Welcome & Foreword

We have the pleasure of presenting the Northern Ireland Audit Office (NIAO) Corporate Plan 2024-2029.

The Comptroller & Auditor General (C&AG) and the NIAO are wholly independent of Government.

We are, however, mindful that it is important the work of the NIAO meets the needs of its various

stakeholders. The development of this Plan follows engagement with many stakeholders, including

politicians, public sector leaders, our Advisory Board, and our own people, as well as citizens and

public service users. We will continue to engage with audited bodies and key stakeholders over the

period of the Plan. We are also committed to improving our efficiency and effectiveness so that we can continue to meet our obligations, and future challenges as they arise.

We are proud of our response to unprecedented political and economic challenges Northern Ireland

has faced in recent times. We have adjusted to differing ways of working while continuing to deliver

on our financial audit and public reporting programmes. As we look to the period ahead, this Plan sets out our key strategic priorities and how we will continue to deliver independent scrutiny in reporting our findings on the finances of both central and local government. It sets out our ambitions for the next five years, the priorities we will use in fulfilling these ambitions, and the outcomes and key activities that will shape our work going forward.

We want to thank everyone who contributed to the development of this Plan.

Preface & Background

Preface

The Local Government Auditor is responsible for preparing a Code of Audit Practice (the Code) which sets out the framework for auditing Local Government bodies in Northern Ireland. This newly updated Code of Audit Practice will be in place for the next five years.

The Code of Audit Practice continues to be a principles-based approach derived from legal

requirements and the current professional international auditing standards and professional practices

in operation at this time. Should there be any subsequent changes to legislation affecting the duties

of the Local Government Auditor, the implications for this Code will be considered and revised if

necessary. In particular, I am aware of the NI Assembly’s review of the governance and accountability arrangements for the Northern Ireland Audit Office in 2022, which recommended a number of changes to public sector audit in Northern Ireland including the role of the Local Government Auditor, which will require legislation.

Public sector audit is carried out in the public interest and therefore the scope of public sector audit

is wider than that of the private sector. It is essential for holding public bodies and representatives to

account for their spending and stewardship of public money. It also makes an important contribution

to the corporate governance mechanisms in place designed to deliver public services which are in the

public interest.

The Local Government Auditor will continue to seek opportunities to carry out comparative and

other studies on the local government sector and to publicly report the findings of this work over

the next five years. In addition, the Local Government Auditor will continue to seek to identify and

report on examples of good practice that may be applied to local government organisations. It is also

worth noting that many of the reports published by the Comptroller and Auditor General include

recommendations which are applicable to local government too. As central and local government

continue to work closely together, the Local Government Auditor may choose to report on public

spend in conjunction with the C&AG.

The principles set out in this Code will support the Local Government Auditor to meet statutory

obligations and will ensure that auditors’ contributions are maximised to improve local government

financial accountability, performance and transparency.

Background

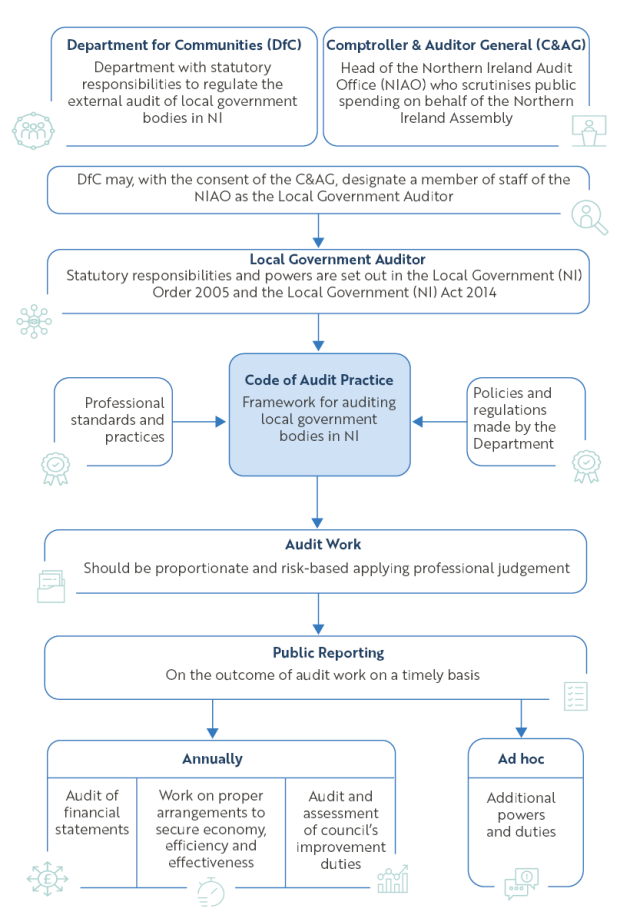

The Code of Audit Practice (the Code) sits at the centre of the arrangements for public audit of Local Government in Northern Ireland (NI). This is illustrated below. The Code reflects the legal requirements for local government audit. It also reflects the professional and ethical standards with which auditors must comply and covers the wider scope of public audit compared to the private sector.

Independent appointment of the Local Government Auditor

The Local Government (Northern Ireland) Order 2005 (the Order) provides that the Department for Communities may, with the consent of the Comptroller and Auditor General (C&AG), designate a member of staff of the Northern Ireland Audit Office (the NIAO) as the Local Government Auditor. Once designated, this Auditor carries out statutory responsibilities, and exercises their professional judgement, independently of the Department and the C&AG.

The roles of the Department, Comptroller and Auditor General, and the Northern Ireland Audit Office

The department with regulatory responsibility (the Department) is a central government department with statutory responsibilities to regulate the external audit of local government bodies in Northern Ireland – currently the Department for Communities.

The C&AG is an Officer of the Northern Ireland Assembly to which they report the results of their work. The C&AG is head of the NIAO who supports in the delivery of their functions, including the external audit of central government bodies in Northern Ireland.

Whilst the designated Local Government Auditor is independent and has responsibility for the functions to which this Code relates, operationally much of the work is delegated to staff within NIAO. Additionally, NIAO has in place contractual arrangements with some private audit firms to assist with this audit work.

Consequently, in this Code the use of the terms ‘auditor’ and ‘auditors’ apply collectively to:

- the Local Government Auditor;

- employees of NIAO; and

- any persons contracted to provide audit services to NIAO.

NIAO has established arrangements for the training and development of audit staff, the provision of advice and support on technical matters and regulating the quality of audit work.

