List of Abbreviations

BSO Business Services Organisation

C&AG Comptroller and Auditor General

DfC Department for Communities

DfI Department for Infrastructure

GRO General Register Office

LPA Lone Pensioner Allowance

LPS Land and Property Services

NFI National Fraud Initiative

NIAO Northern Ireland Audit Office

NIHE Northern Ireland Housing Executive

RTI Real Time Information

SRO Senior Responsible Officer

UK United Kingdom

VAT Value Added Tax

Foreword

Preventing and detecting fraud is a challenge for all organisations, including the public sector. It is essential that organisations in receipt of public money do all that they can to minimise losses to fraud, in order to maximise the proper use of funding for public services. It is not possible to eradicate fraud but we must do all in our power to minimise its impact.

Under statutory powers inserted in the Audit and Accountability (Northern Ireland) Order 2003 by the Serious Crime Act 2007, I undertake data matching exercises for the purpose of preventing and detecting fraud. These powers have strengthened the fight against fraud. The main data matching tool I use is the National Fraud Initiative (NFI), administered by colleagues in the Cabinet Office.

This is the sixth NFI exercise to be undertaken in Northern Ireland and outcomes to date are almost £40 million, representing current and past fraud and error stopped and potential future fraud averted.

This achievement would not be possible without the efforts of the participating organisations in Northern Ireland who review and investigate data matches in order to detect fraud and error. I thank all those involved in this important work. The results speak for themselves.

Nationally, outcomes from data matching through the NFI stand at almost £2 billion, demonstrating the continuing value of this cross-jurisdictional exercise. I continue to work collaboratively with the Cabinet Office and participating organisations to ensure that the value and impact of the NFI is maximised.

An emerging challenge is the fraud risks associated with the Covid-19 pandemic and I will engage positively with NFI colleagues to ensure that data matching can be used to best effect to address these risks.

Kieran Donnelly CB

Comptroller and Auditor General

NFI Headlines 2018 – 20

213% increase in NFI outcomes compared with the previous reporting period

£5.5 million actual or estimated savings in total

1,200 removals from GP register

£2.7 million estimated cost avoidance for health service

44 properties recovered for reallocation to households in need

£1.6 million estimated savings on temporary accommodation and other costs

261 cases of rates evasion identified

£935,000 of rates arrears recovered and future rates evasion averted

1,482 concessionary travel passes cancelled

Risk of fraudulent use averted

NFI Overview

How the NFI works

The National Fraud Initiative (NFI) is a major data matching exercise undertaken every two years, administered by the Cabinet Office. It compares data from over 1,200 organisations across England, Scotland, Wales and Northern Ireland, making the NFI a powerful counter fraud tool which gives local organisations access to data that they would not otherwise have. This report summarises the recently-completed sixth exercise to be undertaken in Northern Ireland.

Participating organisations submit a range of datasets where there has been proven fraud in the past, for example: payroll; pensions; trade creditors; housing tenants; blue badges; concessionary travel passes; private supported care home residents; and domestic rates. Data matches highlight inconsistencies which could indicate fraud, but the existence of fraud or error can only be determined by investigation. The NFI risk-scores the data matches, helping organisations to prioritise their work. Organisations are not expected to investigate all matches but should base their work on a fraud risk assessment and knowledge of key fraud risks.

Examples of the types of matches undertaken include:

|

Data match |

Potential fraud or error |

|---|---|

|

Payroll to payroll |

Employee working elsewhere while on sick leave |

|

Pensions to death records |

Pension fraudulently or erroneously paid where a pensioner has died and pension administrator has not been notified |

|

Rates to electoral register |

Person(s) registered to vote at an address that is not listed for rating purposes |

|

Private supported care home residents to death records |

Care home continuing to receive payments after a resident’s death |

Participation

Bodies whose accounts are audited by the Comptroller and Auditor General (C&AG) or a local government auditor may be required to participate in the NFI. Other bodies may participate on a voluntary basis. Over 80 organisations from across central government, local government and the health sector participated in the current exercise. See Appendix 1 for a full list of participants.

