

|

5 |

Ulster Council GAA |

Kilcoo Owen Roe's GAC |

45,057 |

GAA club that received 110% more than requested |

|

6 |

IRFU Ulster Branch |

Donaghadee RFC |

34,316 |

Rugby club that received 214% more than requested |

Appendix 10– Sport Covid 19 Funding in other parts of the UK and Ireland provided through sports councils (Para. 54)

The table below shows only additional COVID 19 spend provided only through the individual sports councils. Some jurisdictions also provided flexibility in the use of their normal annual spend. Details below were checked with the relevant sport body in each jurisdiction.

|

SPORT ENGLAND |

|

|

* |

Sport England is actively involved in the Department for Digital, Culture, Media and Sport’s £300m winter support package for major spectator sports i.e. rugby union, horse racing, netball, basketball, badminton and the lower tiers of football’s National League.

Of the £300m, only £50m is in the form of grants, with the remainder being loans. Department for Digital, Culture, Media and Sport solicited clubs, rather than clubs applying. |

|

* |

Figure 2 data Population: 56.3m Additional Covid Support: £50m £ per head of population: £0.89 |

|

SPORT SCOTLAND |

|

|

* |

August 2020: £1.5m Covid Recovery Support Fund for Governing Bodies. |

|

* |

December 2020: £55m emergency sports funding package to tackle lost ticket revenue during the pandemic. The funding comprised grants and low-interest loans. This was for targeted sports listed below:

This brings the total support package to £56.5m; excluding loans this is £31.5m |

|

* |

Figure 2 data Population: 5.5m Additional Covid Support: £31.5m £ per head of population: £5.73 |

|

Sport Wales |

|

|

* |

April 2020: Emergency Relief Fund (£200,000 from the Welsh Government and £400,000 from Sport Wales) giving £600,000 in total. This was for storm Ciara flooding and initial COVID 19 impact support. £525,000 was provided as COVID 19 support. |

|

* |

July 2020: Be Active Wales Fund distributed £4m (mix of public and lottery funds) in two Schemes. It was aimed at `not for profit’ sports clubs and organisations including |

|

|

voluntary and community groups, charitable trusts and regional bodies, all of which must deliver or enable sport/physical activity. There were two streams:

|

|

* |

September 2020: A £14m funding package was announced. Of this, £2m was aimed at clubs. |

|

* |

January 2021: a £17.7m Spectator Sports Survival Fund was announced. The funding is Covid related, due to loss of income, and is additional funding from the Welsh Government to sport.

This brings the total support package to £24,225,000. |

|

* |

Figure 2 data Population: 3.2m Additional Covid Support: £24,225m £ per head of population: £7.57 |

|

SPORT IRELAND |

|

|

* |

June 2020: Department for Tourism, Transport and Sport in Dublin announced a support package for the sports sector of €70M consisting of four separate allocations:

|

|

* |

November 2020: Additional €15m for GAA, Camogie, Ladies Gaelic Football Championships specifically for the running of the Inter-County Championships

This brings the total support package to €85m. |

|

* |

Figure 2 data Population: 4.9m Additional Covid Support: £73.42m £ per head of population: £14.98 |

|

NORTHERN IRELAND |

|

|

* |

Figure 2 data Population: 1.9m Additional Covid Support: £26.1M £ per head of population: £13.74 |

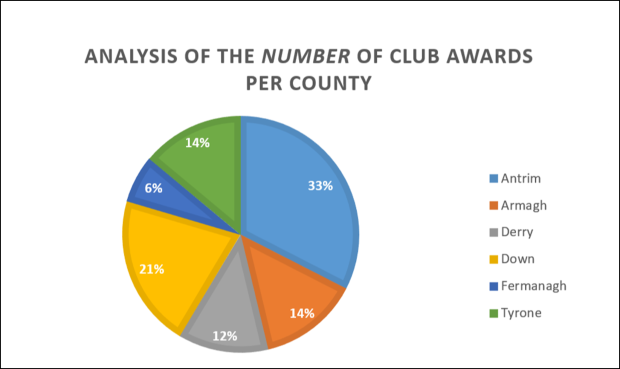

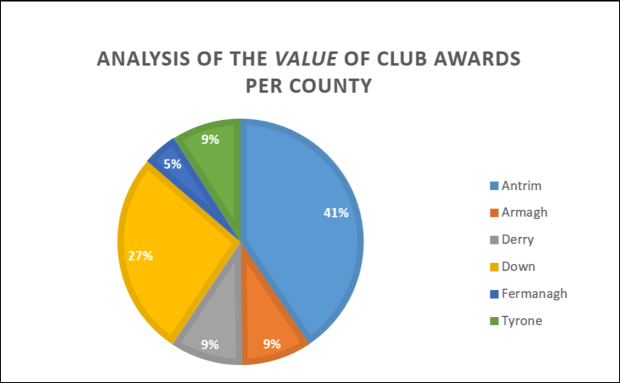

Appendix 118– Analysis of Club Awards per County (Para. 59)