The role of the Local Government Auditor

The Local Government Auditor has a statutory responsibility to give an independent opinion on local government bodies’ financial statements, referred to in legislation as the ‘statement of accounts’. The annual audit must also include a review and report on aspects of the arrangements put in place by local government bodies to ensure the proper conduct of its financial affairs, management of its performance and use of its resources.

The external audit for the Northern Ireland local government sector has three distinct features:

- The Local Government Auditor is appointed independently from the bodies being audited and is a member of staff from NIAO.

- The Local Government Auditor‘s work covers not only the audit of financial statements but also includes aspects of corporate governance, arrangements to secure the economic, efficient and effective use of resources, performance improvement, value for money studies and grant certification.

- The Local Government Auditor may report aspects of the work to the public and other key stakeholders.

These features are consistent with the ‘principles of public audit’ as defined by the Public Audit Forum which comprises all the national audit agencies in the United Kingdom (UK).

Statutory responsibilities and powers of the Local Government Auditor

The statutory responsibilities and powers of the designated Local Government Auditor relating to local government bodies are set out in the Order and the Local Government (Northern Ireland) Act 2014 (the Act). These are summarised in Schedule 1.

The Local Government Auditor issues a Statement of responsibilities of Local Government Auditor and Local Government Bodies which aligns to this Code and serves as the formal terms of engagement between the Local Government Auditor and local government bodies. It summarises where the different responsibilities of the Local Government Auditor and of the local government bodies begin and end, and what is expected of both parties.

In discharging the Local Government Auditor’s specific statutory responsibilities and powers, auditors are required to carry out their work in accordance with this Code of Audit Practice.

There are three main strands of work undertaken each year:

- the audit of the financial statements of all local government bodies (Chapter Two);

- a review of proper arrangements in place to secure economy, efficiency and effectiveness in the use of resources of all local government bodies (Chapter Three); and

- to determine and report on whether a council has met its duties for performance improvement and whether a council is likely to secure continuous improvement in the exercise of its functions (Chapter Four).

There are a number of additional powers and duties available to the Local Government Auditor when certain circumstances permit, and these are outlined in more detail in Chapter Six.

The Code of Audit Practice

Legislation requires the Local Government Auditor to prepare, and keep under review, a Code of Audit Practice (the Code) which prescribes the way in which the functions under that legislation are to be carried out and embodies, “what appears to the Local Government Auditor to be the best professional practice with respect to the standards, procedures and techniques to be adopted by the Local Government Auditor”.

The Code must be read in conjunction with any policies or regulations made by the Department regarding the preparation of accounts and the audit of local government bodies.

The Local Government Auditor is committed to keeping the Code up to date to reflect changes in the operating environment of audited bodies and statutory legislation, as well as auditing standards and practices. The Code may be amended where appropriate, in the light of practical experience.

The Code must be approved by a resolution of the Northern Ireland Assembly at intervals of not more than five years. This revised Code was approved in [date to be confirmed] XXXX 2026. In the intervening period, the Code may be amended by the Local Government Auditor in consultation with councils and other appropriate bodies and persons.

The Local Government Auditor’s approach

This revised Code relates to the audits of all local government bodies in Northern Ireland and a list of these bodies is given in Schedule 2. In line with other UK regions, a principles-based, rather than a rules-based framework has been adopted. This framework enables the Local Government Auditor to:

- prepare a concise, high level code applicable to the audit of all local government bodies within the local government audit model established by legislation;

- provide a clear methodology that will fulfil statutory duties;

- ensure the Code does not quickly become out of date as the regulatory environment continues to evolve; and

- adopt a flexible and responsive approach to sector developments and to the specific circumstances at each local government body.

The scope of work required to perform a good quality audit may vary in response to the individual circumstances of each local government body. Although auditors should discuss the audit scope with the audited body, the audit coverage will be a matter for the auditors’ independent, professional judgement and must be consistent with International Standards on Auditing.

The successful delivery of an audit under the Code is dependent upon the audited body meeting its statutory responsibilities to provide the auditor with the facilities and information the Local Government Auditor reasonably requires for the purposes of fulfilling functions, in a timely manner and to an appropriate standard.

Chapter One: Status of the Code, application and general principles

1.1 This chapter covers the status of the Code, provides details on its application and sets out principles which should underpin the conduct and work of the auditor in discharging their statutory duties.

Status of the Code

1.2 The Local Government Auditor is required to prepare the Code under Article 5(3) of the Local Government Order 2005 (the Order) and to lay it before the Northern Ireland Assembly for approval.

1.3 The Code was laid before the Northern Ireland Assembly in [date to be confirmed] XXXX 2026 and comes into effect from 1 April 2026. It replaces the Code that had been in effect from April 2021.

1.4 The Code is applicable to the audit of all Northern Ireland local government bodies’ financial statements from the financial year 2025-26 onwards and until the Code is replaced.

1.5 The Code also applies to the audit and assessment of councils’ performance improvement duties established under the Local Government Act (Northern Ireland) 2014 (the Act).

Application of the Code

1.6 The Code prescribes the way in which the Local Government Auditor should carry out statutory functions. The Code applies to the audit of relevant bodies as set out in Schedule 2.

1.7 As with any code that attempts to cover a wide variety of circumstances, the application of the Code in any particular case will depend on specific circumstances, relevant supplementary guidance, policies or directions made by the Department and the Local Government Auditor’s assessment of what is reasonable and appropriate in those circumstances. All the provisions of the Code are to be read and applied with that necessary qualification.

1.8 This Code cannot guarantee the quality of judgements made by the auditor nor prevent significant failure or wrongdoing by a local government body. Indeed, it is the responsibility of local government bodies to have in place effective governance, financial management and internal control arrangements. It is the responsibility of auditors to apply professional standards in terms of both the ethical conduct of the audit and the quality of the audit work performed.