Organisations participating in the current exercise received their data matches in January 2019 and had over 12 months to complete planned investigations. Outcomes from incomplete investigations will be captured and reported as part of the next NFI exercise.

Interpretation of outcomes

Monetary outcomes for an organisation indicate that fraud or error has been found and that controls may need to be strengthened. Organisations which have few matches, or find no fraud or error in the matches they investigate, can take positive assurance that their internal control environment is operating effectively. Participation in the NFI can be used to inform an organisation’s Annual Governance Statement.

The NFI can also help to identify non-monetary outcomes, such as errors or inaccuracies in an organisation’s data, which might increase the risk of fraud in the future. Examples include incorrect national insurance numbers or duplicate creditor references. The NFI provides the opportunity for such errors and inaccuracies to be rectified.

Data protection and data security

Data protection and data security are fundamental to the NFI. A Code of Data Matching Practice ensures compliance with data protection legislation. The Code lets individuals know why their data is being matched, the standards that apply and where they can find further information. The C&AG has statutory authority to data match and does not require the consent of the individuals concerned.

The NFI uses a secure web-based application for the transmission of data and for the accessing of matches by the participating bodies. The NFI’s systems are accredited to handle, store and process information up to the restricted classification level.

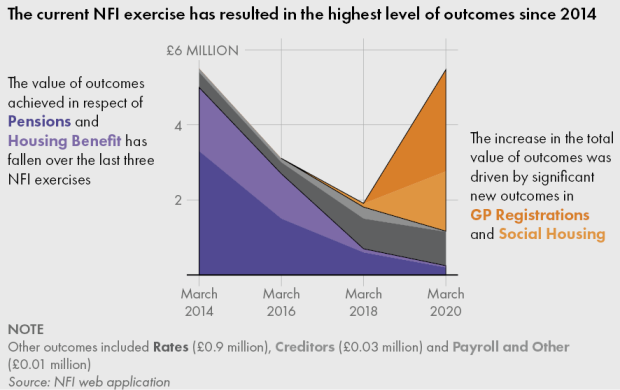

Summary of outcomes in Northern Ireland

Between 1 April 2018 and 31 March 2020, outcomes for the NFI in Northern Ireland were over £5.5 million, compared with almost £1.8 million in the previous exercise (an increase of just over 200 per cent). The increase is mainly attributable to a pilot exercise in relation to GP registrations (see page 16), and a new data match between housing tenants and care home residents who are funded, in whole or in part, by the health and social care trusts (see page 17).

The total figure comprises actual outcomes of £714,000 and estimated outcomes of £4.8 million (Appendix 2 explains how estimated savings are calculated).

Total NFI outcomes for the six NFI exercises to date in Northern Ireland are almost £40 million (see Appendix 3).

NFI Outcomes 2018 – 2020

GP patient registrations (pilot) – £2,736,913

Purpose of matching

- A pilot data match for the Business Services Organisation (BSO), which administers GP patient registrations, matched a group of high risk registrations with a range of social security benefits, in order to confirm residency in Northern Ireland (and, thereby, entitlement to publicly funded health and social care services).

- Those not in receipt of a benefit were flagged as high risk in a report to the BSO in late 2017. The BSO commenced work on these high risk cases in early 2018, following them up in line with normal BSO protocols to confirm residency. This work is still ongoing.

Outcomes

- To date, 1,202 people have been removed from the GP register as a result of this pilot.

- The BSO applies a “cost avoidance” figure to each person removed from the register, based on the annual average cost per head of health services in Northern Ireland for the relevant period.* Applying this estimate (see Appendix 2), outcomes from the pilot currently stand at £2.7 million.

* Sources:

Country and Regional Analysis, HM Treasury, November 2018, Table B8 https://www.gov.uk/government/statistics/country-and-regional-analysis-2018

Country and Regional Analysis, HM Treasury, November 2019, Table B8 https://www.gov.uk/government/statistics/country-and-regional-analysis-2019

GP patient registrations – Case example

The individuals removed from the GP Register as a result of the pilot were confirmed as not entitled because:

- they had already failed the economic footprint screening process adopted by the BSO; and

- they were NOT in receipt of a benefit; and

- they responded to BSO’s letters issued as a result of the pilot, but were unable to provide sufficient proof of entitlement; or

- they did not respond to BSO’s letters and no new address was identified; or

- removal was requested by the GP.

