Executive Summary

1. On 30 November 2020 the Minister for Communities wrote to me as Local Government Auditor. The Minister issued a direction under Article 22 of the Local Government (Northern Ireland) Order 2005 that I hold an extraordinary audit of the accounts of Causeway Coast and Glens Borough Council, concentrating on land disposals and easements and related asset management policies and procedures.

2. My report details the findings and recommendations emanating from the audit of land disposals and easements in Causeway Coast and Glens Borough Council since its formation on 1 April 2015. This audit also included enquiries about land transactions that did not result in a disposal, or which are still ongoing.

3. During this audit we noted two particular cases where a number of significant failings were evident. The cases related to an easement granted in 2016 at Ballyreagh Road, Portstewart (“The Pits”) and a disposal of land in 2016 at Castleroe Road, Coleraine (“Castleroe”). These cases are included in some detail within this report.

- Chapter 1: Easement at Ballyreagh Road, Portstewart (‘The Pits’)

This easement granted to a developer was sealed by Council in March 2016 and signed for £1 in June 2016. Planning permission for a hotel complex was granted by the Council in June 2017, but was subsequently overturned as a result of Judicial Review proceedings in 2019. The following issues were found in respect of my review of the granting of this easement.

- There is a case for finding the easement has not been granted lawfully.

- There was a failure to demonstrate that best price was obtained including lack of professional valuation prior to the grant of the easement.

- Inadequate information was presented by Senior Council Officers to Committees and Council to enable them to make informed decisions.

- The Council’s Chief Executive was directly involved in the transacting of this easement.

- Inadequate records were kept of key matters.

- Inaccurate and unreliable information was provided to the Local Government Auditor.

- The conduct of some Senior Council Officers fell well short of expected standards.

- Chapter 2: Disposal of land at Castleroe Road, Coleraine

Council agreed in principle to sell the land in question to a registered charity, subject to satisfactory contractual, asset disposal and legal consideration, in order to facilitate the development of a boutique hotel in Coleraine. In October 2016, the memorandum of sale was signed for a value of £5,000. The following issues were found in respect of my review of the disposal of this land.

- There is a case for finding the disposal has not been granted lawfully.

- Failure to demonstrate that best price was obtained.

- The Council’s Chief Executive was directly involved in the transacting of this disposal.

- Inadequate records were kept of key matters.

- The advice and guidance of Legal Officers was not followed.

- The strategic impact of this disposal was not adequately considered.

- There were perceptions of conflicts of interest.

- The conduct of some Senior Council Officers fell well short of expected standards.

4. My review also examined a number of other cases and these have been detailed in Chapter 3. From this review four key themes have emerged, along with sub-themes of evidence that indicated, or led to, significant failings in a number of transactions as follows:

- Theme 1: The Council failed to demonstrate that it obtained best price in the transacting of land disposals and easements

- The Council did not fully consider the requirement to obtain best price, as directed by legislation and guidance, and failed to obtain adequate valuations for land disposals.

- Many disposals reviewed took a significant period of time to complete, tying up valuable Council resources and increasing costs.

- Theme 2: There were significant governance failings in the Council’s transacting of land disposals and easements

- Inadequate information was presented by Senior Council Officers to Committees and Council to enable them to make informed decisions.

- The roles and responsibilities of Senior Council Officers involved in transactions were unclear in a number of cases reviewed.

- There was inadequate challenge and oversight by Elected Members.

- Inadequate records were kept of key matters and key decisions.

- The advice and guidance of Legal Officers was not always followed.

- The strategic impact of recommended disposals was not adequately considered.

- Theme 3: The behaviour of some Senior Council Officers has fallen short of the standards expected in a public body

- Senior Council Officers failed to follow best practice and guidance in the transacting of Council assets.

- There were instances where the basis for decisions was not evidenced due to poor record keeping.

- On a number of occasions, information presented to Members was insufficient to allow them to make informed decisions.

- Whilst in some cases examined there seemed to be a momentum driven by Officers to complete transactions at speed, there were many other cases where transactions took an inordinate amount of time to complete.

- The extent of the detailed involvement of the Chief Executive in a number of cases reviewed was unusual.

- Examples have been highlighted of perceived conflicts of interest.

- A written response provided to the Local Government Auditor included inaccurate and unreliable information, despite being agreed by three Senior Council Officers.

- Theme 4: The Council failed to have adequate policies and procedures in place to protect its assets

- The delay in developing appropriate land and property policies led to the inefficient and ineffective management of the Council estate.

- There have been delays in the registration of land and property, an issue raised by the NIAO in audits for a number of years, with several adverse possession claims noted.

- The Council is unable to prove ownership of a number of its assets.

- The Council has maintained assets which it did not own.

- Procedures followed in the disposal of land and property were often inconsistent and disjointed.

5. Throughout this audit, I have identified evidence that adherence to legislation and best practice in land and property matters was not part of the culture of the Council. There was evidence that Senior Officers were advocating actions that were contrary to best practice. This leads me to conclude that a culture existed of bypassing best practice and guidance to get land ‘deals done’ which set the wrong tone from the top of the organisation. In some cases legal advice was ignored and, on one occasion, inaccurate and unreliable information was provided to the Local Government Auditor (Pits case). There was also evidence of poor governance, for example, there was a lack of clarity over roles and responsibilities, with various Officers being involved in land transactions that appeared to be outside their remit. The effectiveness of Elected Members’ challenge and oversight was also questionable at times. Underpinning all of this was evidence that the behaviour of some Senior Council Officers fell short of what is expected from public servants. I am also aware that there have been leaks of information on Council matters over a significant period of time which have eroded trust and further damaged working relationships within the Council.

6. This extraordinary audit has highlighted a number of concerns regarding land disposals, easements and related asset management policies and procedures. Some of the issues highlighted here have been the subject of a number of interventions including: a review by the Council’s internal auditor; approaches to the NIAO, the Department and others; a Judicial Review and a subsequent disciplinary process; and this extraordinary audit. This has been particularly costly for a Council which has been under significant financial pressure in recent years. There are cultural and behavioural issues which underlie many of the matters highlighted in this report. The resolution of these issues will require strong leadership and a willingness and commitment from Members and Officers.

7. My review has identified clear evidence that the behaviour of some Senior Council Officers has fallen short of the standards expected of employees in a public body. In considering the extent of serious and concerning behaviour by Senior Council Officers I consider this should be dealt with through Council and/or professional body processes.

8. Throughout this report, case studies have been used to evidence the significant failings listed above. There are lessons to be learnt in what can be a complex area for this Council and potentially others. I have made recommendations which I consider should be addressed as a priority to ensure that the Council adheres to statutory and other requirements and can demonstrate compliance with best practice (Annex A). I intend to keep the implementation of these recommendations under review.

Introduction

9. The purpose of this extraordinary audit is to carry out an independent audit and report to the Department for Communities (DfC). The purpose of this extraordinary audit as included in the the terms of reference (Annex B) was as follows:

- provide an overview of land disposals and easements and related asset management policies and procedures within the Causeway Coast and Glens Borough Council;

- conclude on the adherence to statutory and other requirements by the Causeway Coast and Glens Borough Council for land disposals and easements;

- consider any issues where expected procedures and good practice have been breached; and

- make recommendations for improvement.