Principles

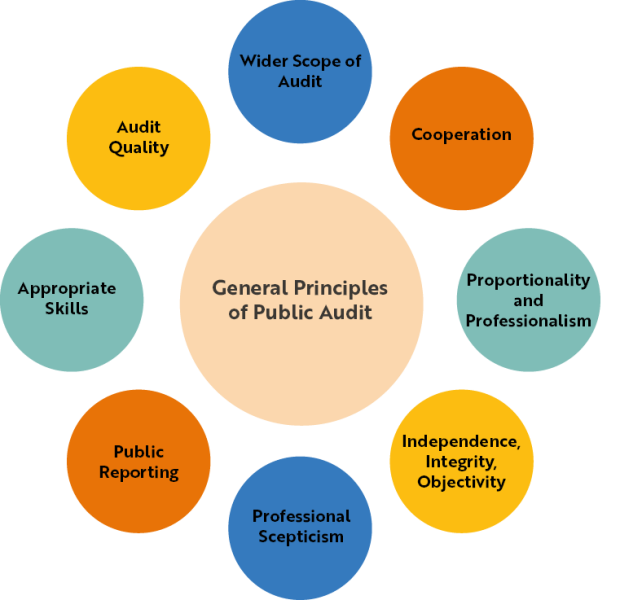

1.9 The Code takes as its starting point general principles of public audit shared across the UK: Wider scope of public audit; Independence of auditors; and Public reporting of audit findings, and then builds on them as set out below.

Wider scope of public audit

1.10 The audit of a public sector organisation is wider in scope than that of a private sector body. Additional accountability and scrutiny is attached to the use of public money and the conduct of local government business. As a result, the scope of external audit is extended to not only consider and report on the truth and fairness of the financial statements of local government bodies, but also on aspects of the stewardship of public funds including:

- the arrangements in place for securing economy, efficiency and effectiveness in the use of resources;

- the arrangements in place to secure continuous performance improvement in the exercise of a council’s functions; and

- to report on matters that are in the public interest.

1.11 The Local Government Auditor does not act as a substitute for the audited body’s own responsibility for putting in place proper arrangements to ensure that public business is conducted in accordance with the law and proper standards, and that public money is safeguarded, properly accounted for and used economically, efficiently and effectively.

1.12 Auditors should, however, ensure that arrangements are open and transparent and recognise their responsibilities to local government bodies and to local taxpayers. The audit should add value to the local government body through applying the highest professional standards to audit work and publicly reporting on audit recommendations and areas of good practice.

Cooperation

1.13 Local government bodies can operate, commission and deliver services in a range of partnerships and other forms of joint working or contracts with other public, private or third sector bodies. In meeting the statutory duties the Local Government Auditor should consider how best to obtain assurance over such arrangements, working effectively with other auditors and organisations where appropriate.

1.14 Auditors should build effective coordination arrangements with internal audit, using the work of internal audit where, in the auditor’s judgement and in line with professional standards, it is considered appropriate.

1.15 Auditors should adopt an integrated approach where the knowledge gathered and work carried out, in support of each of the Local Government Auditor’s statutory and reporting obligations, informs the overall judgments and conclusions reached.

1.16 The legislation allows the Local Government Auditor to access documents held by third parties in carrying out statutory duties, including work on comparative and other studies or investigations directed by the Department. However, an auditor’s access will be limited to the papers and records which relate to the local government body and not to the general business of the third party.

1.17 Where access to a third party is required, the auditor will liaise with the relevant local government body in advance, explaining the purpose and scope of the intended work and agreeing an effective coordination approach with the third party.

1.18 The auditor should ensure that audit teams comply with statutory and other relevant requirements relating to the security, transfer, holding, disclosure and disposal of information, particularly personal information received or obtained during the course of their audit work.

Proportionality and professionalism

1.19 Auditors must carry out their work in compliance with the requirements of the Code which itself requires compliance with international and national standards, where relevant, issued by a relevant regulatory body, such as the Financial Reporting Council. The auditor’s work should be:

- Risk-based - Auditors should apply their professional judgement to tailor their work to the circumstances in place at the audited body and the assessed audit risks;

- Proportionate - Whilst this applies to all audited bodies, it is particularly relevant for smaller local government bodies where expenditure is low and systems are non-complex;

- Designed to meet the Local Government Auditor’s statutory responsibilities;

- Conducted economically, efficiently, effectively and in as timely a way as possible; and

- Sufficiently transparent, considering the legal and professional framework the auditor operates within, so that audited bodies understand the purpose, scope and nature of the audit work being undertaken.

1.20 There may be circumstances in which it appears to the auditor that aspects of the Code need to be applied in a certain way in order to meet the specific circumstances of certain bodies. For example, smaller local government bodies may have a limited range of activities and relatively small amounts of public money that they control. In these circumstances, auditors will apply their professional judgement.

1.21 Whilst auditors are required to undertaken certain duties and must obtain information and explanations to provide evidence of meeting these responsibilities, they are not expected to review all aspects of an audited body’s arrangements, system or records.

Independence, integrity and objectivity

1.22 Auditors must carry out their work with integrity and objectivity to underpin and safeguard their independence at all times. Auditors also need to comply with the ethical standards established by the Financial Reporting Council and relevant professional institutions or statutory guidance. The Local Government Auditor will report in public and make recommendations on findings without being influenced by any other parties.

1.23 Auditors exercise their professional judgement and act independently of both the Department and the audited body. Auditors must be, and should be seen to be, impartial and independent. A lack of independence creates audit risk as it may mean that the auditor is unduly influenced, or may be seen to be unduly influenced, in their decision-making and professional judgment. Auditors need to consider threats to independence. Accordingly, they should not carry out any other work for an audited body, if that work would impair their independence in carrying out any of the Local Government Auditor’s statutory duties, or might reasonably be perceived as doing so. Auditors must remain independent when responding to requests for advice from audited bodies, ensuring they do not compromise the Local Government Auditor’s ability to report on a matter or to apply statutory functions.

Professional scepticism

1.24 In carrying out their work, the auditor’s attitude should be characterised by professional scepticism and professional judgement. Professional scepticism means maintaining professional distance, remaining open-minded and having an alert and questioning attitude when assessing the sufficiency and appropriateness of evidence obtained throughout the audit. Auditors should obtain and document such information and explanations as they consider necessary to provide sufficient, appropriate evidence in support of the Local Government Auditor’s judgements. Auditors should meet the requirements of the legislation, the Code and, where applicable, professional standards.

Public reporting

1.25 The Local Government Auditor has a range of means available, as set out in relevant legislation, whereby findings may be reported publicly. The Local Government Auditor should be able to report on a timely basis without fear or favour, using professional judgement on the most appropriate and effective means of reporting.

1.26 The auditor should use judgement in deciding the most appropriate and effective means of reporting. Auditors should adopt a constructive and positive approach to their work.

1.27 In making recommendations the auditor should set out clearly the judgements made and the evidence on which such judgements were based, explain the impact on the audited body and the actions the body should take in response. To support and encourage worthwhile change, auditors should also consider carefully the practical and resource implications for the audited body when framing recommendations.