Source: Business Services Organisation

Social housing tenancies – £1,589,280

Purpose of matching

- The NI Housing Executive (NIHE) owns and manages the majority of social housing in Northern Ireland (around 86,000 properties). Its tenancy data, plus that of one registered housing association, was included in this NFI exercise.

- Data matching can detect tenancy fraud by identifying where a person appears to be resident at two properties and one property may be occupied unlawfully.

- As a pilot exercise, the NIHE’s tenancy data was also matched to health trusts’ care home residents data (cases where the trusts fund or part-fund care), to identify where a tenant had moved into long-term care, allowing the NIHE to confirm proper succession of the tenancy, or recover the property if appropriate.

Outcomes

- The NIHE was able to recover 44 properties as a result of the pilot data match to trust-supported care home residents. The estimated outcomes figure for these recovered properties is £1,589,280 (see Appendix 2).

- The pilot exercise helped the NIHE to identify other individuals living at properties and enabled staff to proceed with successions, assignments and change of tenancies where there was sufficient information to support these. This helps ensure that tenancy records are accurate and up-to-date, thereby reducing the risk of tenancy fraud.

- In addition, the NIHE has strengthened its policy and procedures when investigating cases where tenants have been admitted to care, and is revising and updating its Data Sharing Agreement with the health trusts.

Social housing tenancies – Case examples

A data match highlighted that an NIHE tenant was in a care home. Housing staff carried out thorough investigations to determine the tenant’s status and established that the tenant was determined to be a permanent resident in care in August 2019. A termination of tenancy was obtained in September 2019 and the property was recovered. As result, the property was re-let in October 2019 to a household on the waiting list.

A data match highlighted that an NIHE tenant was in a care home. Housing staff carried out thorough investigations to determine the tenant’s status and established that the tenant was determined to be a permanent resident in July 2019, but sadly passed away whilst investigations were being completed. The investigations continued, to establish if anyone else was residing in the property, and an application for succession of tenancy was made by the tenant’s elderly and vulnerable sister who had been residing with her for a significant amount of time. The relevant Housing Benefit department was notified and the tenancy was succeeded from August 2019. The data match helped the NIHE to deliver good housing management and ensure that the change in tenancy was actioned in a timely manner.

Source: NI Housing Executive

Domestic rates – £935,000

Purpose of matching

- Rates are a property tax based on the valuation of a residential property and payable by the occupier (or landlord in certain circumstances).

- Rates records are matched to the electoral register to identify:

- properties where someone is registered to vote but the property is not registered for rates

- properties marked as vacant on the rating system yet someone is registered to vote at the address.

- Lone Pensioner Allowance (LPA) gives a 20 per cent rate rebate to people aged 70 or over who live alone. LPA records were matched to death records, electoral records and state pension records to determine whether the award of LPA was still valid.

Outcomes

- 135 cases of rates avoidance were detected, with outcomes (including estimated forward savings) totalling almost £858,000.

- 126 cases of incorrect award of LPA were detected, with outcomes (including estimated forward savings) of almost £78,000.

Domestic rates – Case examples

NFI data matching identified a property which was not on Land and Property Services’ (LPS) rating system. A bill has been issued to recover outstanding rates dating back to 2014, amounting to £18,820. Repayment of the outstanding amount commenced in March 2020.

The NFI identified a property of which LPS was unaware. A bill was issued to recover outstanding rates dating back to 2015, amounting to almost £16,000. The amount was repaid in full in December 2019.

NFI data matching identified a property which was marked as vacant on LPS’s rating system but at which someone was registered to vote. Outstanding rates dating back to 2014, and amounting to almost £10,500, are in recovery.

An NFI data match showed that a recipient of Lone Pensioner Allowance had died in 2017 but LPS was not aware of the death. Overpayment of allowance of almost £800 has been recovered from the person’s estate.

Source: Land and Property Services

Pensions – £176,000

Purpose of matching

- Pension information is matched to deceased records (known as mortality screening) to detect where the pension paying authority is not notified of the death of a pensioner and so a pension continues to be paid. Six public sector pension paying bodies submitted pensions data for mortality screening.