10. The NIAO audit approach is a risk based approach and the audit was conducted in accordance with International Standards on Auditing (UK) (ISAs) and the Code of Audit Practice. Only land disposals and easements dealt with by the new Council (formed 1 April 2015) fell within the scope of this audit.

11. The Council was requested to provide a list of all land disposals made and easements granted since 1 April 2015 and a list of six cases was provided. A detailed review of all six was carried out. Council, committee and sub-committee meeting minutes were reviewed to identify instances where land disposals and easements had been presented, including those which did not eventually lead to a disposal. From this information, a risk assessment was used to select an additional sample of 18 cases for detailed examination. From this review, a number of failings are noted and discussed in this report. A summary of key events in each case discussed in this report is included at Annex D.

12. The audit has been undertaken by reviewing Council documentation in relation to the identified sample and included:

- checking adherence to statutory requirements, with reference to good practice and guidance as appropriate;

- reviewing policies and procedures;

- reviewing controls, including fraud controls specifically relating to land;

- reviewing documentation; and

- examining the role of Senior Council Officers and Elected Members (‘Members’).

13. In addition to the audit work performed, a public call for evidence was issued in relation to land disposals and easements and related asset management policies and procedures at Causeway Coast and Glens Borough Council. This was aimed at individuals and organisations who could provide evidenced information which was relevant to the purpose and scope of the extraordinary audit. Meetings were held with a number of individuals, and the evidence provided has been reflected in this report, where it can be corroborated by evidence held by the NIAO or the Council.

14. I acknowledge the assistance provided to the team by the Officers and Members of Causeway Coast and Glens Borough Council.

Background

15. Causeway Coast and Glens Borough Council was created on 1 April 2015 by the merging of Ballymoney Borough Council, Coleraine Borough Council, Limavady Borough Council and Moyle District Council. The Council has a population of approximately 140,000 and is led by 40 Councillors from seven District Electoral Areas. The Council recorded gross income of £74.3 million and gross expenditure of £75.8 million in its 2020-21 accounts and employs 644 employees (501 full-time and 143 part-time).

16. The Council is governed through a committee structure. At the top of the structure sits the full Council which is supported by the following committees:

- Leisure & Development – terms of reference agreed 14 April 2015;

- Corporate Policy & Resources – terms of reference agreed 21 April 2015;

- Planning – terms of reference agreed 22 April 2015;

- Environmental Services – terms of reference agreed 5 May 2015;

- Audit – terms of reference agreed 29 June 2015; and

- Finance – terms of reference agreed 24 October 2019.

17. There are also a number of sub-committees and working groups which have either terms of reference agreed by Council, or are tasked with a particular project.

18. At its first meeting on 21 April 2015, Members of the Corporate Policy & Resources (CP&R) Committee agreed the Committee’s terms of reference and that meetings would normally be held monthly, except during agreed recess periods. It was established that the CP&R Committee would be ‘responsible for recommending to Council the key decisions and actions required to be taken specifically in relation to the work of the Performance Directorate and the Finance Department’. In practice, this meant that all land and property related matters had to be reported directly to the CP&R Committee before a recommendation would be taken to Council.

19. At this meeting, Members also agreed that the Committee could ‘establish and appoint any number of sub-committees and working groups it deems necessary to consider in more detail the work of the Committee concerning specific issues related to the Performance Directorate and Finance Department’. To this end, the Land & Property (L&P) Sub-Committee was established and its Terms of Reference were agreed at its first meeting on 21 February 2017. The minutes of that meeting advised of three levels of decision-making within the L&P Sub-Committee’s remit:

i. operational issues, where it was anticipated straightforward land and property issues would be processed via the Director of Performance and Chief Executive;

ii. contentious issues, where a sub-committee need was defined for input and direction; and

iii. simple easements etc., which, it was anticipated, would be processed through the CP&R Committee.

The initial meeting of the L&P Sub-Committee also agreed that a Planning Officer would be in attendance at meetings, as and when required, and that meetings would normally be held monthly.

20. In summary therefore, from the creation of the Council in April 2015, all land and property related matters were initially reported directly to the CP&R Committee, before a recommendation was taken to Council. From February 2017, following the establishment of the L&P Sub-Committee, all key decisions and actions in relation to the work of the Land and Property section within Council required recommendation or approval firstly through the L&P Sub-Committee, then the CP&R Committee and then onto Council. In any event, Section 7(3) of the Local Government Act (Northern Ireland) 2014 provides that “a Council’s functions with respect to…(d)…disposing of land may only be discharged by the Council itself”. There was no formal delegation of decision-making from Council in place.

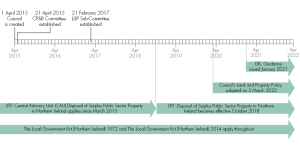

21. The relevant legislation and guidance in relation to land and property matters from the creation of the Council in April 2015 can be summarised as follows:

|

Legislation / Guidance |

Applicability |

Effective from |

Relevance |

|---|---|---|---|

|

The Local Government Act (Northern Ireland) 1972 |

Applies to the Council – legal basis |

25 March 1972 |

Section 96(5)(a): “Except with the approval of the Ministry1, any disposal of land shall be at the best price or for the best rent or otherwise on the best terms that can be reasonably obtained.” Therefore, the Council can dispose of land at less than best price/terms, albeit with Departmental approval. It has been confirmed with DfC, that since its creation in April 2015, the Council has not sought approval for land disposals at less than best price/terms. |

|

The Local Government Act (Northern Ireland) 2014 |

Applies to the Council – legal basis |

1 April 2015 |

Sections 79 – 83: Relates to general powers of competence of councils. Section 79(1): “A Council has the power to do anything that individuals generally may do” (unless there is a law to prevent it from doing so). Section 79(4): “Where subsection (1) confers power on the Council to do something, it confers power […] to do it in any way whatever, including: (a) power to do it for a charge or without charge; and (b) power to do it for, or otherwise than for, the benefit of the council, its district or persons resident or present in its district.” |

|

Land and Property Service (‘LPS’) Central Advisory Unit (‘CAU’) Disposal of Surplus Public Sector Property in Northern Ireland March 2013 (‘LPS’ 2013 Property Disposal Document’) |

Best practice for the Council with the Council ‘strongly encouraged’ to follow it. Whilst relevant public sector bodies should ensure the guidance is incorporated into their property disposal procedures, the Council as an ‘other public sector body’ should regard this guidance as best practice in general terms. In the definition of ‘relevant public sector bodies’ it is noted that the CAU ‘strongly encourages district councils to adopt this guidance and it routinely includes them in the clearing house procedure in respect of surplus properties declared by other bodies in their area’. |

April 2013 - superseded by October 2018 LPS guidance |

Contains guidance on the disposal of surplus public sector property to ensure that value for money is achieved and high standards of propriety are maintained. Sections include: identification and disposal of surplus property; notification of disposal to LPS and CAU; open market sales – agents, methods and marketing; and sale price and market value. It is noted that ‘…Property Centres and Accounting Officers…should not normally depart from the guidance unless there is a very good reason to do so’ and that ‘compliance with these guidelines can be important in the context of a Judicial Review or an investigation…’ It has been confirmed with DfC that granting of a land easement is considered to be a disposal of property – therefore, this guidance is applicable to both land disposals and granting of easements. Per paragraph 6.2: ‘The transfer must take place at the best value obtainable, being no less than Market Value assessed in accordance with the Royal Institution of Chartered Surveyors Valuation Professional Standards Global & UK 8th Edition (March 2012) (the RICS Red Book). (In special circumstances and with the agreement of the Ministers on behalf of both the disposing and acquiring bodies, a transfer may take place at less than best value – see paragraph 9.4).’ Per paragraph 9.4: ‘While public sector disposals should normally be made at the best price reasonably obtained for the property, there may occasionally be cases where it will be reasonable to consider wider issues and accept an amount lower than best price. This should only be done in highly exceptional circumstances and must be justified by the public body’s Accounting Officer and approved at Ministerial level.’ DfC has confirmed that it has never received a request from the Council to approve the disposal of land at a price below best price. |

|

LPS’ Disposal of Surplus Public Sector Property in Northern Ireland October 2018 (‘LPS’ 2018 Property Disposal Document’) |