Appropriate skills

1.28 To undertake audits effectively in accordance with these principles, the auditor should ensure they have the necessary skills and knowledge to discharge their functions effectively and have arrangements in place to ensure that audit teams have sufficient knowledge of the local government financial reporting, regulatory and legislative frameworks.

Audit quality

1.29 The Local Government Auditor should obtain assurance that audits meet the highest professional standards on quality control. Comprehensive audit quality arrangements apply to all audit work.

1.30 In line with the requirements of the Financial Reporting Council’s International Standard on Quality Management (ISQM1), NIAO has established arrangements for the training and development of audit staff, the provision of advice and support on technical matters and regulating the quality of audit work. An evaluation of the system of quality management is undertaken at least annually.

Chapter Two: Audit of the financial statements

2.1 The statutory responsibilities for the Local Government Auditor’s audit of the financial statements of Northern Ireland local government bodies are summarised in Schedule 1: The Local Government Auditor’s statutory responsibilities.

Responsibilities of the audited body

2.2 The specific responsibilities of audited bodies regarding the production and reporting of financial statements and other information are set out in relevant legislation, regulations, accounting frameworks and Departmental policy circulars. All audited bodies are expected to have effective corporate governance arrangements in place to deliver their objectives. The publication of the financial statements is an essential means by which an audited body accounts for its stewardship and use of public money at its disposal.

2.3 The precise form and content of the audited body’s financial statements, and any additional schedules or returns for consolidation purposes, should reflect the requirements of the relevant accounting and reporting framework in place and any additional guidance issued in support of the accounting and reporting framework as directed by the Department.

2.4 The audited body may also be required to prepare a return to facilitate the preparation of HM Treasury’s Whole of Government Accounts.

Responsibilities of the Local Government Auditor

2.5 To meet the duties in respect of the audit of the financial statements, auditors should comply with auditing standards currently in force in the United Kingdom, as amended from time to time, having regard to any other relevant guidance and advice issued by the Financial Reporting Council, including Ethical Standards.

2.6 Auditors should undertake work to support the provision of the Local Government Auditor’s audit report to the audited body. In respect of the audit of the financial statements, the Local Government Auditor’s report should include the following components:

Opinion on the audited body’s financial statements

- whether the financial statements give a true and fair view of the financial position of the audited body and its income and expenditure for the year in question; and

- whether the financial statements have been prepared properly in accordance with the relevant accounting and reporting framework as set out in legislation, applicable accounting standards or other Departmental direction.

Opinion on other matters

- whether other information published together with the audited financial statements is consistent with the financial statements; and

- where required, whether the part of the remuneration report to be audited has been properly prepared in accordance with the relevant accounting and reporting framework.

Conclusions relating to going concern

- whether the going concern basis of accounting in the preparation of the financial statements is appropriate; and

- whether any identified material uncertainties, relating to events or conditions that individually or collectively, have been disclosed in the financial statements that may cast significant doubt over the body’s ability to continue to adopt the going concern basis.

Opinion which will be reported by exception

2.7 There are a number of other matters, which the Local Government Auditor will report by exception:

- If the Annual Governance Statement does not reflect compliance with proper practices, as required by the Department or is misleading or inconsistent with other evidence gathered during the audit.

- If adequate accounting records have not been kept.

- The financial statements and the part of the Remuneration Report to be audited are not in agreement with accounting records.

- If the Local Government Auditor has not received all of the information and explanations required for the audit.

- Matters reported in the public interest under Article 9 of the Local Government (Northern Ireland) Order 2005.

- Any recommendations made to the audited body under Article 12 of the Local Government (Northern Ireland) Order 2005.

- Application to the High Court for a declaration that an item of account is contrary to law under Article 19 of the Local Government (Northern Ireland) Order 2005.

- Certification of a loss caused by a failure to account or wilful misconduct under Article 20 of the Local Government (Northern Ireland) Order 2005.

- Application for judicial review under Article 21 of the Local Government (Northern Ireland) Order 2005.

2.8 Other information published together with the audited financial statements covers material that the audited body chooses, or is required, to provide alongside its financial statements, for example the narrative report and the governance statement. In reading the information given with the financial statements, auditors should take into account the knowledge of the audited body, including that gained through audit work in relation to the body’s proper arrangements for securing economy, efficiency and effectiveness in its use of resources and performance improvement.

Certificate signifying completion

2.9 At the close of an audit, a certificate is issued to a local government body which marks the point at which the Local Government Auditor’s statutory responsibilities, in respect of the audit of the financial statements for that period, have been discharged. This should only be issued when all statutory and legal considerations have been concluded.

Chapter Three: The Local Government Auditor’s work on proper arrangements and comparative and other studies

3.1 The Local Government Auditor has statutory duties in respect of the local government body’s arrangements in place to secure economy, efficiency and effectiveness in the use of its resources, often referred to as ‘proper arrangements’. The Local Government Auditor also has statutory power in relation to the undertaking of comparative and other studies on local government bodies designed to lead to improvements in economy, efficiency and effectiveness in the provision of services. Further details of these duties are set out in Schedule 1: The Local Government Auditor’s statutory responsibilities.

Proper arrangements

Responsibilities of the audited body

3.2 Local government bodies are required to maintain an effective system of internal control that supports the achievement of their policies, aims and objectives, while safeguarding and securing value for money from the public funds and other resources at their disposal. It is their responsibility to put in place proper arrangements to secure economy, efficiency and effectiveness in its use of resources and to ensure proper stewardship and governance. The adequacy and effectiveness of its system of internal control should be regularly reviewed.

3.3 A local government body is required to bring together commentary on its governance framework and how this has operated during the period in an annual governance statement.

3.4 In preparing its governance statement, the audited body should tailor the content to reflect its own individual circumstances, consistent with the requirements of the relevant accounting and reporting framework and having regard to any guidance issued in support of that framework. This must include a description of the arrangements for ensuring that its functions and services are delivered in a manner which represents the best use of resources, considering measures for economy, efficiency and effectiveness.

Responsibilities of the Local Government Auditor

3.5 The Local Government Auditor has a statutory responsibility to be satisfied that the audited body has put in place proper arrangements to secure economy, efficiency and effectiveness in its use of resources.