- Pension records are also matched to payroll records to identify cases of pensioners returning to work without notifying the pension paying body, thereby possibly avoiding a reduction (abatement) in pension.

Outcomes

- Mortality screening revealed 10 cases of fraud or error resulting in outcomes of just over £171,000, including estimated forward savings.

- One pension abatement case was identified, with outcomes of just over £5,000.

Pensions – Case examples

A pensioner died in May 2018. The pension administrator only became aware of the death upon review of an NFI data match in May 2019. Overpayment of pension amounted to £13,242. The overpayment was fully repaid in October 2019.

An NFI data match released in January 2019 showed that a person who retired on age grounds in 2017 had been re-employed in the same sector. The pension administrator only became aware of the Annual Earnings Limit being breached via the NFI data match. The overpayment of pension amounted to £5,247 and is being recovered through deductions from on-going pension payments.

Source: A pension administrator

Housing benefit – £48,000

Purpose of matching

- People on low incomes may receive housing benefit. Fraud and error can occur when calculations are based on inaccurate information, for example where:

- the claimant does not declare a source of income; or

- the claimant does not declare a change of circumstances, e.g. additional residents at the address.

- The NFI matches housing benefit records to a range of datasets, including public sector payroll and pensions, student loans and housing tenancies, in order to detect inaccuracies.

- The NI Housing Executive (NIHE) administers housing benefit for those who rent their homes; the Department of Finance (Land and Property Services) administers housing benefit for those who own their homes.

Outcomes

- Housing benefit outcomes reduced significantly after NIHE housing benefit fraud investigation transferred to the Department for Communities (DfC) in 2017. The DfC uses Real Time Information (RTI) from employers and pension providers as its main focus for housing benefit investigations. The Department of Finance continues to use NFI data for investigation purposes.

- Student loans information available through the NFI remains an important data source for housing benefit investigations.

- The current exercise has identified 32 cases of housing benefit fraud, error and overpayment totalling just over £48,000.

Housing benefit – Case examples

A data match between housing benefit and payroll revealed an overpayment of housing benefit to a client, due to undeclared income, of almost £700. An adjustment to weekly benefit has been made and estimated forward savings (see Appendix 2) in this case are £402.

Source: Department of Finance

A data match on address between housing benefit and payroll revealed an overpayment, due to an undeclared partner, of over £900. Weekly benefit has been adjusted and estimated forward savings in this case are £425.

Source: Department of Finance

A data match between housing benefit and housing tenants revealed a person who was in receipt of housing benefit at a private address but was also an NIHE tenant at a different address. Overpayment of housing benefit was almost £850. Estimated forward savings in this case are almost £500.

Source: Department of Finance

A data match between housing benefit and student loans revealed an overpayment of housing benefit to a client of almost £3,500, due to student loan income not being declared. The overpayment has been recovered and an adjustment made to weekly benefit. Estimated forward savings in this case are £1,221.

Source: NI Housing Executive

Procurement and trade creditors – £31,000

Purpose of matching

- NFI data matching between payroll, Companies House data and trade creditor records helps to detect links between staff on an organisation’s payroll and companies with which the organisation trades. Matches may reveal undeclared conflicts of interest which have resulted in a financial advantage to the staff member or someone with whom they are closely connected.

- Trade creditors’ data matching can also help organisations to identify duplicate payments and incorrect VAT calculations, and highlight cases where system improvements or “housekeeping” are required, for example the removal of duplicate creditor reference numbers.

Outcomes

- One case of an undeclared interest was identified. The organisation updated its register of interests accordingly and confirmed that the person had not acquired any financial advantage from the undeclared interest.

- Organisations also identified six duplicate payments totalling almost £31,000. In a further 95 cases, action has been taken to correct non-monetary errors, such as a duplicate creditor reference number. Such corrections reduce the chance of fraud and error occurring in future.

Procurement and trade creditors – Case examples

- A non-departmental public body detected two duplicate payments totalling £24,072. The money has been recovered from the relevant suppliers.