Best practice for the Council with the Council recommended to follow it. Whilst the Council does not fall into the list of public sector bodies defined as expected to adhere to this policy, bodies not within the list are ‘recommended to apply this policy and guidance’. |

October 2018 |

Contains guidance on the disposal of surplus public sector property as a result of an increased demand for rigour and transparency in the disposal process. The main areas of update from LPS’ 2013 Property Disposal Document (above), which this supersedes, are: timescales to progress circulation process; new IT system; internal and external markets; community asset transfers; roles and responsibilities; quick reference guide and Frequently Asked Questions. As with LPS’ 2013 Property Disposal Document, this guidance would be applicable to both land disposals and easements. Per paragraph 6.13: ‘When a property is to transfer at best price that figure should be no less than Market Value as defined by the relevant Royal Institution of Chartered Surveyors (RICS) Valuation – Global Standards 2017 document (the Red Book) or subsequent editions…’ |

|

Council’s Land and Property Policy 3 March 2020 |

Applies to the Council – their own policy |

3 March 2020 |

In line with the Council’s Estate Management Strategy, the purpose of the policy is to:

|

|

Department for Communities (Northern Ireland) Guidance for District Councils Local Government Disposal of Land at Less Than Best Price January 2021 |

Applies to the Council – ‘All Northern Ireland local councils should adhere to this guidance…’ |

January 2021 |

Sets out the processes to be used when a council wishes to dispose of land without charging the prospective recipient of that land the full market value. Note this applies equally to sales and easements. Per paragraph 3.2: ‘A council must seek the approval of the Minister to dispose of any land at less than best price or at less than best rent or otherwise on less than best terms that can reasonably be obtained.’ |

22. The following timeline indicates the statutory and other guidance relevant to the Council in its handling of land and property issues.

Other relevant considerations from legislation, policy and guidance:

i. Share in future value increases

23. In terms of public bodies’ ability to share in future increases in value, LPS’ 2013 Property Disposal Document and LPS’ 2018 Property Disposal Document state that the failure of disposing bodies/asset owners ‘to secure a share of uplifts in the development value of surplus land has in the past attracted audit and Public Accounts Committee criticism. Particularly in a buoyant market, there is always a risk that property may be purchased and sold again within a short time period for a profit. In order to safeguard a share of such windfall and speculative gains, and to ensure a maximum value is received following disposal, it is recommended that some means of participating in future profit or gain is considered in every case of land with development potential. These cases tend to produce difficult issues and raise questions to which there may be no single correct solution. To minimise the risk of criticism, disposing bodies should follow these guidelines and obtain appropriate legal and valuation advice on a case by case basis’.

ii. Clawback/Overage

24. The guidance further outlines the concept of ‘overage’ clauses in a contract which ‘provide for additional sums to be paid to the vendor, over and above the original purchase price, if and when certain trigger events occur’. The guidance states that overage clauses may ‘provide for income sharing where land is resold by the purchaser, usually after some improvement, for a sum that is greater than that expected at the time of the contract’. It continues ‘income sharing may also be appropriate where land is developed by the purchaser more profitably than was expected at the time of sale…The most common application of overage however is to enable vendor participation in value increases arising from new planning consents…not reflected in the market assumptions at the date of sale’.

25. Council’s own March 2020 Land and Property policy also refers to consideration being made, in every case involving third party requests to purchase Council land, over whether it is necessary to agree a clawback or overage clause.

iii. Special/marriage value

26. LPS guidance also introduces the concept of special or marriage value to a potential purchaser. Under the ‘definition of best value’ heading, it is stated to include ‘where applicable, any special value attributable to the bid of a particularly willing buyer, for whom a certain asset has special value because of advantages arising from its ownership that would not be available to general buyers in the market e.g. due to “marriage value”. It will also include “synergistic value” which is defined by the RICS Red Book as “An additional element of value created by the combination of two or more interests where the combined value is more than the sum of the separate values” (may also be known as marriage value).’

iv. European Union state aid rules

27. Any sale at less than best price had the potential, when the UK was a member of the EU, to breach European Union state aid rules. This is on the basis that by selling at less than best price, the purchaser is in effect granted the value of the gap between the sale price and the open market price. Whether a particular sale at less than best price amounts to state aid is not a straightforward assessment, but suffice to say that if any sale at less than best price has occurred there is a significant risk of such.

Chapter 1: Easement at Ballyreagh Road, Portstewart (‘The Pits’)

Summary case details

28. In this case, an approach was made by a developer to the Chief Executive in 2015, followed by a meeting in October 2015 between Council Officers, the developer and representatives from the North West 200 (a Northern Irish motorsport event). A request for an easement over Council land to allow site access for a proposed hotel development project at Ballyreagh Road, Portstewart was then presented at a CP&R Committee in January 2016. The report stated that a valuation of the land would be obtained. The CP&R Committee agreed to recommend that Council grant the request, in principle, subject to satisfactory contractual, legal and asset disposal considerations and conditional on planning considerations. This recommendation was adopted by Council that same month and the easement was sealed by Council in March 2016 and signed for £1 in June 2016. Planning permission for the hotel complex was granted by the Council in June 2017, but was subsequently overturned as a result of Judicial Review proceedings in 2019.

1.1 There is a case for finding the easement has not been granted lawfully

29. In my view:

- the grant of the easement was not properly authorised;

- the easement was granted without proper compliance with section 96(5) of the Local Government Act (Northern Ireland) 1972; and

- the easement was otherwise granted without considering key matters.

The grant of the easement was not properly authorised

30. The easement was not properly authorised by the Council. This is evidenced as follows:

- On 19 January 2016 the Council’s CP&R Committee “AGREED: to recommend that the Council grants, in principle, access/servitude rights over its land to permit site access subject to satisfactory contractual, legal and asset disposal considerations and conditional on planning considerations”

- On 26 January 2016 the Council approved the recommendation. The approval was an approval of an “in principle” recommendation which was subject to a number of factors which required judgment to be exercised as to whether or not the considerations had been dealt with “satisfactorily”/such as to satisfy the conditional approval.

- Section 7(3) of the Local Government Act (Northern Ireland) 2014 provides that “a council’s functions with respect to … (d)… disposing of land may only be discharged by the Council itself”. Accordingly, only the Council could exercise the judgment required to be exercised on the factors outlined in the “in principle” approval.