3.6 In meeting this responsibility, auditors should ensure that sufficient work is undertaken to be able to assess whether, in their view, the audited body has put proper arrangements in place that support the achievement of value for money. In carrying out this work, the auditors are not required to conclude upon whether the audited body has achieved value for money during the reporting period. However, should evidence of poor value for money come to auditors’ attention during the course of an audit, they should consider the implications of this for their audit.

3.7 The auditors’ work should be underpinned by consideration of the proper arrangements the audited body is expected to have in place. This should be based on any relevant requirements, guidance or good practice.

3.8 Auditors should take into account their knowledge of the local government sector as a whole, and the audited body specifically, to identify any risks that, in their judgement, are relevant to the Local Government Auditor’s work on proper arrangements. An understanding of the sector includes the relevant regulatory framework, which may influence the auditors’ assessment of the risk.

3.9 The auditors’ work should be designed to enable the Local Government Auditor to form a view of the arrangements management has made and report a conclusion to those charged with governance that the audited body has (or has not) put in place proper arrangements to secure value for money through economic, efficient and effective use of its resources for the relevant financial year. The Local Government Auditor may make recommendations for improvements to the arrangements in place and report on examples of good practice.

3.10 In reviewing the audited body’s value-for-money arrangements, it is not part of the auditor’s function to question the merits of the audited body’s policy decisions. However, the auditor may examine the arrangements by which policy decisions are reached and implemented. In making recommendations, the auditor should avoid any perception that they have any role in the decision-making arrangements of the audited body.

Comparative and other studies

3.11 In addition to the assessment of proper arrangements, the Local Government Auditor may and, if required by the Department, undertake comparative and other studies which are designed to make recommendations to local government bodies for improving economy, efficiency and effectiveness in its provision of services. Where required under legislation, the Department and the relevant bodies will be consulted on the studies proposed. The results of this work shall be published.

3.12 As central and local government continue to work closely together, the Local Government Auditor may choose to report on public spend in conjunction with the C&AG. NIAO publishes a forward Public Reporting Plan annually incorporating all proposed studies and good practice for both central and local government sectors. This programme may include a schedule of value-for-money studies relating to local government activities. The results of which will published.

Chapter Four: The Local Government Auditor’s work on performance improvements

4.1 The Local Government Auditor must carry out audit work relating to the performance improvement duties of councils as outlined in Schedule 1: The Local Government Auditor’s statutory responsibilities.

Responsibilities of the audited body

4.2 Councils have a general duty to make arrangements to secure continuous improvement in the exercise of their functions and to set improvement objectives for each financial year. Councils will be required to gather information to assess improvements in their services and to issue a report annually on their performance against indicators which they have either set themselves or that have been set by departments. Councils’ performance improvement plans, and the arrangements made to deliver on those plans, will be audited by the Local Government Auditor.

Responsibilities of the Local Government Auditor

4.3 The Local Government Auditor has a statutory responsibility for each financial year to determine and report on whether:

- a council has discharged its duties in relation to improvement planning, published the required improvement information and the extent to which the council has acted in accordance with any guidance issued by the Department in relation to those duties; and

- a council is likely to comply with its statutory requirements to make arrangements to secure continuous improvement in the exercise of its functions.

4.4 To discharge these functions, the Local Government Auditor will:

- undertake improvement information and planning audits, to ascertain whether a council has discharged its duties for publishing improvement planning and performance information;

- carry out improvement assessments, to determine whether a council is likely to comply with its statutory requirements to make arrangements to secure continuous improvement in the exercise of its functions; and

- report on improvement audit and assessment work.

4.5 The Local Government Auditor will conduct improvement audit and assessment functions:

- consistently between councils;

- proportionately so as not to impose an unreasonable burden on councils; and

- with a view to assisting councils to comply with their duties in relation to securing continuous improvement.

4.6 In certain circumstances the Department may direct the Local Government Auditor, or the Local Government Auditor may decide in consultation with the Department, to carry out a special inspection of a council’s compliance with its duties in relation to securing continuous improvement.

4.7 Each year when carrying out performance improvement assessments, auditors will assess whether councils have given due regard to sustainability and other aspects of improvement in their arrangements to secure continuous improvement.

4.8 If the Local Government Auditor thinks it appropriate, recommendations may be made to the Department to provide assistance to a council or give it a direction. The Local Government Auditor will clearly outline the rationale for making such recommendations, based on improvement audit, assessment or inspection findings.

Chapter Five: Reporting the results of the Local Government Auditor’s work

5.1 Effective reporting is the primary means by which auditors’ work achieves its impact. The ability of public auditors to communicate the results of their work and to make them available to the public is a fundamental principle of public audit. Auditors should use their professional judgement to apply the principles of effective reporting through the range of reporting available to them.

5.2 The Local Government Auditor has statutory duties for reporting the results of the audit, as summarised within Schedule 1: The Local Government Auditor’s statutory responsibilities. The Local Government Auditor may report the results of audit work using a range of outputs at an appropriate point in the audit process, as set out below.

Planning the audit

5.3 Audit strategy documents set out how the Local Government Auditor intends to carry out duties in respect of a local government body’s annual financial statements, in accordance with auditing standards and the approach to performance improvement audit work. Audit strategy documents encompass the auditors planned work to meet obligations in respect of:

- Forming an opinion on the truth and fairness of the financial statements;

- Reviewing the arrangements in place to secure value for money through the economic, efficient and effective use of resources;

- Assessing arrangements for securing continuous improvement in the exercise of a council’s functions; and

- Where considered necessary, to fulfil additional powers and duties available to the Local Government Auditor (outlined in Chapter Six).

5.4 The responsibility for establishing the overall audit strategy and the audit plan rests solely with the auditor. Auditors should discuss the risk assessment and planned approach set out in the audit strategy document with management and those charged with governance.

Completion of audit fieldwork

5.5 A report to those charged with governance will be prepared, at least annually, in support of the completion of audit work. The report should comply with auditing standards and may include any matters which the Local Government Auditor wishes to bring to the body’s attention.

Conclusion of the audit

5.6 An audit report is issued to express an opinion on matters, as set out at paragraphs 2.6 to 2.8 of this Code. This will include, by exception, any report by the Local Government Auditor on a range of additional matters, if appropriate.

5.7 An audit completion certificate will be issued at the conclusion of the audit by the Local Government Auditor which usually forms part of the audit report. The effect of the certificate is to close the audit. This marks the point when the Local Government Auditor’s responsibilities in respect of the audit of the period covered by the certificate have been discharged. There may be occasions when the Local Government Auditor is able to issue the audit report but cannot certify completion of the audit because certain, non-material issues remain outstanding. In such circumstances, the Local Government Auditor should consider whether to issue an audit report ahead of certifying closure of the audit.