- A government department detected two duplicate payments totalling £5,106. All the money was recovered in December 2019.

- In December 2019, a local council detected two duplicate payments (to the same supplier) totalling £1,614. The money was recovered from the supplier in February 2020.

Source: NFI web application

Social housing waiting list

Purpose of matching

- The social housing waiting list for Northern Ireland is maintained by the NIHE. The waiting list was matched to housing tenants, housing benefits and deceased records to detect undisclosed tenancies and undisclosed changes of circumstances.

Outcomes

- There have been no removals from the waiting list as a result of the current NFI exercise (there were 17 removals in the previous exercise).

- Following the last exercise, the NIHE recognised the need to strengthen verification processes before adding someone to the waiting list. Work has been ongoing in this area and has included:

- recruitment of large numbers of new staff, with a concurrent transformation of how housing needs/homelessness assessments are conducted;

- a significant training programme to ensure all frontline housing staff are fully trained to deliver housing/homelessness assessments;

- completion of two audits, both of which had satisfactory outcomes but made recommendations for further improvements, all of which are in the process of being implemented or are already implemented; and

- a review of the content of training courses for frontline staff, placing further emphasis on verification processes and enhanced recording of relevant verification details.

- The NIHE is not able to confirm at this stage whether there is a positive correlation between the changes made and the lack of removals from the waiting list due to NFI data matches in the current exercise. However, the process improvements are likely to have been a contributing factor and demonstrate the value of the NFI in encouraging qualitative improvements to systems to prevent future fraud or error.

Concessionary travel passes and blue badges – £281

Purpose of matching

- Concessionary travel passes are administered by Translink and are issued to a number of eligible groups, such as people aged 60 and over. Details of travel pass holders are matched to death records to identify cases where a pass is still in circulation, and could therefore be used fraudulently, after the death of the pass holder.

- Blue badges are administered by the Department for Infrastructure (DfI). A blue badge entitles the holder to concessions such as use of parking spaces designated for blue badge holders and free on-street parking in “pay and display” areas. Blue badge holder records are matched to death records to identify badges which are still in circulation, and could therefore be used fraudulently, after the death of the registered badge holder. The NFI also matches Northern Ireland blue badge data with blue badge records from England, Wales and Scotland, to identify cases where a person may be holding more than one badge.

Outcomes

- Data matching identified 2,628 travel passes still active after the death of the pass holder, but only 11 of these had recorded actual usage after that date (amounting to £281). Translink was already aware of 1,146 of the total cases through receipt of monthly information from the General Register Office (GRO) and had cancelled the passes. It cancelled the remaining 1,482 passes by the end of January 2019.

- Data matching identified 6,812 blue badges still in circulation after the death of the badge holder, a 16 per cent increase on the previous exercise. The increase is due to a data upload error, where deceased cases which should have been excluded from the upload were actually included. All 6,812 badges have been flagged on the DfI’s database as “not for automatic renewal”, meaning the badge is effectively cancelled. The DfI examined a 10 per cent sample of the matches and found 75 cases where the date of death was not previously known. No issues of fraud were found.

Payroll – £10,700

Purpose of matching

- The NFI matches payroll data across all participating organisations to identify cases of employment fraud, in particular:

- employees working for one body while on long-term sick leave from another; and

- employees with two jobs where shift patterns overlap, so that it would not be possible to cover both jobs.

Outcomes

- No cases of payroll fraud or error were identified in the 2018–19 NFI matches but one match from the previous exercise resulted in late outcomes, included in this reporting period, of £10,700. An overpayment occurred as the result of incorrect dates being used in the contract of a person working across two health trusts. The person has repaid the amount in full.

- Inclusion of public sector payroll data in the NFI can contribute to housing benefit outcomes. Of the 32 housing benefit cases with outcomes (see page 21), 14 were as a result of undeclared income by a public sector employee or their co-habiting partner.

Private supported care home residents

Purpose of matching

- Health trusts may contribute to the care home fees of older people. If care homes fail to notify trusts, either fraudulently or erroneously, that a resident has died, payments may continue after the date of death of the resident. The NFI matches trusts’ private care home payment records to death records, to help identify such cases.