- There was no further report to the Council dealing with those factors. Instead, on 22 March 2016 the Council “AGREED” that the Seal of the Council be affixed to the easement. It appears that there was no written report to the meeting, and the audio recording indicates that this was included in a number of items in agenda item 15 seeking authority to affix the Council’s Seal, which Members were told by the chairperson had previously been considered by a committee and which were treated as a matter of form rather than requiring a decision on the merits of the transaction. There was no identification of the land over which the easement should be granted, or the terms of the easement, or the consideration (if any) which was to be given for it. I do not therefore consider that this was a proper authorisation of the grant of the easement in the absence of any further report on the matters which the initial approval had been made “subject to” or “conditional on”. As such there was no proper authorisation to allow the easement to be granted.

The easement was granted without proper compliance with section 96(5) of the Local Government Act (Northern Ireland) 1972

31. Section 96(5) of the Local Government Act (Northern Ireland) 1972 provides that “the right of a council to dispose of land shall be subject to the following restrictions – (a) except with the approval of the Ministry, any disposal of land shall be at the best price or for the best rent or otherwise on the best terms that can be reasonably obtained…”

32. It was confirmed with DfC in February 2021, that since its creation in April 2015, the Council has not sought approval for land disposals at less than best price/terms. Therefore no approval was sought for this disposal. It was therefore unlawful for the Council to proceed with the granting of an easement unless it had considered whether the disposal was at the best price, or for the best rent, or otherwise on the best terms. As set out above, only the Council itself can decide to dispose of any land, and the Council did not consider the matters set out in section 96(5).

33. At a meeting of several Officers of the Council held on 3 March 2016 a discussion took place about the requirements of section 96(5) of the Local Government Act (Northern Ireland) 1972, and a decision was taken that the Projects Director from the Strategic Investment Board (SIB) would produce a note following the meeting (known as the ‘SIB Report’).

34. The SIB Report was produced the same day. It did not constitute a professional valuation. Furthermore, references to the economic value/benefit to the Borough of proceeding with the transaction are legally irrelevant considerations (for the Council) as section 96(5) requires consideration only of the commercial value of the transaction. If the commercial value is not such as to enable the Council to form the view that the disposal is at best price, best rent or on the best terms then the disposal needs to be referred to the DfC in order that it can take account of the wider benefits in reaching a decision on disposal.

35. In any event, there is no evidence that the SIB Report was considered by any Officer after it was received, and it was certainly not put before full Council.

36. Accordingly, in my view the easement was not granted in accordance with section 96(5) of the Local Government Act (Northern Ireland) 1972.

The easement was otherwise granted without considering key matters

37. There was no attempt by the Council to ensure that its own legal costs for granting the easement were covered by the grantee, as is normal commercial practice. This was a failure to consider a relevant consideration in granting the easement.

38. There was also no consideration by the Council of whether or not the grant of the easement constituted state aid. Again, a relevant consideration in granting the easement was not taken into account.

Conclusion

39. I have not been provided with evidence needed to conclude that the decision to grant this easement was in accordance with legislative and other key matters. I have sought legal advice on this matter and, in consideration of this, there is a case for finding the easement has not been granted lawfully.

1.2 Failure to demonstrate that best price was obtained including lack of professional valuation prior to the grant of the easement

40. The ‘Background’ section of this report outlines the requirement to obtain best price as directed by the legislation and guidance. In this case, the Council did not demonstrate that it obtained best price.

41. Deficiencies were noted in the attainment of best price in this case as follows:

- no professional valuation was carried out prior to the easement being granted;

- instructions to value were found to be verbal/inadequate;

- omission of profit sharing/overage clauses;

- omission of marriage value/other special value to the potential purchaser;

- omission of other elements of retained control over land; and

- LPS process mentioned but not followed.

No professional valuation was carried out prior to the easement being granted

42. The request for the easement was initially considered at a CP&R Committee meeting in January 2016. The paper presented by Council Officers to the Committee indicates that a valuation of the land would be obtained. The recommendation by the Committee was that the Council approve the request subject to satisfactory, contractual, legal and asset disposal considerations. The minutes of this meeting were adopted by Council in January 2016 and the easement was then sealed by full Council in March 2016, with a consideration of £1.

43. The notes from a meeting held between Council Officers on 3 March 2016 clearly indicate that a valuation was still required. However, despite this, the easement was not professionally valued prior to its grant. Therefore the Council cannot demonstrate how best price was ensured or how the £1 value was justifiable.

44. When the Council was asked why a valuation was not carried out prior to the easement being sealed, it stated that an independent government expert from SIB with expertise in asset management had provided an opinion and that Officers gave considerable weight to this expert opinion. The opinion to which they refer is contained within the SIB Report. The SIB Report reviewed as part of this audit was undated and it was not clear who the intended reader was or who had prepared it. It is noted from the Judicial Review court proceedings held in 2019, that the supposed author of this document was a Projects Director from SIB covering Causeway Coast and Glens Borough Council and another council. Within the Council, his role was to support overall capital programme management, together with the higher value and/or risk projects, and provide general project delivery and strategic advice. The author of the SIB Report is not a professional valuer but it is understood that he was asked to provide a note following the meeting he attended with Council Officers on 3 March 2016. There was no evidence that the author was instructed to prepare a valuation, but it seems that, according to Council Officers, the SIB Report formed the basis for a de-minimis valuation.

45. A professional valuation of the easement was subsequently obtained in July 2017 (‘retrospective valuation’), more than one year after the deed of easement had been signed, when the possibility of a Judicial Review became apparent and following an enquiry by the NIAO. The ‘retrospective valuation’ had a valuation date of 31 March 2016 and provided a de-minimis value.

Instructions to value were found to be verbal/inadequate

46. Council Officers sought the ‘retrospective valuation’ in July 2017, however, I did not find any evidence of written instructions being issued to the valuer. When this was queried with the Council, it directed me to the actual valuation document. Following a further query, the Council referred to a letter dated 19 January 2017, seeking valuations of three properties, including this piece of land and attaching maps with no further detail. This valuation request related to a potential disposal rather than the valuation of the initial easement. It was noted, through the review of files for Judicial Review proceedings in this matter, that verbal instructions were issued. In any event, the instructions directed to the valuers are, in my opinion, inadequate.

Omission of profit sharing/overage clauses

47. The meeting held on 3 March 2016 was attended by the then Assistant Solicitor, the Director of Performance/Corporate Services, a Land and Property Officer and the Projects Director from SIB. The handwritten notes indicate that there were discussions relating to the possibility of including an overage clause. However, the easement did not contain such a clause.

Omission of marriage value/other special value to the potential purchaser

48. In granting the easement for £1, the potential for marriage value if the developer obtained access over land adjacent to the proposed hotel development does not appear to have been taken into account.

Omission of other elements of retained control over land

49. The handwritten notes of the meeting held on 3 March 2016 document that it was ‘too late to go back re a clawback. Already agreed in principle to this’. However, it was noted that the easement was not sealed until later that month and had previously been approved subject to satisfactory contractual, legal and asset disposal considerations, therefore it is unclear as to why the insertion of a clawback clause was considered to be too late. This was queried with the Council and it reiterated that the economic benefit to the Borough outweighed the short term benefit to the Council, which was confirmed by advice from SIB, stating that the value of such a clause in legal terms is of questionable value in relation to a grant of easement. The SIB Report also recommended that a clause be inserted into the deed or agreement, requiring Council approval of any works to be carried out on the land by the dominant estate, but this did not happen. Such clauses would have gone some way to protect the Council’s interest in the land, leaving the Council with a degree of control.