5.8 An annual audit letter will be produced which should provide a clear, readily understandable commentary on the results of both the financial statement audit and the work on proper arrangements. It should also highlight any issues that the Local Government Auditor wishes to draw to the attention of the public. The Local Government Auditor will issue the annual audit letter as soon as possible after the audit is certified as complete. Whilst it is the responsibility of the council to publish the annual audit letter, the Local Government Auditor may also publish each annual audit letter on the NIAO website to enhance the transparency of public reporting.

5.9 An audit and assessment report will be issued to the Chief Executive of each council and the Department. The report will state whether the Local Government Auditor believes that the council is likely to comply with the statutory duty to make arrangements to secure continuous improvement during the current financial year and may also comment on whether the council is likely to comply in subsequent years.

5.10 Annual improvement reports for each council will be published by the Local Government Auditor that summarises all of the work done in relation to the performance and improvement duties. These will also be published on the NIAO website.

5.11 Once all the audits have been completed, the Local Government Auditor will issue an annual report to the Chief Executive of each council and the Department. The main objective of this report is to provide an overview of all the Local Government Auditor’s functions in that year and share key messages from audits performed during that period. This will also be published on the NIAO website.

Any stage during the audit

5.12 Auditors may progress the actions and outputs identified below at any stage during their work:

- communication on specific elements of their work – auditors should maintain regular communication with the audited body to ensure that emerging findings are raised on a timely basis, in the form and at the level within the audited body, they judge appropriate.

- reports in the public interest – the Local Government Auditor should consider whether, in the public interest, to report on any matter that comes to notice so that it is brought to the attention of the audited body and the public:

– When preparing and issuing reports in the public interest, the Local Government Auditor should tailor the approach to the urgency and significance of the concerns. The Local Government Auditor should make a report during the audit if it is considered the matter is sufficiently important to be brought to the attention of the audited body or the public as a matter of urgency. This may include matters that are already in the public domain however the Local Government Auditor considers it is in the public interest to publish an independent view.

– If the Local Government Auditor issues a report in the public interest, this should be referred to in the audit report and the annual audit letter.

- written recommendations – the Local Government Auditor should consider whether to use the powers the Order provides to make written recommendations to the audited body which need to be considered by the body and responded to publicly. Where the Local Government Auditor considers it necessary to make such recommendations, these can be made during or at the end of the audit and can be included, where relevant, within other written outputs from the audit (including the audit report), or they may be the subject of a specific report to the audited body. Where the Local Government Auditor makes a recommendation under the Order, it should be clearly distinguished from other, more general, recommendations for improvement that may arise during an audit (or as a result from an objection).

- special investigations – if the Local Government Auditor is of the opinion that a council may fail to comply with its performance improvement duties, or if the Department directs the Local Government Auditor to carry out an inspection, then the Local Government Auditor may carry out a special inspection of the council. Such inspections may relate to some or all of a council’s functions. Before deciding whether to inspect, the Local Government Auditor must consult the Department.

Reporting options at a glance

| Timing | All local government bodies (including councils) | Councils only |

|---|---|---|

| Planning the audit | Audit Strategy for the Financial Statements | Audit Strategy for Performance Improvement audit work |

| Completion of audit fieldwork | Report to those Charged with Governance | |

| Conclusion of the audit | Audit Report (opinion on the financial statements Audit Completion Certificate Annual Audit Letter | Performance Improvement Audit Assessment Report Annual Improvement Report |

| Timing | Concerning individual local government bodies | Concerning all local government bodies |

|---|---|---|

| Annually | Annual Local Government Auditor’s Report (to encompass all audit work completed in the period) | |

| Anytime during the audit | Interim Reports to those Charged with Governance Reports in the Public Interest Written recommendations Special investigation regarding performance improvement duties (Councils only) | |

| Ad hoc reports | Comparative and other studies | Comparative and other studies |

Chapter Six: The Local Government Auditor’s additional powers and duties

6.1 The Local Government Auditor under legislation has the use of certain additional powers and duties relating to all local government bodies in Northern Ireland, and these are summarised below.

| Additional powers and duties | Legislation |

|---|---|

Objections To give interested persons the opportunity to raise questions with the Local Government Auditor about the accounts and for the Local Government Auditor to consider and decide upon objections received in relation to the accounts. | Articles 17 and 18 Local Government (Northern Ireland) Order 2005 |

Items contrary to law To consider whether to apply to the court for a declaration that an item of account is contrary to law. | Article 19 Local Government (Northern Ireland) Order 2005 |

Wilful misconduct To consider whether there has been a loss or deficiency caused by a failure to account or wilful misconduct. | Article 20 Local Government (Northern Ireland) Order 2005 |

Judicial review To consider whether to make an application for judicial review. | Article 21 Local Government (Northern Ireland) Order 2005 |

Extraordinary audits To perform an extraordinary audit of the accounts of any local government body if, at any time, it is directed by the Department. | Article 22 Local Government (Northern Ireland) Order 2005 |

Audit accounts of a local government officer To audit the accounts of a local government officer where that officer is in receipt of money or other property on behalf of a local government body or for which he/she ought to account to that body. | Article 23 Local Government (Northern Ireland) Order 2005 |

Certifying claims To make arrangements, if so required by a local government body, for certifying claims, returns or accounts in respect of certain grants or subsidies. | Article 25 Local Government (Northern Ireland) Order 2005 |

VFM Studies To undertake comparative and other studies designed to make recommendations for improving economy, efficiency and effectiveness in the provision of services by local government bodies and to publish the results and recommendations. | Article 26 Local Government (Northern Ireland) Order 2005 |

Additional powers and duties

6.2 In exercising any of the additional powers and duties, the Local Government Auditor should tailor the approach to the particular circumstances of the matters under consideration and having regard to proportionality as outlined in Chapter One.

6.3 Where any representations are made to or relevant matters otherwise come to the attention of the Local Government Auditor, consideration should be given as to whether the matter needs investigation and action under these additional powers and duties or whether it can be considered more effectively within planned work programmes and reporting arrangements under the Local Government Auditor’s other audit engagement responsibilities.