Outcomes

- No cases of fraud or error have been detected in the current exercise.

Getting the best out of the NFI

Best practice tips for your NFI work

The NFI is intended to help you as an organisation in your fight against fraud. It is not intended to be an administrative burden. To make sure this is case, the following tips will ensure you get best value from your efforts:

Roles and responsibilities

- The Senior Responsible Officer (SRO) should nominate an appropriate Key Contact

- The Key Contact should have the necessary time and commitment to ensure NFI work is started and progressed in line with the suggested timetable

- SRO and Key Contact should agree the approach – what reports and matches to focus on, how to sample matches for review. This may be agreed with the Audit Committee

- SRO and Key Contact should agree a timetable for completing the work

- Users must have a good knowledge of the business area they are investigating (payroll, creditors etc.)

- Users should be familiar with the latest guidance and on-line training videos, to ensure effective working

Investigating matches

- Prioritise key reports and higher risk matches

- Use the report comment facility to record your intended approach

- Follow up matches promptly so that fraud and error can be stopped at the earliest opportunity

- Work within the secure web application – this streamlines the process, allows information to be shared easily and ensures data security

- DO NOT investigate every match. Use a risk based approach

- Periodically review shared comments from other organisations and respond appropriately to any queries

Recording and reporting

- Users should record short but informative comments on matches within the NFI web application; this allows the SRO, Key Contact, NFI Coordinator and auditors to determine progress easily

- Use the report comment facility to record a comment for multiple matches where appropriate, rather than entering the same comment numerous times. This saves time and effort in processing matches

- All outcomes, both quantitative and qualitative (e.g. national insurance number corrections), should be recorded in the comments and outcomes boxes

- Use outcomes to make informed system improvements e.g. strengthening controls

- SRO should report progress and outcomes (including nil outcomes) to senior management, the Board and the Audit Committee

- Take positive assurance from having few matches and no monetary outcomes

- Use the outcome of your NFI work to inform your Annual Governance Statement

Compliance by participating organisations

The NIAO monitors progress by participating organisations against best practice, to help ensure they are getting the best out of the information provided and to encourage progress where necessary. A formal review of progress at the end of November 2019, 10 months after matches were released, rated organisations’ practice as High Risk, Medium Risk, or Low Risk (see Appendix 4 for details). This showed that over 80 per cent of participating organisations had made good progress and were considered low risk:

High Risk: 2 organisations

- No reports opened or data matches processed 10 months after match release

- No clear timetable in place to review and investigate matches

- Internal issues in these organisations diverted time and resources away from the NFI

Medium Risk: 13 organisations

- Not all key reports were opened 10 months after match release

- Low number of matches processed

- High risk matches not prioritised

- Comments/queries from other organisations not being responded to

Low Risk: 64 organisations

- Work commenced promptly after match release

- Key reports and higher risk matches prioritised

- Clear and informative comments recorded for matches reviewed

- Outcomes clearly recorded

- Report comment facility used appropriately to record a comment for multiple matches

- Shared comments from other organisations reviewed and responded to as appropriate

- Clear arrangements for internal reporting of the NFI exercise

NIAO staff raised key issues with those organisations categorized as red or amber. By March 2020, most had made further and adequate progress.

Examples of good practice

Examples of good practice within participating organisations include:

- a planning document setting out proposed approach to the review of data matches – prioritisation, sample sizes, officers responsible etc.;

- a steering group which oversees progress on NFI work and reports to the Audit Committee; and

- provision of regular progress reports to Audit Committee and senior management.

The NFI – looking forward

Covid-19 fraud risks

The coronavirus pandemic and the resulting emergency measures put in place, for example the payment of business support grants, have increased the opportunities for fraudsters. The need to expedite payments may mean normal due diligence controls are not fully implemented.

The NIAO will work with NFI colleagues to promote the use of data matching as a means of preventing fraud, by way of up-front checks and detecting fraud through post-payment checks. Organisations have already been offered the opportunity to access additional checks on bank account verification and company status in relation to business support grants.

Cabinet Office NFI Strategy

The Cabinet Office, which runs the NFI, has identified the following key objectives for the period to 2022. The NIAO will contribute to these objectives, where appropriate, in relation to local organisations.