LPS process mentioned but not followed

50. The handwritten notes of the meeting held on 3 March 2016 also mention the LPS guidance (LPS’ 2013 Property Disposal Document would have been applicable at that time) stating ‘if we add reasonable justification – broader view of best value’, ‘need to implement process for a case by case analysis’ and refers to the need to ‘follow guidance – unless there is a reason. Document rationale and keep on file’. Although there was evidence that the guidance was discussed, review of the file clearly indicated that the guidance was not followed. In an affidavit in Judicial Review proceedings, the asset disposal process and D1 Public Sector Clearing House arrangements (per LPS’ 2013 Property Disposal Document) were referred to as having been discussed in the weeks prior to this meeting. It appears that the SIB Report was considered by Council Officers to be adequate justification for deviating from the guidance. The SIB Report stated that ‘it could be argued that a higher value could be obtained for the easement on the land on the basis that it is key land for the proposed development. However, this has to be weighed against the broader benefits to Council that would accrue from the development proceeding’. The SIB Report then lists a number of monetary and non-monetary benefits including business rates income, jobs and encouraging growth in the primary and secondary sectors of business and industry. As already mentioned above, section 96(5) of the Local Government Act (Northern Ireland) 1972 requires consideration only of the commercial value of the transaction and therefore other considerations in the attainment of best value are legally irrelevant.

Council response to queries raised

51. A number of queries were raised with the Council on the issues identified above, but Senior Council Officers’ responses repeatedly referred to the economic value/benefit to the Borough as justification for the decisions taken. I do not consider that these responses sufficiently excuse the divergence from good practice and guidance. Responses in relation to a number of other queries raised were found to be either incomplete or unsatisfactory.

52. In my opinion, this case demonstrates little regard for getting the best price for the Council and ratepayers.

1.3 Inadequate information was presented by Senior Council Officers to Committees and Council to enable them to make informed decisions

53. The ‘Background’ section of this report outlines the LPS guidance which advises on what should be included in submissions seeking approval for transfers within the public sector. In this case, key information was found to be missing from the report brought to Members at the CP&R Committee in 2016 as follows:

- valuation – no professional valuation was brought to Members at this committee meeting or indeed prior to granting of the easement;

- consideration of the wider impact on the Council; and

- details of the size of the land (although a map was provided).

54. In this case, a handwritten note was held on file as an Officer’s record of a meeting on 3 March 2016. The handwritten note raised the following queries ‘need to review – what kind of licence is required – how much land do they need’, which confirms that important detail was not provided to Members in the report presented. The Council confirmed that all information available at the time was presented to Members, however, they acknowledged that, in hindsight, additional information may have been necessary. The Council has advised it has learnt from this experience and introduced new policies and procedures with additional staff including a dedicated Land and Property Solicitor, Asset Realisation Officer and a Land and Property Sub-Committee.

55. Members’ scrutiny of the merits of a potential easement was more difficult as incomplete information was presented to them which may have resulted in incorrect decisions being made.

1.4 The Council’s Chief Executive was directly involved in the transacting of this easement

56. In this case, email correspondence on file from the Chief Executive stated that the ‘document is ready but requires final sign off at the month’s Council meeting…It is a procedural formality…’. The easement had been approved subject to satisfactory contractual, asset disposal and legal considerations, but at this point a valuation had yet to be carried out. There is no evidence of a reference to outstanding matters being addressed prior to seeking this approval. An internal email from the Chief Executive to the Director of Performance/Corporate Services in February 2016 notes ‘let’s turn this around really quickly’ and the Director of Performance/Corporate Services then asks the then Assistant Solicitor and the Council Solicitor to ‘add this to the priority list’. It is unclear why Senior Council Officers were demanding a quick turnaround, given that other land and property issues were protracted over so many years, but the approach resulted in key actions not being undertaken. Despite the speediness of this, an associated planning decision which included the granting of this easement, was ultimately challenged through the courts in a Judicial Review in 2019. Significant staff time has been incurred in defence of this legal challenge, as well as external legal costs. Staff time has been diverted away from other important land issues, in particular the initial registration of lands, an issue for the Council, which I refer to later in this report.

57. Transcript tapes of a conversation between a Member and the then Assistant Solicitor in this case, agreed to by the judge in Judicial Review proceedings as being admissible in court, included the fact that the Chief Executive pushed the development project ‘very hard and put pressure on everyone to just get this done’ and that was the ‘directive’ issued by him. Also, he instructed the then Assistant Solicitor to carry out tasks with which he was ‘uncomfortable’. In an affidavit as part of the Judicial Review proceedings, the Senior Council Solicitor (previously Assistant Solicitor) clarified that he was referring to his unfamiliarity at that time with internal processes and the approach of the management team which was to produce results quickly, the combination of which caused him to feel uncomfortable from time to time. Occasionally he contacted his superior for advice. When he refers to his advice to do what the Chief Executive told him, the Senior Council Solicitor added that neither he nor his superior were, for a moment, contemplating anything improper, it was really the management style they were talking about.

58. I find the extent and nature of the issues raised in this case concerning. There appears to have been a culture of pressure to get ‘deals done’, bypassing best practice and guidance and prioritising the prospect of the hotel development over due process and good value for the Council. It is never acceptable to circumvent proper procedures which are there to protect Members and Officers, and to ensure that both domestic and European legislation is not breached. This culture within the Council led directly to the easement being granted without full considerations being followed up on, including the omission of a professional valuation.

1.5 Inadequate records were kept of key matters

59. In this case, the Council was asked to provide a copy of the minutes of the meeting which took place with the developer in October 2015. Confirmation was also sought as to who attended the meeting between the Council and the developer in December 2015, referred to in the files reviewed. The Council provided handwritten minutes of the meeting in December 2015 from which it is difficult to ascertain the attendees, but they included architects, planning consultants, staff from Events/Operations, Planning, Tourism, the Council’s Chief Executive, Director of Performance/Corporate Services and Director of Leisure and Development. No minutes were provided by the Council of the initial meeting prior to this in October 2015, but the Council noted that attendees other than the Council included representatives of the North West 200 and the developer. This was in order to hear the concept of a possible development adjacent to the area leased to the North West 200. Meetings taking place without being minuted result in a lack of transparency and make it impossible to evidence the attendees at the meeting and the detail of the discussions which took place.

1.6 Inaccurate and unreliable information was provided to the Local Government Auditor

60. In June 2017, an individual (treated as a whistleblower), asked ‘if it is was within the powers of the Local Government Auditor to investigate whether or not a Council obtained best value for money for its ratepayers if it choose (sic) to provide an access easement over lands to a developer for £1 when the said access was essential to the development and in consequence might have had ‘key land’ value.’

61. Enquiries were made to the Chief Executive of the Council to seek details of the procedures followed by the Council to agree the access easement in this case and specifically how the Council ensured it safeguarded and secured value for money from the public funds and resources at its disposal.

62. On 4 July 2017, a response was received from a Senior Council Officer. This letter included the following attachments:

- Corporate Policy and Resources Committee minutes and attachment referring to the easement matter, dated 19 January 2016;

- Council minutes dated 26 January 2016 which were referred to in the letter as ‘council minutes in respect of the decision’; and

- Report of Strategic Investment Board (‘SIB Report’).