6.4 In considering whether to exercise any of the additional powers and duties, and in determining the time and resource to be spent on dealing with such matters the Local Government Auditor should consider the relevant requirements of the Order and:

- the significance of the subject matter;

- whether there is wider public interest in the issues raised and/or whether it would be in the public interest for the Local Government Auditor to comment publicly on an issue;

- whether the substance of the matter has been considered previously by the Local Government Auditor;

- the costs of dealing with the matter when set against the sums involved and the size of the local government body, bearing in mind that these costs are borne by the taxpayer and so should be proportionate and in the public interest; and

- in the case of objections, the rights of both those subject to objection and of the objector.

Raising concerns

6.5 The Local Government Auditor is a prescribed person under the Public Interest Disclosure (Prescribed Persons) (Amendment) Order (Northern Ireland) 2022. This means that any relevant concern brought to the attention of the Local Government Auditor from local government employees and third parties in relation to the proper conduct of local government business, value for money, and fraud and corruption can be considered. NIAO published updated guidance on this matter in June 2020, Raising Concerns: A good practice guide for the Northern Ireland public sector. [Note: This is currently being reviewed and is expected to be published in 2026]

Fraud notifications

6.6 With the consent of the Department, local government bodies agreed to voluntarily submit returns about all actual, suspected and attempted frauds involving public money to the Local Government Auditor. These returns should be used by the auditor to identify potential control weaknesses and to provide an overview of risks across the sector. The Local Government Auditor may exercise the powers and duties to report on such matters if it is considered in the public interest to do so.

National Fraud Initiative

6.7 The National Fraud Initiative is a major two-yearly data matching exercise operated by the Public Sector Fraud Authority in which all local councils participate. Their payroll and trade creditors’ data is matched with the data of other organisations across Northern Ireland, England, Scotland and Wales using sophisticated computer-based data matching techniques, to help identify potentially fraudulent and duplicate transactions. The Local Government Auditor may review data matches generated by this exercise, including a council’s approach to investigating such matches, in the interests of the detection and prevention of fraud.

Schedule 1: The Local Government Auditor’s statutory responsibilities

This schedule summarises relevant sections of the Local Government (Northern Ireland) Order 2005 and the Local Government Act (Northern Ireland) 2014. However, for further details of the statutory provisions in place, the relevant legislation should be referred.

| Local Government Auditor’s statutory responsibilities | Statute |

|---|---|

Audit scope To be satisfied that the accounts comply with statutory requirements. To be satisfied that proper practices have been observed in compiling the accounts. To be satisfied that proper arrangements have been made for securing economy, efficiency and effectiveness in the use of resources. To be satisfied that a council has discharged its performance improvement duties and acted in accordance with any guidance. To determine whether a council is likely to comply with its performance improvement duties in the financial year and in subsequent financial years. | Article 6(1)(a)(b) Article 6(1)(c) Article 6(1)(d) Section 93 Section 94 |

Reporting To comply with the Code of Audit Practice prepared by the Local Government Auditor and approved by the Northern Ireland Assembly. To consider whether, in the public interest, to report on any matter that comes to the attention of the auditor so that it may be considered by the body concerned or brought to the attention of the public. To certify the completion of the audit. To express an opinion on the accounts. To consider whether a written recommendation should be made to the audited body requiring it to be considered and responded to publicly. To issue an ‘audit and assessment report’ each financial year in respect of each council certifying whether a council has discharged its performance improvement duties and acted in accordance with any guidance. In addition, the report will include a statement from the Local Government Auditor stating whether or not the council is likely to comply with its performance duties. To publish an ‘annual improvement report’ in relation to each council which summarises or reproduces the Section 95 report and the results of any special inspection work. For each financial year, prepare a report on the exercise of the Local Government Auditor’s functions in that year and send a copy of the report to each council and the Department. | Article 6(2) Article 9 Article 10(1)(a) Article 10(1)(b) Article 12(2) Section 95 Section 97 Article 4(5) |

Additional powers and duties To give interested persons the opportunity to raise questions with the Local Government Auditor about the accounts and for the Local Government Auditor to consider and decide upon objections received in relation to the accounts. To consider whether to apply to the court for a declaration that an item of account is contrary to law. To consider whether there has been a loss or deficiency caused by a failure to account or wilful misconduct. To consider whether to make an application for judicial review. To perform an extraordinary audit of the accounts of any local government body if, at any time, it is directed by the Department. To audit the accounts of a local government officer where that officer is in receipt of money or other property on behalf of a local government body or for which he/she ought to account to that body. To make arrangements, if so required by a local government body, for certifying claims, returns or accounts in respect of certain grants or subsidies. To undertake comparative and other studies designed to enable him/her to make recommendations for improving economy, efficiency and effectiveness in the provision of services by local government bodies and to publish the results and recommendations. | Articles 17 and 18 Article 19 Article 20 Article 21 Article 22 Article 23 Article 25 Article 26 |

Access rights To have access at all reasonable times to every document relating to a local government body. To restrict disclosure by the Local Government Auditor of information obtained during the course of their work to third parties. | Article 7 Article 27 |

Schedule 2: List of local government bodies covered by the Code as at April 2026

- Antrim and Newtownabbey Borough Council

- ARC21

- Ards and North Down Borough Council

- Armagh City, Banbridge and Craigavon Borough Council

- Belfast City Council

- Causeway Coast and Glens Borough Council

- Derry City and Strabane District Council

- Fermanagh and Omagh District Council

- Lisburn and Castlereagh City Council

- Local Government Staff Commission

- Mid and East Antrim Borough Council

- Mid Ulster District Council

- Newry, Mourne and Down District Council

- North West Regional Waste Management Group

Glossary

The Accounting standards. Accounting standards are authoritative statements of how transactions and balances are to be recognised, measured, presented and disclosed in financial statements. The Local Government (Capital Finance and Accounting) Regulations (Northern Ireland) 2011 and the relevant accounts direction issued by the Department require bodies to comply with the CIPFA: Code of Practice on Local Authority Accounting in the UK, which is based upon current accounting standards and their application to the local government sector, and is updated each year.

Act ‘the’. The Local Government (Northern Ireland) Act 2014.

Annual Audit Letter. Report issued by the Local Government Auditor to an individual audited body, which summarises the audit work carried out in the period, the Local Government Auditor’s opinions or conclusions (where appropriate) and significant issues arising from audit work.

Annual Governance Statement. Local Government (Accounts and Audit) Regulations (Northern Ireland) 2015 requires local government bodies to prepare an annual governance statement in accordance with proper practices on internal control.

A governance statement brings together in one place a local government body’s disclosures about its governance framework, including risk management and internal control arrangements, and how it has operated during the year.