NFI Strategy Objectives

- Improve targeting of existing and new fraud risks

- Improve communication and engagement with users, to better understand and meet customer need

- Increase both the volume and frequency of data that is used in, or accessed through, the NFI

- Embrace new technologies and techniques to improve existing, and develop new, products

- Secure the extension to legislative purposes to increase the usage and impact of the NFI

NFI products

AppCheck is an NFI product that can be used in application-based processes to check details provided, and flag any inconsistencies that might suggest fraud, at the point of application. This can help organisations prevent fraud entering the system. AppCheck has been trialled in Northern Ireland in relation to housing benefit and housing tenancy applications. The NIAO will continue to work with organisations to identify possible opportunities for AppCheck to be adopted as a counter fraud measure.

NFI pilot exercises

The value of pilot data matches has been clearly demonstrated in this current NFI exercise, with the majority of outcomes resulting from two successful pilots. The NIAO will continue to explore options for new pilot exercises with relevant organisations.

Acknowledgement

Once again the NIAO is indebted to the Cabinet Office NFI team and their data processors for their invaluable help and support for the process in Northern Ireland.

Appendix 1 Participating bodies

Northern Ireland Departments:

Department of Agriculture, Environment and Rural Affairs (DAERA)

Department for Communities

Department for the Economy

Department of Education

Department of Finance (DoF)

Department of Health

Department for Infrastructure (DfI)

Department of Justice

The Executive Office

Public Prosecution Service (non-ministerial)

Executive Agencies:

Forest Service (inc. in DAERA)

Driver and Vehicle Agency (inc. in DfI)

Northern Ireland Environment Agency (inc. in DAERA)

Northern Ireland Statistics and Research Agency (inc. in DoF)

Northern Ireland Guardian ad Litem Agency

Northern Ireland Medical and Dental Training Agency

Labour Relations Agency

Youth Justice Agency of Northern Ireland

Forensic Science Northern Ireland

Northern Ireland Courts and Tribunals Service

Public Health Agency

Legal Services Agency Northern Ireland

Other central government bodies:

Education Authority

Land and Property Services (inc. in DoF)

Invest Northern Ireland

Northern Ireland Assembly

National Museums Northern Ireland

Northern Ireland Council for the Curriculum,

Examinations and Assessment

Northern Ireland Fire and Rescue Service

Northern Ireland Housing Executive

Tourism Northern Ireland

Arts Council of Northern Ireland

Sport Northern Ireland

Livestock and Meat Commission

Agri-Food and Biosciences Institute

Libraries NI

Council for Catholic Maintained Schools

Construction Industry Training Board

Ulster Supported Employment Ltd

Belfast Metropolitan College

South West College

South Eastern Regional College

Southern Regional College

Northern Regional College

North West Regional College

General Consumer Council

Health and Safety Executive

Commissioner for Children and Young People NI

Equality Commission Northern Ireland

Strategic Investment Board

Probation Board for Northern Ireland

Northern Ireland Authority for Utility Regulation

Community Relations Council

Stranmillis University College

Northern Ireland Local Government Officers’ Superannuation Committee

Health Services Bodies:

Business Services Organisation

Health and Social Care Board

Belfast Health and Social Care Trust

Northern Health and Social Care Trust

South Eastern Health and Social Care Trust

Southern Health and Social Care Trust

Western Health and Social Care Trust

Northern Ireland Social Care Council

Regulation and Quality Improvement Authority

Northern Ireland Blood Transfusion Service

NI Ambulance Service HSS Trust

Local Government Bodies:

Antrim and Newtownabbey Borough Council

Ards and North Down Borough Council

Armagh City, Banbridge and Craigavon Borough Council

Belfast City Council

Causeway Coast and Glens Borough Council

Derry City and Strabane District Council

Fermanagh and Omagh District Council

Lisburn and Castlereagh City Council

Mid and East Antrim Borough Council

Mid Ulster District Council

Newry, Mourne and Down District Council

Arc21

Voluntary participants:

Northern Ireland Audit Office

Translink

Northern Ireland Water

Choice Housing

Victims and Survivors Service

Appendix 2 Formulae for calculating outcomes, including forward savings

|

Dataset |

Basis of calculation |

|---|---|

|

Housing benefit |

Value of fraud or error detected plus forward savings calculated as the weekly benefit reduction multiplied by 21 weeks. |

|

Housing tenants |

Total estimated figure per recovered property in NI is £36,120, based on the annual cost of providing temporary accommodation for the displaced tenant, plus an estimate of other costs such as legal costs and the cost of restoring the property. |

|

Social housing waiting list |

The estimated figure for removal of a person from the waiting list is based on the annual cost of temporary accommodation, the likelihood of future losses due to fraud and the period of time the fraud may have continued without NFI intervention. The figure is £1,440 per person removed from the list. |

|

Pensions |

Cabinet Office formula: annual pension multiplied by the number of years until the pensioner would have reached the age of 85. |

|

Creditors |

Value of overpayments. |

|

Rates |

Value of fraud or error detected plus forward savings calculated as the average annual rates bill (£1,000) multiplied by 2. For Lone Pensioner Allowance, the forward savings are (£1,000 x 2 x 20%) for each case, as LPA gives 20% relief. |

|

Payroll |

Value of overpayments, plus £5,000 per case where an employee is dismissed or resigns, or £12,000 per immigration case (estimated amounts based on future losses prevented where a fraudulent employee resigns or is removed from post). |

|

Procurement |

Value of contract cancelled and invalid payments prevented. |

|

Private supported care home residents |

Value of fraud or error detected plus forward savings calculated as 13 weeks x average weekly cost (£544), rounded down to £7,000. |

|

GP patient registrations |

Estimated saving is “cost avoidance” figure – annual cost per head of medical services in NI, (Sources: HM Treasury Country and Regional Analysis, November 2018 and November 2019) 401 removals x £2,195 plus 801 removals x £2,318 |

Appendix 3 Total NFI outcomes in Northern Ireland to date

This is the sixth NFI report for Northern Ireland. Total outcomes to date are set out in the table below.

|

Dataset |

Total from previous exercises 1 April 2008 to 31 March 2018 (£) |

Current exercise 1 April 2018 to 31 March 2020 (£) |

NI Total to 31 March 2020 (£) |

|---|---|---|---|

|

Rates |

15,719,245 |

935,251 |

16,654,496 |

|

Housing benefit |

9,388,534 |

48,059 |

9,436,593 |

|

Pensions |

*8,248,608 |

176,381 |

8,424,989 |

|

Creditors |

792,590 |

30,792 |

823,382 |

|

Social housing |

130,480 |

1,589,280 |

1,719,760 |

|

Private supported care home residents |

92,149 |

0 |

92,149 |

|

Payroll and other |

77,239 |

9,167 |

86,406 |

|

GP patient registrations |

0 |

2,736,913 |

2,736,913 |

|

TOTAL |

*34,448,845 |

5,525,843 |

39,974,688 |

Outcomes are made up of actual fraud, error and overpayments identified by participating bodies and recorded on their web application plus, where appropriate, an estimated amount using the calculations set out in Appendix 2.

*Due to a formula error, pensions outcomes in the previous NFI exercise were overstated by £95,676. The pensions figure and the total to 31 March 2018 (above) have been adjusted accordingly.

Appendix 4 Audit assessment of organisations’ NFI arrangements

RED (High Risk)

- There has been little or no activity and progress on matches.

- There is a significant risk that all planned review and investigation work will not be carried out on time.

- The Key Contact for the NFI is an inappropriate person for that role or has inadequate influence within the organisation.

AMBER (Medium Risk)

- Work on NFI data matches was slow to begin.

- There has been some progress on matches in key reports but not all key reports have been opened and high risk matches have not always been prioritised.

- There is a risk that all planned review and investigation work will not be carried out on time.

- The Key Contact for the NFI is an appropriate person but improvements to NFI arrangements could be made.

GREEN (Low Risk)

- Good and timely progress has been made on all key reports; high risk matches have been prioritised.

- The organisation is on track to complete all review and investigation work on time, or has already completed the work.

- The Key Contact for the NFI is effective and experienced in the NFI process.