63. The letter referred to the need for a hotel in the area and to a scoping study carried out by the former Department for Social Development in 2015, which specifically identified the need for the type of hotel the developer intended to build. The letter then referred to the easement as follows (emphasis in bold added): Council agreed to grant an easement through an area of land which is already leased to the Coleraine and District Motor Club and on which there is an NIE substation under a wayleave agreement. Therefore, Council could do very little with this land and the motor club consented to an easement being granted to encourage and show its support for the project. Council still retains ownership of the land with the easement granting a right of way for the hotel development. The decision to grant the easement for £1 was based on the ’SIB Report‘. This report is commercially sensitive and should not be disclosed. The monetary value of granting the easement would have been de-minimis and the value of the project to the borough is considerable and far outweighs the de-minimis value.

64. On receipt of this information, a reply was made to the whistleblower, outlining that the response was based on enquiries made with the Council, and detailing the involvement of the CP&R Committee and the Council. In addition, the whistleblower was told that the Council had received advice from SIB which considered the wider benefits of the hotel development and had advised a de-minimis value was appropriate. The response to the whistleblower concluded that: ‘as Council approved the granting of this easement, Council officials had taken professional advice on this matter prior to seeking the approval and as Council has identified this is within its powers and remit this action would seem appropriate.’

65. I was advised of the commencement of a Judicial Review process later in 2017 in respect of this proposed hotel development.

66. As more information came to light during the Judicial Review process and in the course of this audit, I note the following:

- An independent professional valuation of the easement should have been made available to the CP&R Committee and Council when the matter was brought to them for a decision.

- As noted above, the SIB Report reviewed as part of this audit was undated and it was not clear who the intended reader was or who had prepared it. It is noted from court proceedings that the supposed author of this document was a Projects Director for SIB covering Causeway Coast and Glens Borough Council and another council. Within the Council, his role was to support overall capital programme management, together with the higher value and/or risk projects, and provide general project delivery and strategic advice. The author of the SIB Report is not a professional valuer.

- When the Council responded to the enquiries made, the SIB Report was mispresented as having been provided to Council, with the letter stating: ‘The decision to grant the easement for £1 was based on the SIB Report.’ It is now clear the SIB Report had never been provided to Members and indeed came after the Committee and Council meetings where the easement was agreed and then ratified.

- The SIB Report has been widely criticised, specifically by Mr Justice McCloskey in the Judicial Review when he referred to it as ‘an irregular internal valuation of the easement over Council lands’. When received by the Local Government Auditor, it was identified as an attachment ‘Report of Strategic Investment Board’ and by its importance as being part of the decision process.

67. I therefore consider that the information provided by the Council in response to enquiries made was inaccurate and unreliable. Furthermore, I am now aware from this audit that a number of Senior Council Officers agreed the response to the enquiries made before it was sent, which is of particular concern as this resulted in me providing a conclusion to the whistleblower that appropriate action had been taken.

1.7 The conduct of some Council Officers fell well short of expected standards

68. I examine the role of Officers in this case and others in Chapter 3 of this report.

69. There were indicators of wilful misconduct which I considered carefully in my assessment of whether the overall threshold for each individual officer assessed was reached. In conclusion, regarding the assessment of wilful misconduct it is my view the threshold has not been adequately reached for any officer. Whilst I found that the behaviour of Senior Council Officers was serious and concerning, I consider these can more properly be dealt with through Council and/or professional body processes.

Chapter 2: Disposal of Land at Castleroe Road, Coleraine

Summary case details

70. In mid-2015 there were discussions between the Chief Executive, a private developer and his business partner and a registered charity that were seeking to purchase Council land for parking and amenity, to progress a project to create a five-star boutique hotel and conference centre. A report was taken directly to Council in December 2015, where Officers responded to queries relating to the value of the plot of land owned by Council and the procedure for disposal of assets. Council agreed in principle to sell the land in question to the registered charity, subject to satisfactory contractual, asset disposal and legal consideration, in order to facilitate the development of a boutique hotel in Coleraine. In October 2016, the memorandum of sale was signed for a value of £5,000.

2.1 There is a case for finding the disposal has not been granted lawfully

71. In my view:

- the disposal was not properly authorised;

- the disposal was made without proper compliance with section 96(5) of the Local Government Act (Northern Ireland) 1972; and

- the disposal was otherwise made without considering key matters.

The disposal was not properly authorised

72. This is evidenced as follows:

- On 15 December 2015 the Council reviewed a report entitled “Land sale for Boutique Hotel Development” and AGREED: “in principle, to sell the land in question to a registered charity, subject to satisfactory contractual, asset disposal and legal consideration, in order to facilitate the development of a boutique hotel in Coleraine.”

- On 12 January 2016, a report prepared by the Projects Director for SIB was provided to the Chief Executive and Director of Leisure and Development. The report recommended the sale of the land at an agreed non-key land price to facilitate and enable the development to proceed and indicated that this clearly achieved best value for Council. It further concluded that the land value was very low and therefore the CAU process was “likely to be a significant percentage or even exceed the value that would be obtained”. There is no record of this report having been taken to Council.

- Section 7(3) of the Local Government Act (Northern Ireland) 2014 provides that “a council’s functions with respect to … (d)… disposing of land may only be discharged by the Council itself”. Accordingly, only the Council could exercise the judgment required to be exercised on the factors outlined in the “in principle” approval.

- Although the Council agreed “in principle” to the sale in the meeting held on 15 December 2015, there was no further report to the Council to deal with the considerations (satisfactory contractual, asset disposal and legal considerations) that the “in principle” decision was subject to. Instead, the memorandum of sale was signed on 18 October 2016 by the purchaser and signed by the Council on 23 November 2016 by the Chief Executive and the Mayor without any further Council or other committee meeting considering the sale, its terms, or the consideration (if any) which was to be given to it. I do not consider that the Council’s “in principle” decision of 15 December 2015 authorised the sale. The Members could not have considered that they were being asked to take any such decision (as opposed to merely agreeing the sale “in principle”) with the limited information provided. Accordingly, the memorandum of sale was not properly authorised before being signed by Officers of the Council.

The disposal was made without proper compliance with section 96(5) of the Local Government Act (Northern Ireland) 1972

73. Section 96(5) of the Local Government Act (Northern Ireland) 1972 provides that “the right of a council to dispose of land shall be subject to the following restrictions – (a) except with the approval of the Ministry, any disposal of land shall be at the best price or for the best rent or otherwise on the best terms that can be reasonably obtained…”

74. It was therefore unlawful of the Council to proceed with the disposal unless it had considered whether the disposal was at the best price, or for the best rent, or otherwise on the best terms. As set out above, only the Council itself can decide to dispose of any land, and the Council did not consider the matters set out in section 96(5).

75. The memorandum of sale was signed by the Council on 23 November 2016 for consideration of £5,000. It did not appear from the review of the records as part of this extraordinary audit that any consideration was given to seeking an indemnity to at least cover the Council’s costs as a term of the sale. It would seem that this could contribute to the finding under this sub-heading that the disposal was unlawful in this regard (even if the land to be developed or the hotel had no value which could be “ransomed”). Such an indemnity would have been a reasonably obtainable term of monetary value to the Council which any reasonable authority would have considered obtaining, and insisting upon, in the circumstances.