Audited body, localgovernment body, body. A body to which the Department is responsible for assigning the local government auditor, comprising both the members of the body and its

management (the senior officers of the body). Those charged with governance are the members of the audited body. (See also ‘members’ and ‘those charged with governance’).

Audit Report. The Local Government Auditor must prepare a report on the financial statements each year which complies with Auditing Standards. This report concludes the results of the audit work for relevant statutory functions. The content of this report is described in Chapter Two.

Auditor(s). This term includes the terms ‘auditor’ and ‘auditors’ refers collectively to:

- the Local Government Auditor;

- employees of the Northern Ireland Audit Office; and

- any person who is contracted to provide audit services to the NIAO

Auditing standards. Standards issued by the Financial Reporting Council which the Local Government Auditor is required to comply with when conducting an audit of the financial statements.

Comptroller and Auditor General (the). The Comptroller and Auditor General (C&AG) is an Officer of the Northern Ireland Assembly and is the head of the Northern Ireland Audit Office. The

C&AG is responsible for the external audit of central government bodies in Northern Ireland and in their role as Comptroller, is responsible for authorising the issue of money from the Consolidated Fund of Northern Ireland to Northern Ireland departments.

Code (the). The Code of Audit Practice issued by the Local Government Auditor and approved by the Northern Ireland Assembly.

Consolidated accounts. Financial statements of a group in which the assets, liabilities, reserves, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity. Consolidated accounts are also referred to as group accounts.

Corporate governance. The system of structures, rights, duties and obligations by which organisations are directed and controlled.

Department (the). The central government Department, currently the Department for Communities, with statutory responsibilities to regulate the external audit of local government bodies in Northern Ireland and to promote improvement in the provision of services by local government bodies.

Ethical Standards. Standards issued by the Financial Reporting Council, intended to maintain integrity, independence and objectivity that auditors are required to comply with when conducting their work.

External audit. The audit of the accounts of an audited body, which comprises the audit of the financial statements and other work to meet the Local Government Audit’s statutory responsibilities under the Local Government (Northern Ireland) Order 2005. In addition, it includes performance improvement audits and assessments under Part 12 of the Local Government (Northern Ireland) Act 2014.

Financial Reporting Council (FRC). The Financial Reporting Council is an independent regulator in the UK and Ireland, responsible for regulating auditors, accountants and actuaries, and setting the UK’s Corporate Governance and Stewardship Codes. It promotes transparency and integrity in organisations and is aimed at those who rely on financial statements, audit reports and high-quality risk management.

Financial statements (also see Statement of Accounts). The financial statements, or Statement of Accounts, are statements that audited bodies are required to prepare which set out what they spend and receive and what they own and owe. For the purpose of providing the auditor’s opinion, the Code interprets relevant references in the Order to the ‘statement of accounts’ and the ‘accounts’ in respect of the general duties of auditors as equivalent to ‘financial statements’.

Improvement audit. An audit to determine whether a council has carried out its duties under the Act and relevant guidance issued by the Department.

Improvement assessment. An assessment to determine whether a council is likely to comply with the requirements of the Act in the period. An assessment may also be made of a council’s likely compliance in subsequent financial years.

Internal audit. Internal audit is an assurance function that primarily provides an independent and objective opinion to the organisation on the control environment comprising risk management, control and governance by evaluating its effectiveness in achieving the organisations objectives. Local government bodies are required to have an internal audit function under the Local Government (Accounts and Audit) Regulations (Northern Ireland) 2015.

Local government bodies. A council or a committee of a council for which accounts are separately

kept, or a joint committee of two or more councils (as defined in Article 3(2) of the Order).

Members. The elected councillors or appointed members of local government bodies who are responsible for the overall direction and control of the audited body. (See also ‘those charged with governance’ and ‘audited body’).

Narrative report. This is an annual report produced along with the financial statements which describes the aims, performance and achievements of an audited body during a particular year.

NIAO. Northern Ireland Audit Office. The NIAO supports the C&AG in delivery of their functions and scrutinises public spending on behalf of the Northern Ireland Assembly.

Order (the). The Local Government (Northern Ireland) Order 2005.

Professional standards. In the context of the Code, professional standards comprise accounting standards, auditing standards, ethical standards and quality control standards – these are defined in this glossary.

Quality control standards. International Standard on Quality Management (UK) 1 (ISQM1) issued by the Financial Reporting Council or any other relevant standards with which the Local Government Auditor is required to comply.

Regulations. Secondary legislation made by the Department using powers conferred by the Northern Ireland Assembly.

Remuneration Report. A remuneration report provides details of members’ and senior management’s salary, pension and other benefits.

Report by exception. Reporting only when information or the results of the Local Government Auditor’s work is materially inconsistent with the understanding of the body or the requirements placed on the body.

Should. The Code of Audit Practice has been approved by the Northern Ireland Assembly. It has the status of secondary legislation and the Local Government Auditor’s compliance with the Code is mandatory. The use of ‘should’ highlights a specific requirement placed on the Local Government Auditor within the Code.

Studies for improving economy, efficiency and effectiveness. Under Article 26 of the Order, the Local Government Auditor may, and if required by the Department, shall, carry out ‘value for money’ studies in local government, to enable the Local Government Auditor to make recommendations for improving economy, efficiency in the provision of services by local government bodies.

Statement of accounts (also see Financial Statements). The financial statements, or Statement of Accounts, are statements that audited bodies are required to prepare which set out what they spend and receive and what they own and owe. For the purpose of providing the auditor’s opinion, the Code interprets relevant references in the Order to the ‘statement of accounts’ and the ‘accounts’ in respect of the general duties of auditors as equivalent to ‘financial statements’.

Third Sector. The third sector includes voluntary and community organisations, social enterprises and cooperative and mutual organisations.

Those charged with governance. The persons with responsibility for overseeing the strategic direction of the entity and obligations related to the accountability of the entity. This includes overseeing the financial reporting process.

Value for money. Arrangements in place to make the best use of resources through:

- economy – careful management of resources, keeping costs as low as possible whilst meeting appropriate standards and objectives;

- efficiency – obtaining an optimal relationship between the resources used and the outputs/impacts achieved; and

- effectiveness – achieving alignment between intended and actual outcomes.

Whole of Government Accounts. The Whole of Government Accounts (WGA) are the consolidated financial statements for the whole of the United Kingdom public sector, showing what the United Kingdom government spends and receives and what it owns and owes.