76. Although a professional valuation was carried out on 5 November 2015 by a valuer before the memorandum of sale was signed, it was carried out on the basis of the land comprising “poor amenity lands” and no special value to the purchaser or developer was considered. It is noted that the valuer was in separate discussions with the developer at that time around potential lease terms from the registered charity. There is no evidence to demonstrate that the sale for £5,000 would be for the best price or terms reasonably obtainable. It is not clear from the minutes of the Council meeting on 15 December 2015 that the Members or Officers were made aware that a higher value might be obtainable due to marriage value or the possibility of an open market sale to make sure the best value was obtained. Accordingly, the Council failed to comply with section 96(5) of the Local Government Act (Northern Ireland) 1972.

77. The report prepared by the Projects Director for SIB on 12 January 2016 recognised by inference that a higher value could be obtained as the Council’s interest in the land might have a “ransom value”. However, it went on to recommend the sale by consideration of the economic and tourism benefits of facilitating the development. These references to the economic value/benefit to the Borough of proceeding with the transaction are legally irrelevant considerations (for the Council) as section 96(5) requires consideration only of the commercial value of the transaction. If the commercial value is not such as to enable the council to form the view that the disposal is at best price, best rent or on the best terms then the disposal needs to be referred to the DfC in order that it can take account of the wider benefits in reaching a decision on disposal.

78. In any event there is no evidence that the report prepared by the Projects Director for SIB was put before full Council and it was confirmed with DfC in February 2021, that since its creation in April 2015, the Council has not sought approval for land disposals at less than best price/terms. Therefore no approval was sought for this disposal.

79. Accordingly, the disposal did not comply with section 96(5) of the Local Government Act (Northern Ireland) 1972.

The disposal was otherwise made without considering key matters

80. There was no attempt by the Council to ensure that its own legal costs for granting the disposal were covered by the grantee, as is normal commercial practice. A relevant consideration in granting the disposal which should have been taken into account.

81. There was also no consideration by the Council of whether or not the disposal constituted state aid. Again, this amounted to a failure to consider a relevant consideration in making the disposal.

Conclusion

82. I have not been provided with evidence upon which I can conclude that the decision to dispose of the land was in compliance with relevant legislation. I have sought legal advice on this matter, and in consideration of this and the evidence as a whole, I conclude there is a case for finding the disposal has not been made lawfully.

2.2 Failure to demonstrate that best price was obtained

83. The ‘Background’ section of this report outlines the requirement to obtain best price as directed by the legislation and guidance. In this case, the Council did not demonstrate that it obtained best price.

84. Deficiencies were noted in the attainment of best price in this case as follows:

- land disposed of at a value which was challenged by Officers and Members;

- instructions to value were found to be verbal/inadequate;

- omission of profit sharing/overage clauses;

- omission of marriage value/other special value to the potential purchaser;

- omission of other elements of retained control over land; and

- LPS process mentioned but not followed.

Land disposed of at a value which was challenged by Officers and Members

85. The land was valued using an external valuer in November 2015 at £5,000. However, evidence indicates that the basis of valuation was queried internally by the Council’s Solicitor who stated in an email that it was clear that it was key land and had a value. In internal emails that same month, the Chief Executive refers to the land as ‘swampland of no economic value’. A report brought to Council by Council Officers the following month defined the lands as ‘poor amenity lands’. In response to a query to the Council as to how it was satisfied that best value was obtained in this particular transaction, the Council referred to the valuation. Council minutes record that Officers ‘responded to queries relating to the value of the plot of land’. However, when the Council was asked what these queries were, and if they were satisfactorily resolved prior to disposal, the response was found to be inadequate. Concerns were also raised by Council Officers regarding the potential disposal in that ‘strategically it would scupper any plans for future public realm and access potential’. This issue is discussed later in this Chapter. Council minutes do not record whether Members were made aware that the valuer was also involved in discussions with the potential developer, a potential conflict of interest raised later in this Chapter. In early discussions with the Chief Executive in October 2015, the valuer makes it clear that he has been discussing provisional leasing terms with the developer for his hotel project idea. In my view there are a number of unanswered questions regarding the basis of the valuation obtained.

Instructions to value were found to be verbal/inadequate

86. The valuation report refers to emailed instructions, but the email viewed was not considered to be sufficient as a written instruction. The Council eventually confirmed that the instructions to the valuer were provided by telephone. The use of verbal instructions provides no evidence that correct and accurate instructions were given, taking account of all relevant circumstances. In any event, the instructions directed to the valuers are, in my opinion, inadequate.

Omission of profit sharing/overage clauses

87. Even though the Council was aware of the proposed development of the site, profit sharing/overage clauses were not included in the disposal document. This is despite overage being specifically considered in an email from February 2016 from the Project Director for SIB to the Director of Performance/Corporate Services stating ‘We can also consider an overage clause where if the development is “flipped” for a large profit in the first 5 – 10 years, we then get full value for our enabling land’. Internal emails were viewed, which cautioned Council Officers against discussing the matter with third parties (the developer), following Council approval for the sale of the land, as it was proposed the land should be transferred to the potential purchaser, and not the developer of the site. The onward sale or lease to a developer was not detailed in the report brought to Council, nor does it appear to have been considered as part of the valuation process. The inclusion of a profit sharing/overage clause could have ensured that best price was obtained by sharing in the potential gains made from the development.

Omission of marriage value/other special value to the potential purchaser

88. The importance of the site to the hotel development does not appear to have been considered or reflected in the valuation process. Indeed, in email correspondence one month before the valuation date, the valuer, who advised he had been present in a meeting with the Chief Executive and eventual purchaser, noted he had been discussing provisional leasing terms with the developer, and further stated that he didn’t envisage there being a huge value attributable to the land. It was queried with the Council whether, given the importance of the land to the proposed project, the valuer was instructed to consider any such special value. The Council responded that the land acquisition was not essential to the development, that the developer had an existing entrance to the site, and that a full brief had been given to the Council meeting. However, emails reviewed from the potential purchaser to the Chief Executive made it clear from the outset that Council land was required ‘to route the hotel entrance road through this area, with some parking space in it too’. These communications were made prior to the valuation and report being brought to Council. Further emails from the potential purchaser, dated after the valuation but prior to the matter being brought to Council, highlighted that the developer was keen to move on with the hotel project and referred to the land as an essential pre-requisite. It is alarming that Senior Council Officers’ response to queries as to the importance of the land seems to be contrary to the evidence reviewed, which deemed the land essential to the eventual development.

Omission of other elements of retained control over land

89. Elements of retained Council control, e.g. a clawback clause, do not appear to have been considered and were not inserted into the disposal document.

LPS process mentioned but not followed

90. In November 2015, the Council’s Solicitor advised other Officers by email that the Council must be careful to follow the correct process set out in the Department of the Environment (DoE) guidance (LPS’ 2013 Property Disposal Document), mentioning public sector trawl and open market sale. Despite this advice, the LPS disposal process was not followed. When the rationale for proceeding without going to public sector trawl and open market was queried with the Council, it replied that it was not required to go through the D1 process for such low grade riverbank land. It is my view that, given that this land was referred to as being essential and required to unlock the site’s full potential, the LPS guidance should have been followed.

Council response to queries raised

91. As with the Pits case in Chapter 1, a number of queries were raised with the Council on the issues identified above, but Senior Council Officers’ responses repeatedly referred to the economic value/benefit to the Borough as justification for the decisions taken. I do not consider that these responses sufficiently excuse the divergence from good practice and guidance. Responses in relation to a number of other queries raised were found to be either incomplete or unsatisfactory.

92. As I concluded for the Pits case in Chapter 1, I find the extent and nature of the issues raised in this case concerning. This leads me to conclude that a culture existed of bypassing best practice and guidance to get ‘deals done’. It is never acceptable to circumvent proper procedures which are there to protect Members and Officers, and to ensure that both domestic and European legislation is not breached. In my opinion, this case demonstrates little regard for getting the best price for the Council and ratepayers.

2.3 The Council’s Chief Executive was directly involved in the transacting of this easement

93. In August 2015, an approach was made to the Council’s Chief Executive to request the purchase of Council land to facilitate development of a five-star boutique hotel. Six months later, in February 2016, a letter from the valuer relating to the agreement by Council to sell the land, refers to ‘ongoing correspondence’ between the valuer and the Chief Executive. The valuer in this case was involved in meetings with the purchaser and also in negotiations for a potential lease with the developer. Furthermore, this land and property matter did not follow normal Council procedures; it by-passed the CP&R Committee and was tabled directly at Council in December 2015. This was queried with the Council which stated that there was no CP&R Committee meeting that month due to Christmas holidays. In my view, this is not a satisfactory explanation for failing to follow normal Council procedures. Evidence was viewed referring to this land as an essential pre-requisite to a hotel development, yet a Senior Council Officer told us that it was desirable, but not essential to the development. Given the explanation from the Council, the urgency of this transaction is unclear. The Chief Executive presented the initial report, ‘Land Sale for Boutique Hotel’, to Council. In my view, this is highly unusual; I would have expected the Director with a remit for land and property disposal to lead on this and present the proposal at the Council meeting as she was herself in attendance. I queried this with Council and I was told that ‘The five organisation merger created a huge burden of work on senior staff so all senior management, including the Chief Executive, had to shoulder this workload. The Chief Executive fronted all of the Committees and Council meetings at that time and took his share of the reporting duties’. Perceived conflicts of interest identified in this case are also discussed below.

2.4 Inadequate records were kept of key matters

94. The minutes of the Council meeting in December 2015, note that ‘Officers also responded to queries relating to the value of the plot of land and the procedure of disposal of assets’. Unfortunately, as these queries are not detailed it is difficult to ascertain the exact nature of information given to Members, or how the decision not to follow the disposal process as outlined in LPS guidance was defended. The Council was asked what the nature of these queries was and if it was satisfactorily resolved prior to disposal. The Council responded that they related to the opportunity for extending the Bann river walk and connecting onto Mountsandel as part of any development, but did not specifically address how the queries were resolved.

2.5 The advice and guidance of Legal Officers was not followed

95. In November 2015, the Chief Executive asked for an update in an email on the case from the Director of Performance/Corporate Services and stated that the Council should avoid public clearing if they could. The email was subsequently forwarded by the Director of Performance/Corporate Services to the Council’s Solicitor, who advised that they couldn’t see how the proposed sale could proceed without first going through public sector trawl and open market, and attached a copy of LPS’ 2013 Property Disposal Document. By this email the Council’s Solicitor makes it clear that the LPS process should be followed. On the same day as the Council Solicitor’s advice, the Chief Executive emails one of the directors, with another in copy, to ask if Council could do a development brief instead, stating ‘shame to lose a 5* boutique hotel over process’. The Council’s Solicitor in emails just a few days later advised that ‘Council must be careful to follow the correct process as set out in the DoE guidance and we also must ensure that Council is paid best value for this plot of land. Swamp land or not…this is key land and clearly has a value’. It was queried with the Council as to whether the public clearing method of disposal was considered and the rationale for proceeding without going to public trawl and open market. The Council responded that in relation to valuations for this transaction, advice at that time was that the Council was not required to go through D1 process for such low-grade riverbank land. It was not made clear where this advice came from.

96. In an email from April 2016 including various Senior Officers, the Council’s Solicitor cautioned that she ‘…had discussed briefly given we are aware these lands are to be used for development purposes there being two possible risks that I could forsee:- 1. Upon completion the lands are then transferred into the ownership of a less favourable property developer 2. The lands are not used as indicated but for other purposes not akin to what members would be agreeable to. There is an option of inserting an [sic] buy back option or other conditions into the conveyance and contract, that is, the purchaser, should these events occur must offer the lands back to council to purchase for the same value. Council would therefore have some control should the purchaser’s plans change to the detriment of Council.’ Despite this advice, this was not included within the final deed. In fact, in January 2022, it came to light that a planning application was submitted to the Council by the purchaser for a mixed-use development at the site. The application consists of a cafe/restaurant, an office unit and 34 apartments – a change of use from the hotel project which was brought to Council when considering the sale in December 2015.

2.6 The strategic impact of this disposal was not adequately considered

97. In this case an internal email from a Council Officer raised concerns regarding this potential disposal, in that ‘strategically it would scupper any plans for future public realm and access potential’. The Chief Executive emailed senior staff and the then Assistant Solicitor, stating ‘perhaps our officers could better focus their efforts on protecting, mapping and dedicating the existing rights of way before more are encroached on’. Further emails from the Council staff referred to a four-metre strip of land which would be included within any legal transfer. They stated that this was critical to future proof the Council’s Tourism Strategy, to create a link path to ensure a riverside walkway. However, rather than seeking to alleviate concerns raised, an email from the Chief Executive in April 2016, which appeared to reference the concerns, stated that ‘This has potential to delay or scupper this vital strategic scheme’ and that ‘Council has already made the decision’. At this point, the decision of agreement to proceed by Council in December 2015 was ‘in principle’ and subject to ‘satisfactory contractual, asset disposal and legal consideration’. The matter was not brought back to Council again until sealing in November 2016 and neither minutes of this meeting nor any prior Council meeting note a discussion relating to any concerns or their resolution.

98. A member of staff emailed the Chief Executive directly in April 2016, and copied in a Senior Council Officer, making reference to the Chief Executive’s concern of a potential delay or scuppering of what could be a vital strategic scheme. The staff member outlined why public access along the river frontage should be ensured and why failure to secure this could be detrimental in the longer term. The staff member makes the point that failure to secure the four-metre strip of land ‘could lead to future problems whereby a hotel would be open, but public access for non-patrons would be denied for along the river frontage’. It was not clear from review of the files if the issues were ever addressed as the paperwork on file moved straight onto conveyancing and memorandum of sale. In December 2016, the matter appears to have been closed, with the Council acknowledging safe receipt of the monies which match the valuation obtained. I do not consider that the Council adequately answered our queries as to how concerns were addressed prior to the sealing of the transaction.

2.7 There were perceptions of conflicts of interest

99. During review of this case, it was noted that the actions of individuals constituted a perceived conflict of interest. The NIAO’s ‘Conflicts of Interest – A Good Practice Guide’ states:

A perceived conflict of interest exists where it could be perceived, or appears, that private-capacity interests could improperly influence the performance of a public official or Board Member’s official duties and responsibilities. It may pose no actual risk to the conduct of public business, but it requires proper management in order to minimise the risk of reputational damage both to the organisation and the individual(s) concerned.

100. I consider that there were two examples of perceived conflicts of interest:

- The valuer of the Council land was present in a meeting with the eventual purchaser at an early stage in the disposal process, and was also involved in discussions of provisional leasing terms with the developer for a luxury hotel project idea at the site. It is clear the valuer was acting for the developer of the hotel and also valued the land on behalf of the Council.